Evolving Workforces

U.S. Life Sciences Talent Trends 2024

Identifying America’s Most Compelling Clusters of Life Sciences Talent

June 3, 2024 27 Minute Read

Executive Summary

This year, our expanded analysis covers the nation’s top 100 markets, including rankings for life sciences manufacturing and medtech talent clusters.

Low unemployment and demographic constraints suggest that securing top talent will remain challenging in 2024.

Boston-Cambridge, the San Francisco Bay Area and San Diego each earned top marks in R&D, manufacturing and medtech talent rankings.

The established R&D clusters of Washington, D.C.-Baltimore, New York-New Jersey and Raleigh-Durham also rank high, as do smaller hubs like Madison, WI, Trenton, NJ and Columbus, OH.

Life sciences manufacturing talent can be best accessed in larger clusters like New York-New Jersey, Houston and Philadelphia. Smaller hubs like Albany, NY, Worcester, MA and Greenville, SC also offer advantages.

Los Angeles-Orange County and Minneapolis-St. Paul dominate our medtech talent rankings. Smaller markets like Salt Lake City and Pittsburgh also demonstrate a significant depth of talent.

Our latest research into emerging, underexplored talent clusters reveals several smaller university-anchored clusters that support much larger life sciences ecosystems beyond traditional metro area boundaries.

Insights from the Life Sciences Roundtable Q3 2024

A panel of CBRE experts explored key findings from recently released reports on U.S. life sciences talent and real estate investment.

U.S. Life Sciences Talent Trends

Despite a notable hiring slowdown in the U.S. life sciences industry over the past two years, historically low unemployment is contributing to the labor market’s stability. This suggests that the challenge of acquiring top talent in life sciences subsectors like R&D, manufacturing or medtech may not significantly lessen in 2024.

