Chapter 3

Market Environment and Regional Outlook

Global Office Fit-Out Cost Guide 2024

5 Minute Read

Looking for a PDF of this content?

Section 4a: Key Changes for 2023/2024

As we move through 2024, the office fit-out landscape continues to evolve, driven by a confluence of economic, technological and societal shifts. Our exploration into the key changes for the upcoming period reveals several pivotal trends that are poised to redefine the industry:

- Global Economic Outlook

Amid a landscape of economic recalibration, the fit-out market is navigating through inflationary pressures and cautious investment climates. The industry's resilience is being tested by fluctuating material costs and the global tug-of-war between supply chain constraints and market demand. Yet opportunities arise, as organizations reevaluate their spatial needs, fostering a wave of innovative fit-out projects aimed at long-term value creation and operational efficiency. - Technology and Innovation

Technology continues to be a harbinger of change, introducing groundbreaking tools and methodologies. Virtual design and construction (VDC) are transcending traditional boundaries, enabling precise simulations and fostering collaboration across continents. The increasing integration of the Internet of Things (IoT) within office environments promises enhanced user experiences and operational insights, driving the fit-out industry toward a smarter, data-driven future. - Workplace Evolution

The office is no longer just a place of work; it's a hub of wellbeing, collaboration and corporate identity. The emphasis on health and wellness is more pronounced, with biophilic design principles and adaptive spaces becoming the norm. Organizations are seeking fit-out solutions that not only speak to their brand ethos but also adapt to the changing nature of work—where flexibility and employee empowerment take center stage. - Sustainability

Sustainability is no longer a buzzword but a core criterion in the fit-out decision-making process. There's a palpable shift toward carbon neutrality, with a growing number of projects seeking green certifications and prioritizing eco-friendly materials and practices. This global green wave is reshaping procurement strategies and inspiring a new genre of fit-outs that are as sustainable as they are aesthetically pleasing. - Investment Patterns

We observe a shift in investment patterns, with a keen focus on adaptability and resilience. Investors and occupiers are aligning their strategies to accommodate hybrid work models, technological advancements and the escalating demand for sustainable infrastructure. The forward-thinking approach is geared toward creating spaces that are not only efficient and flexible but also primed for future transformations.

As we continue to monitor these developments, this guide will delve deeper into the regional specifics, examining how these global trends manifest across different markets and locales. The comprehensive Regional Insights section dissects the implications of these changes at a local level.

Section 4b: Industry Trends Overview

As we look at the landscape of office fit-outs for 2023/2024, several key trends stand out, shaping the way organizations think about and execute their workspace designs:

- Hybrid Work Environments

The push for flexible work arrangements continues to influence office designs. Spaces are now being reconfigured to accommodate both in-person collaboration and remote connectivity, with an emphasis on hot-desking and shared spaces to reflect the changing dynamics of the workforce. - Technology and Innovation

Cutting-edge technology is being seamlessly integrated into modern workspaces. From advanced video conferencing systems to IoT-enabled environments that can be controlled via smart devices, the drive for efficiency and connectivity is dictating fit-out costs and design considerations. - Sustainability and Wellbeing

A focus on sustainable design and employee wellbeing is no longer optional but a mandate. This trend is manifesting in the use of eco-friendly materials, increased natural lighting, and biophilic design elements that foster a healthier and more engaging work environment. - Adaptive and Resilient Spaces

In the wake of the pandemic, adaptability and resilience are critical. Offices are being designed with the flexibility to pivot quickly in response to health guidelines and changing business needs, which include modular furniture and reconfigurable layouts. - Cost Rationalization

Budgets are being scrutinized more closely as companies seek to optimize their investments. There's a growing trend toward cost-effective solutions that do not compromise on quality or functionality, with many organizations looking to refurbish rather than relocate. - Branding through Design

Offices are increasingly being used as a tool for branding, with designs that reflect the company's culture and values. This personalization of space is becoming a significant factor in attracting and retaining talent.

These trends are not only indicative of the shifting priorities within the corporate world but also signal a transformation in the way office spaces are perceived—from mere places of work to hubs of innovation, culture, and wellbeing.

