Intelligent Investment

Mega Leases Make Up Greater Share of Top 100 Industrial Leases

July 18, 2024 2 Minute Read

Despite high interest rates and economic uncertainty, significantly more million-sq.-ft. and larger leases were completed in 2024’s first half (31) than in the same period last year (24). Occupiers seized the opportunity to lease mega facilities at rental rates that were driven lower by elevated new construction completions in recent years. First-year taking rents were down 2.2%, on average, for one-million-plus sq. ft. leases, while rents for all sizes increased 7.7%.

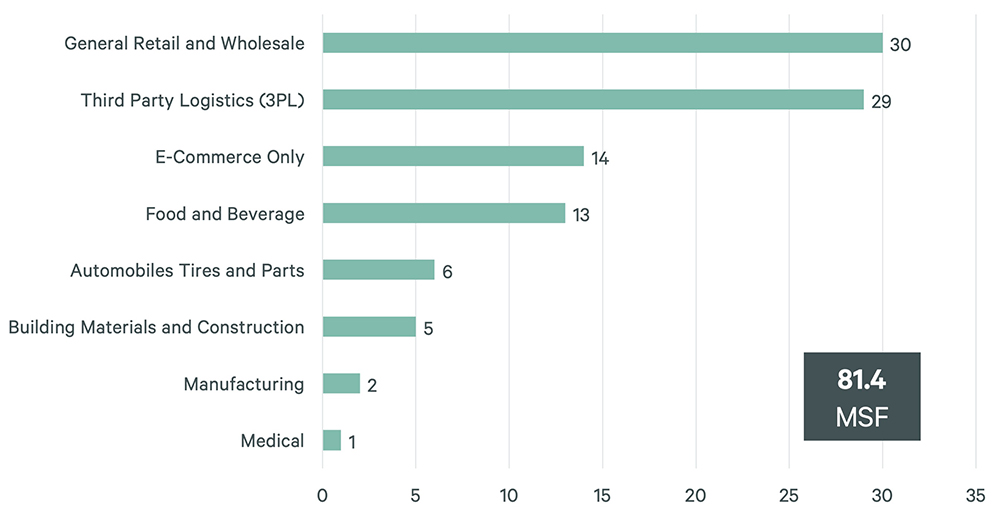

The top 100 industrial leases totaled 81.4 million sq. ft. in H1 2024, up modestly from 79.1 million sq. ft. in H1 2023. The average transaction size also increased moderately this year to 814,000 sq. ft. Forty-one of the top 100 were renewals—six more than a year ago.

Traditional retailers/wholesalers were again the most active occupiers, although they inked four fewer deals than in last year’s H1. Third-party logistics (3PL) operators completed four fewer transactions but were still the second-most active group overall. The food & beverage and e-commerce-only sectors made up for slightly weaker retailer/wholesaler and 3PL demand; both accounted for twice as many top 100 transactions than in H1 2023.

Figure 1: Industry Share of Top 100 U.S. Industrial Leases in H1 2024

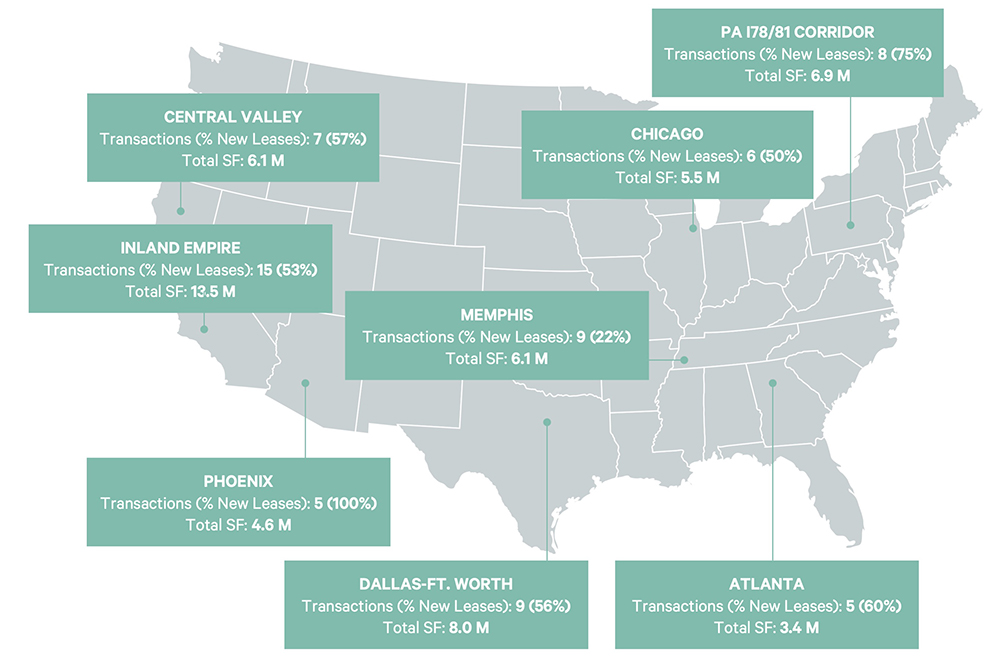

The Inland Empire led all markets with 15 of the top 100 leases, including the most new leases and the most measuring one million sq. ft. or larger. Memphis and Dallas-Ft. Worth followed with nine each.

Demand for mega distribution centers should hold steady in H2 2024, with a pickup expected in 2025, supported by lower interest rates and more economic certainty. Increased demand, coupled with less new supply coming online could result in higher rentals in 2025.

Figure 2: Leading Markets for Top 100 Lease Transactions in H1 2024

Related Insights

Related Services

- Property Type

Industrial & Logistics

We represent the largest industrial real estate platform in the world, offering an integrated suite of services for occupiers and investors.

Optimized, data-led real estate solutions that enable 3PL providers to reliably serve their clients and more efficiently meet the multifaceted demands...

- Industrial & Logistics

Intelligent Site Selection

Make smarter location decisions with a comprehensive and holistic approach that weighs factors around real estate, labor and incentives.

Contacts

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services