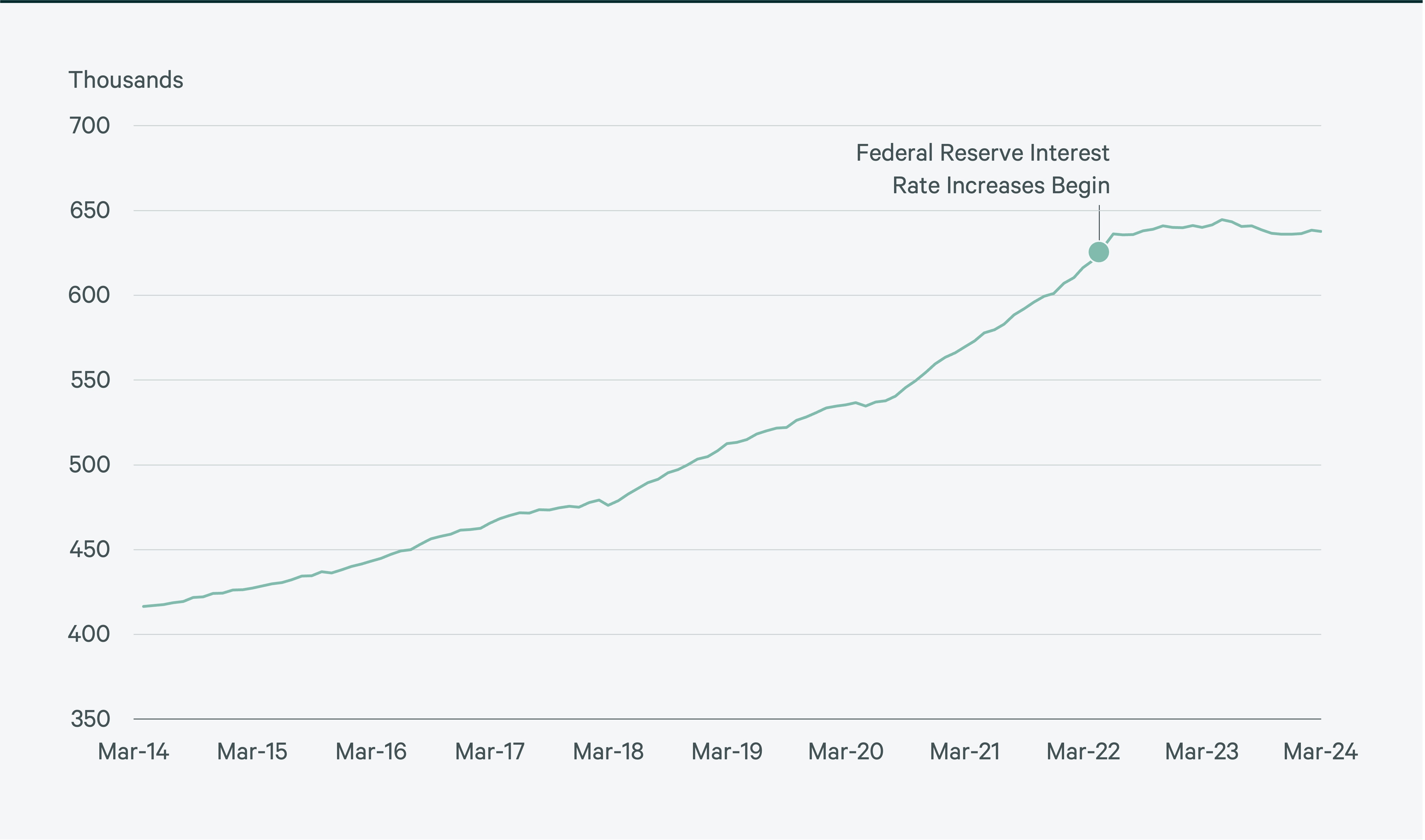

Figure 1 shows slowing U.S. life sciences industry employment, represented by jobs in the biotechnology R&D and pharmaceutical/medicine manufacturing industries. This slump began three months after the Federal Reserve initiated interest rate hikes in March 2022 and has persisted for nearly two years. The biotechnology industry, specifically, is interest rate-sensitive due to challenges in financing projects with lengthy timelines and significant hurdles to success.

Employment in the biotechnology R&D and pharmaceutical/medicine manufacturing industries has grown only 0.2% in the 21 months following June 2022. This contrasts with a 15.8% jump in the preceding 21 months (September 2020 and June 2022). The forecast for the next year anticipates continued sluggishness, possibly even declines, in life sciences labor markets.

Figure 1: U.S. Employment in the Biotechnology R&D and Pharmaceutical/Medicine Manufacturing Industries