To stay ahead, companies must consider these factors when planning their fit-out projects, balancing cost with the need to create spaces that are agile, tech-forward and sustainable. The office of tomorrow is being built today, and these trends are the blueprint.

Section 4c: Global Economic Outlook

The global economy continues to be affected by efforts to bring inflation down through aggressive interest rate hikes. It looks increasingly as though the major western economies will experience a “soft landing” in which inflation is brought back closer to target without recession or major disruption to labor markets. The short-term growth outlook nonetheless remains subdued.

Headline inflation in Western economies has eased decisively in response to earlier rate rises and the fact that growth in energy and commodity prices has weakened. While this doesn’t necessarily signal an immediate lowering in policy rates—central banks will want to be satisfied that inflation is back under control before lowering rates—we believe that policy rates in Europe and the U.S. have now peaked and that the next moves will be downward. Greater price stability and lower interest rates will support both economic growth and investment activity.

The sharp drop in bond yields towards the end of 2023, although partially unwound since, indicate that markets have incorporated lower inflation expectations and the likelihood of policy rate cuts in 2024. We also expect long-term interest rates will come in a bit further still in 2024 as inflation continues to ease.

There are of course risks to this view, principally the possibility of policy rates remaining higher for longer. A more sustained period of higher interest rates would weigh on borrowing rates and dampen investment activity.

The labor market is also a key focus area: Despite small increases in some economies, unemployment is at historically low rates and not expected to climb much higher. This will support consumer spending and service demand.

Geopolitics also present notable downside risk. Tensions in the Middle East in particular could create volatility and exacerbate elevated energy prices, putting renewed upward pressure on inflation. Several major economies will hold elections in 2024, which will further impact global markets, depending on the outcomes.

Against this background, indicators suggest that economic activity will remain generally more subdued through 2024, albeit with some brighter spots. CBRE’s current house view has a global GDP growth of a little over 2% during the year, before a pickup thereafter.

Economic growth in the U.S. has surprised to the upside throughout 2023, mainly the result of healthy consumer spending and robust fiscal policy. Key indicators for mainland China remain uneven particularly in the housing and construction sectors. In Europe, higher energy prices have continued to act as a drag on growth and corporate sentiment remains somewhat subdued. As European consumers become more optimistic about economic prospects, this will encourage them to spend some of their savings and lead to higher levels of consumption.

The combination of elevated economic uncertainty, tight credit availability and the high cost of financing is causing capital to be highly selective. Global commercial real estate investment volume fell by 37% year-over-year in Q4 2023 to US$157 billion. 2023 annual volume fell by 47% year-over-year to US$647 billion. Stabilization in financial markets, and more clarity emerging on the path of interest rates, will be key to an improvement in capital markets activity from H2 2024.

Leasing activity is also in a sub-par period, particularly in the U.S., due mainly to delayed leasing decisions amid an uncertain business environment and the evolving impact of hybrid work strategies. We expect a modest leasing recovery in 2024, driven mainly by prospective catch-up leasing activity and greater clarity on corporate space needs associated with new working strategies. Importantly, this is likely to involve significant upgrades in typical portfolio quality, with companies looking to align their real estate more closely with their strategies around office attendance and talent attraction. Associated with this shift, the costs and value benefits of refurbishment opportunities will be worth scrutinizing closely.

Section 4d: ESG & Circular Economy

Environmental, social, and governance (ESG) considerations, alongside circular economy principles such as adaptable and reusable design, selection of sustainable materials and renewable energy systems, are increasingly shaping global fit-out priorities. These strategies are crucial not only for their environmental benefits but also for enhancing organizational resilience, future-proofing business models and creating long-term value for both investors and occupiers.

Key Trends in ESG and Circular Economy

Environmental Stewardship

The integration of renewable energy and efficient systems like HVAC and smart lighting is essential. For example, energy-efficient lighting can reduce energy use by up to 75% compared to traditional lighting. Investing in water conservation strategies also plays a vital role, with some systems able to reduce water usage by up to 50%.

Health & Wellbeing

The incorporation of wellness-focused designs is linked to a 10%-15% increase in employee productivity. Natural light, ergonomic furniture and wellness spaces are integral, with studies indicating a significant reduction in absenteeism and improvements in employee satisfaction.

