Intelligent Investment

2023 U.S. Lender Intentions Survey: Less Origination Activity Expected

January 9, 2023 3 Minute Read

Download the Figures

Key Findings

- Lenders cite rising interest rates, a looming recession and the prospect of lower property valuations as their greatest challenges this year, according to CBRE’s 2023 U.S. Lender Intentions Survey.

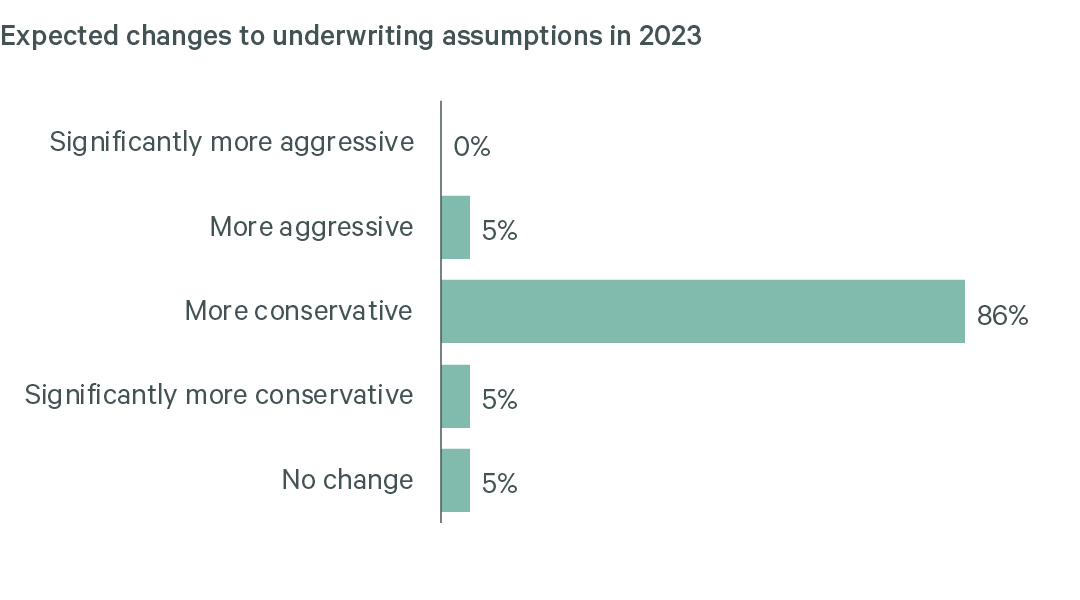

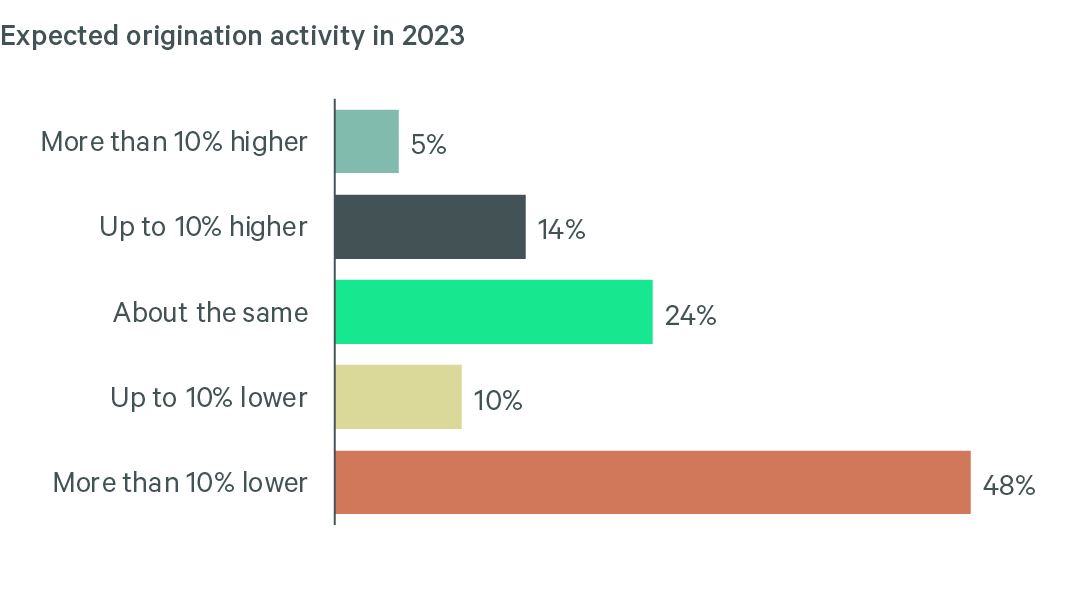

- Nearly 90% of lenders expect that more conservative underwriting standards will reduce loan origination activity from last year, with nearly half expecting a decrease of more than 10%.

- Lenders are particularly bullish on high-growth secondary markets in the Sun Belt, such as Miami, Raleigh-Durham and Atlanta. Western markets, such as San Francisco, Phoenix and Portland are of most concern.

- Industrial and multifamily are the most preferred property types for U.S. lenders, while office is the least preferred. Among alternative assets, life science facilities are the most preferred, followed by student housing and self-storage.

- Survey respondents remain interested in adopting ESG criteria, but more than one-third say they are either delaying or reconsidering their ESG adoption plans due to the current economic environment.

CBRE’s 2023 U.S. Lender Intentions Survey finds that rising interest rates, a looming recession and the prospect of lower property valuations are the greatest challenges facing lenders this year. Nearly half of respondents say they will decrease origination activity by more than 10% from last year, while only 19% expect to increase origination activity.

Nearly 90% of lenders expect to underwrite more conservatively than last year. Underwriting assumptions in 2023 will focus on cap rates, exit strategy and debt yield.

Figures 1 & 2: Lenders expect to underwrite conservatively and originate less amid market slowdown

Source: U.S. Lender Intentions Survey, CBRE Research, December 2022.

Industrial and multifamily are the most preferred property types for lenders, while office is least preferred. Life science assets are the most preferred alternative sector for origination, followed by student housing and self-storage.

Lenders prefer high-growth Sun Belt markets for new origination. Miami, Raleigh-Durham, Atlanta and Nashville are the most preferred markets this year. San Francisco, Phoenix and Portland were of most concern.

Figure 3: Sun Belt markets lead lenders’ most-preferred list

Source: U.S. Lender Intentions Survey, CBRE Research, December 2022.

More than half of lenders indicated they will continue to adopt ESG criteria. However, given the challenging economic environment, 34% of respondents expect to reconsider or delay their adoption of ESG criteria.

The Bottom Line

Rising interest rates, a looming recession and valuation uncertainty will weigh on loan origination activity in 2023. Despite more conservative underwriting, 91% of lenders say they are currently quoting and winning new business. We expect origination activity will pick up around midyear 2023 as interest rates and economic conditions begin to stabilize.

Capital Markets Contacts

Christopher R. Ludeman

Global President, Capital Markets

Kevin Aussef

Americas President of Investment Properties, CBRE

Insights in Your Inbox

Stay up to date on relevant trends and the latest research.