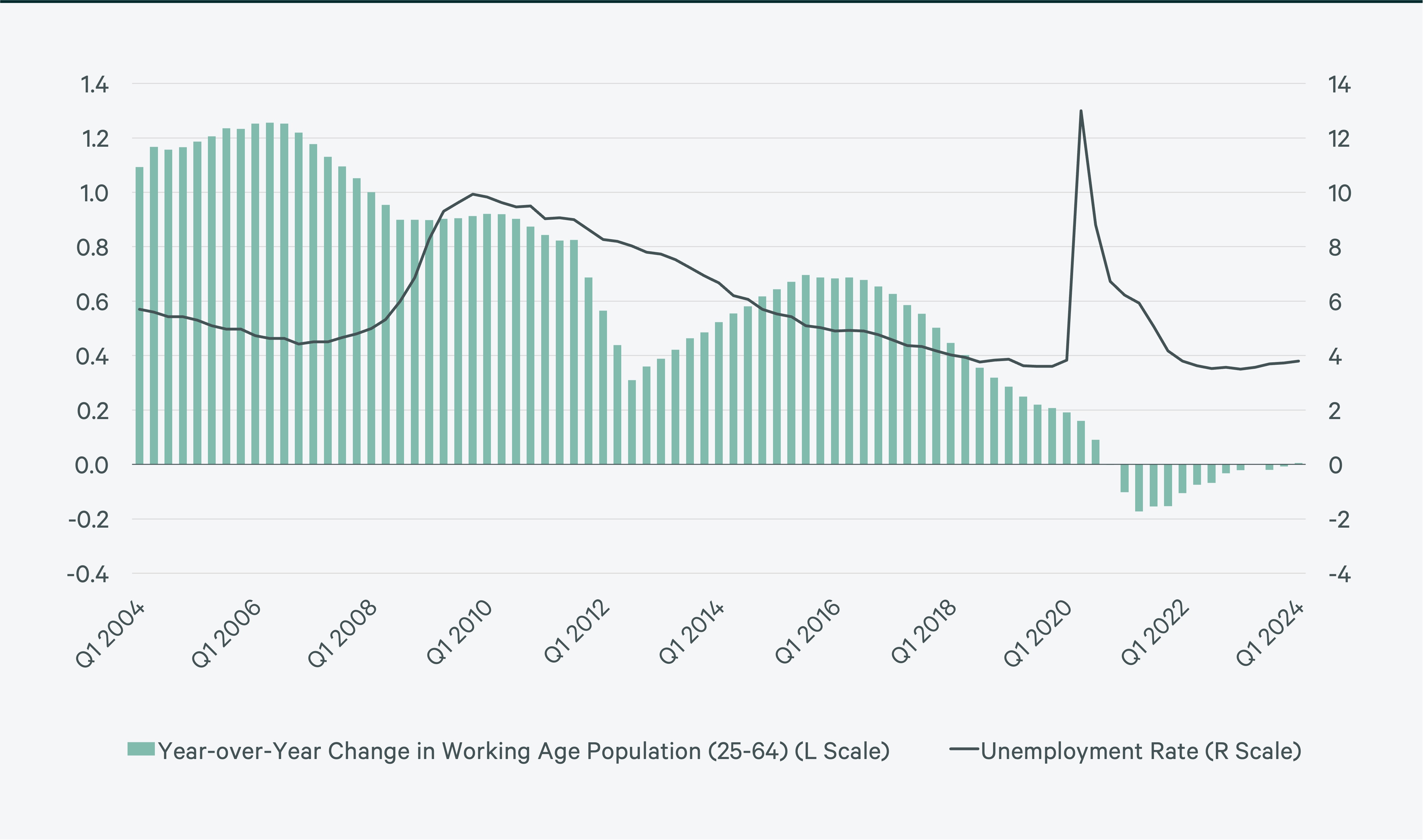

Unlike many past economic cycles where the working-age population grew, it has stalled in the U.S., limiting labor supply and helping keep unemployment near historic lows (Figure 2). Therefore, the impact on unemployment may be minimal, even with anticipated sluggish or weakening labor markets in 2024. This could maintain the ongoing scarcity of labor in the life sciences industry.