Circular Economy and Social Impact

- Redefining Resource Use: Emphasizing the use of reclaimed and recycled materials can reduce waste by up to 30%-40%, supporting a more sustainable approach to office design.

- Economic and Environmental Synergy: While initial investments in circular designs—like flexible and adaptable layouts, energy-efficient operation and the use of non-toxic, recyclable materials—might be higher, they can lead to long-term operational savings of up to 20%-30%.

- Impact Through Sustainable Practices: Focusing on local sourcing and recycled materials can contribute significantly to local job creation. For example, recycling and reuse industries have been observed to create up to 10 times more jobs than landfills or incineration.

- Design for the Future: Sustainable designs are increasingly seen as crucial for future-proofing workplaces, accommodating changing needs over time.

- Creating Regenerative Workspaces: Workspaces designed with circular economy principles in mind not only minimize ecological impact but also promote a healthier, more productive environment for occupants.

ESG Disclosure & Compliance

Compliance with frameworks like LEED, WELL, or Fitwel is becoming a norm. Buildings with LEED certification, for instance, have been shown to consume 25% less energy and 11% less water and have a 19% reduction in maintenance costs.

Workplace Technology and ESG Integration

Smart technologies in office spaces contribute significantly to sustainability goals. For example, smart HVAC systems can reduce energy consumption by up to 20%-30%, and the use of IoT devices for monitoring can further enhance efficiency and reduce carbon footprints.

Section 4e: Regional Insights

While global construction trends emerge, regional distinctions exist in how these trends manifest.

Americas

- Pioneering community-centric, mixed-use spaces that promote inclusion and tap into diverse talent pools, the Americas leverage these projects to enhance social sustainability alongside ecological responsibility.

- Localizing materials sourcing and supply chains to complement broader sustainability goals beyond just LEED certification.

- Leading in the retrofitting of workspaces for hybrid models, this region showcases how adaptive spaces can attract and retain top talent, reflecting the changing nature of work.

Europe, Middle East & Africa (EMEA)

- Balancing refurbishment of heritage buildings with stringent sustainability compliance standards that encourage innovation.

- Emphasizing workplace flexibility and remote work capabilities compatible with prevalent regional work norms.

- Seeking supply chain self-sufficiency given reliance on imported resources like energy.

Asia-Pacific

- Integrating sustainability with technology through ambitious smart cities initiatives.

- Utilizing its robust manufacturing base to bolster supply chain resilience, ensuring the continuity of construction activities amid global disruptions.

- Evolving workspaces centered on constructing efficient, smart infrastructure matching rapid urbanization.