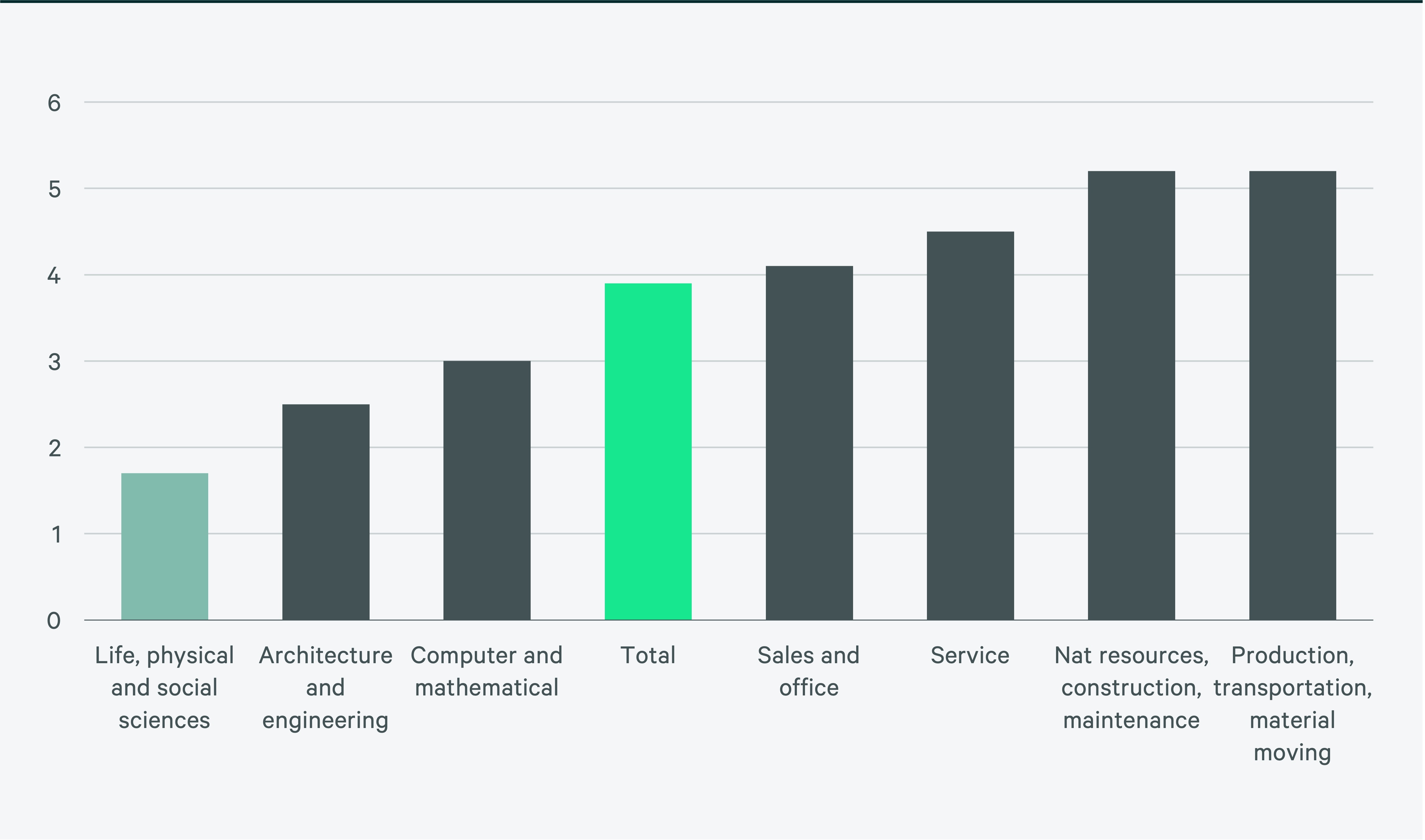

With historically low unemployment in the broader U.S. economy, unemployment in life, physical and social sciences occupations is particularly low (Figure 3). These occupations, coupled with low unemployment in engineering, computer and math occupations, most impact life sciences R&D talent dynamics.

Figure 2: U.S. Unemployment and Working-Age Population Growth (%)

Figure 3: Unemployment Rates by Occupational Group (%)

Sources: U.S. Bureau of Labor Statistics, CBRE Research, Q2 2024.

With historically low unemployment in the U.S. and stalling working-age population growth, unemployment in life, physical and social sciences occupations is particularly low.

As mid-2024 approaches, the U.S. labor market continues to exceed expectations. Figure 4 illustrates this trend in the pharmaceutical industry, where active job postings have shown strong resilience this year, indicating that the demand for talent remains high.

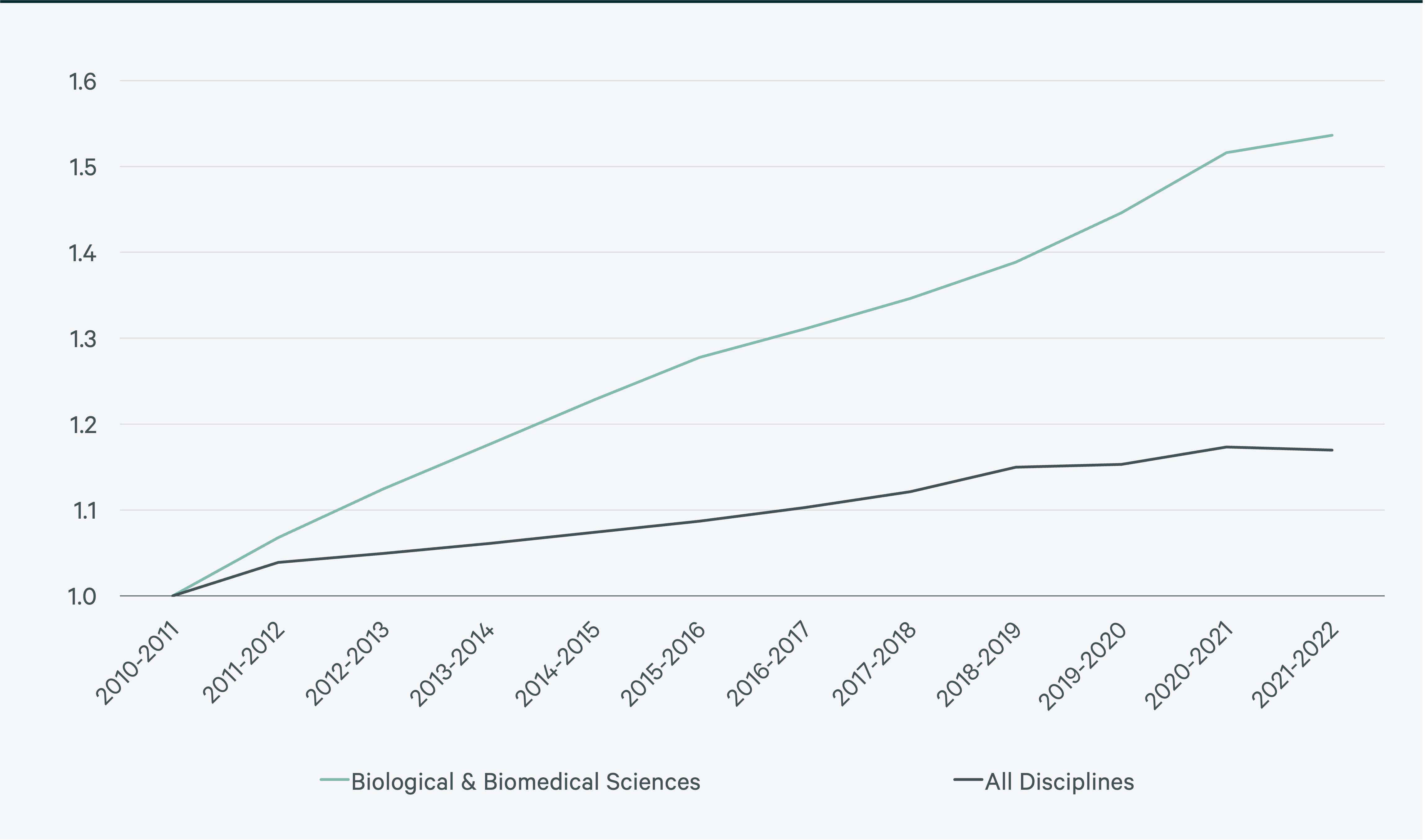

Despite low unemployment, demographic constraints and a resilient job market, the growth in new graduates with scientific and technical experience continues at a strong pace. This supports long-term industry expansion and mitigates some labor market constraints.

Figure 5 shows the growth in U.S. biological and biomedical sciences degrees and certifications issued compared to all degrees and certificates, both indexed to 1.0 in the 2010 to 2011 academic year. The number of these degrees rose from 113,137 in the 2010 to 2011 academic year to 173,825 in 2021 to 2022, marking a 54% increase.

Figure 4: U.S. Biopharmaceutical industry "Active" Job Postings

Figure 5: Indexed Growth of Degrees and Certificates Issued in Biological and Biomedical Sciences vs. All Others (Number of Degrees/Certificates Issued in 2010-2011 = 1.0)