Section 4f: Market Outlook

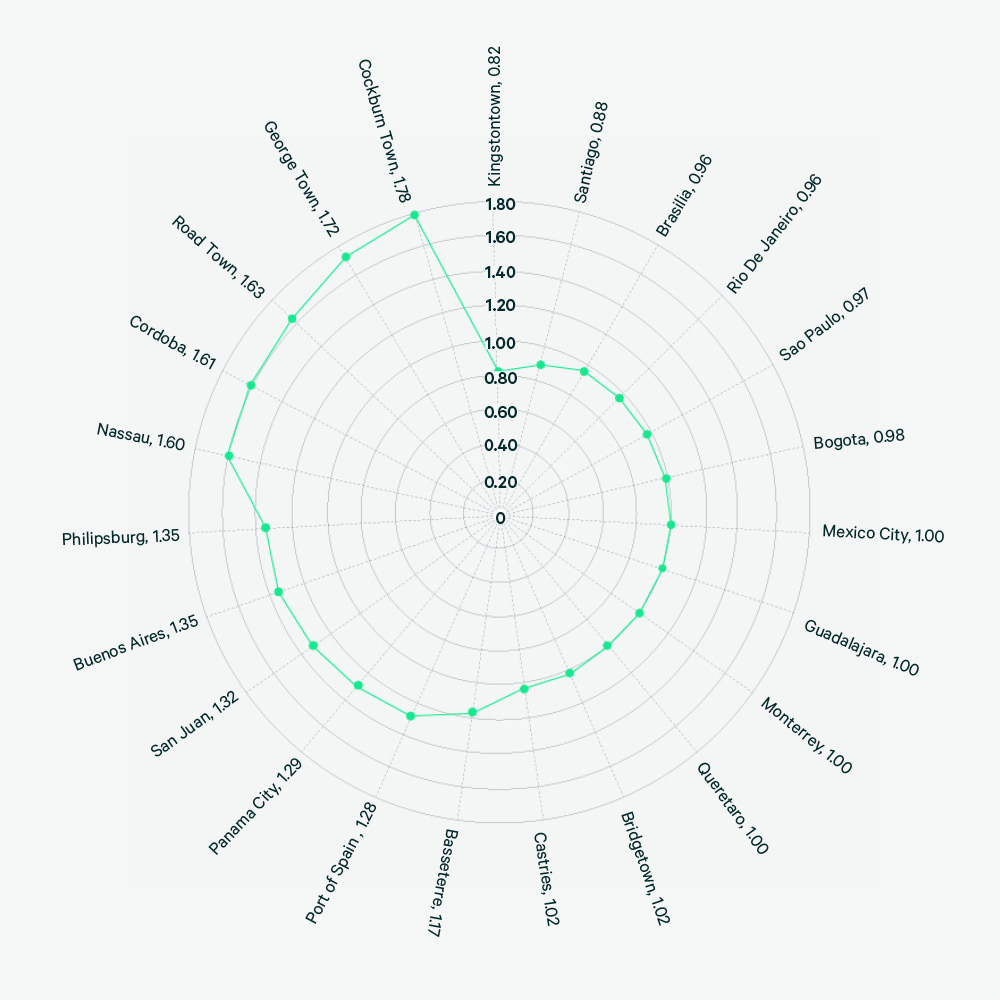