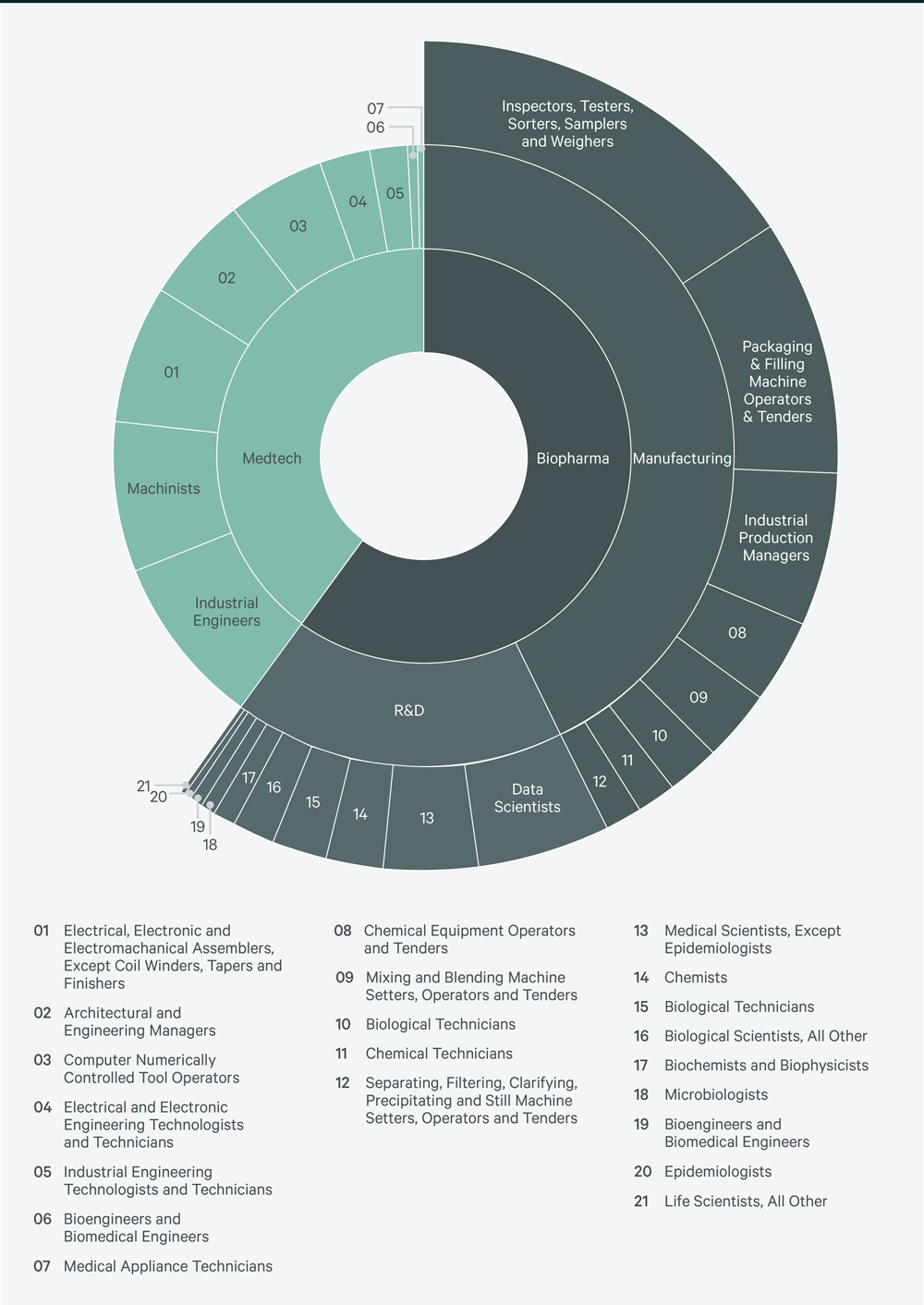

Our 2024 report examines new biological and biomedical sciences graduates at the market level, highlighting the advantage of a local supply of emerging life sciences talent. It also explores the U.S. life sciences workforce in three key areas: R&D, manufacturing and medtech. Markets and metropolitan areas are evaluated by the number and density of occupations in these industry subsets. Figure 6 shows the distribution of these occupations by industry segment.

Figure 6: Life Sciences Occupations in R&D, Manufacturing and MedTech

Note: The share of life sciences industry professionals within certain occupations varies.

Despite low unemployment, demographic constraints and a resilient job market, the growth in new graduates with scientific and technical experience continues at a strong pace.

Related Service

- Property Type

Life Sciences

We provide the life sciences industry solutions that maximize facility and investment performance across labs, manufacturing space and critical enviro...

Related Insights

-

Figures

Life Sciences Vacancy Rate Increases Amid Slowing Construction Pipeline, Modest Rise in Tenant Requirements

May 2, 2024

Vacant construction deliveries totaling 3 million sq. ft., along with 630,000 sq. ft. of negative net absorption.