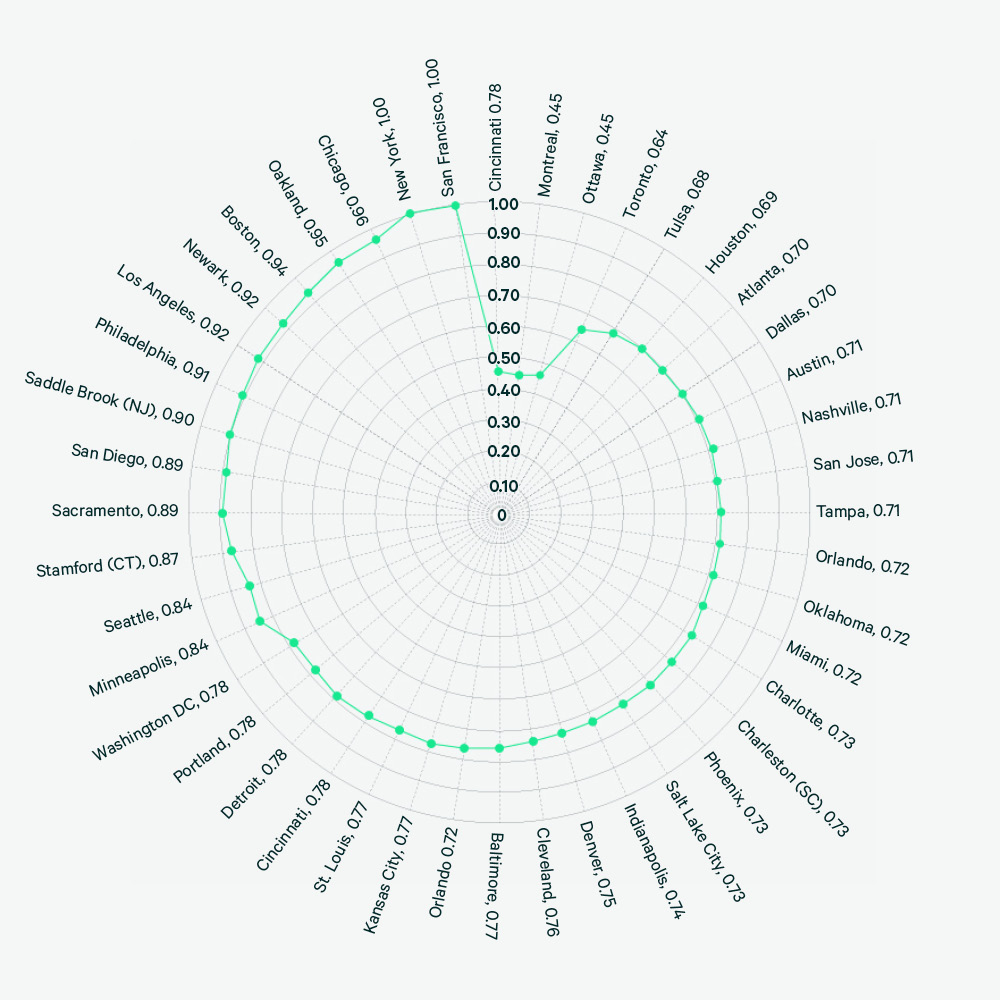

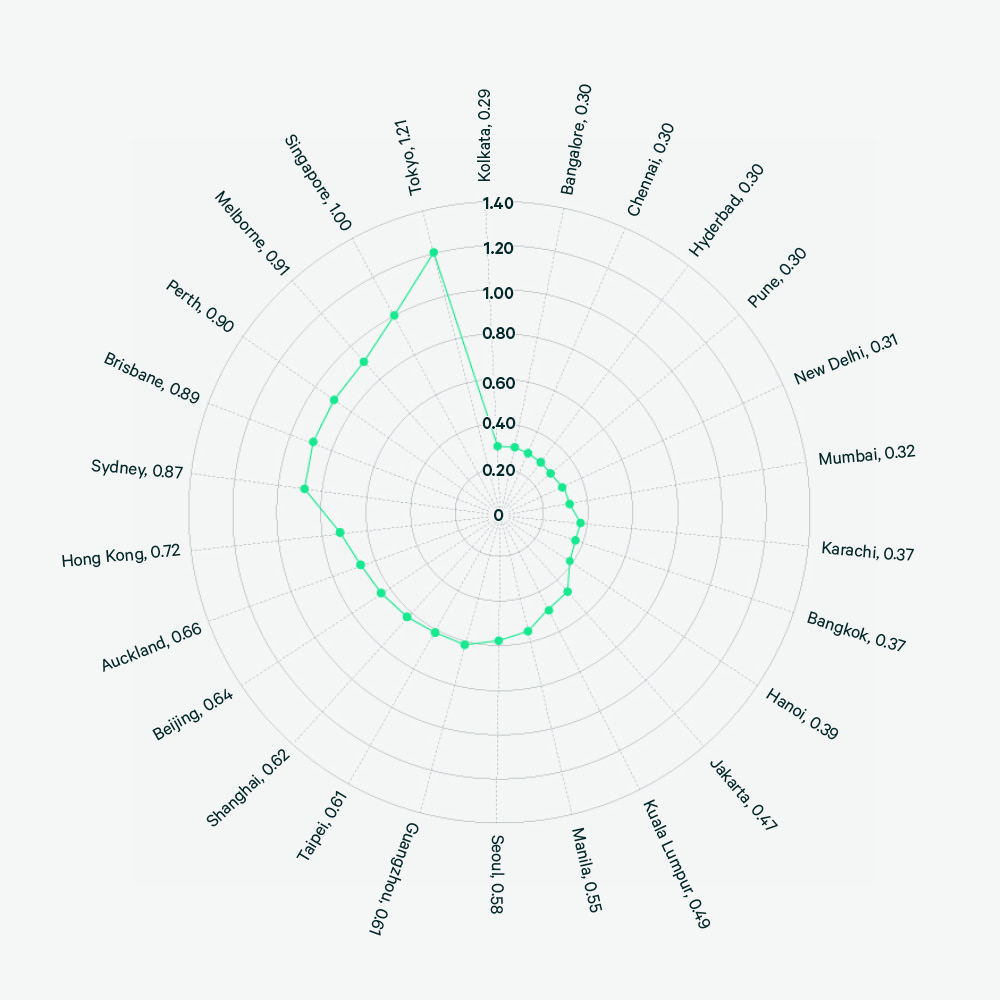

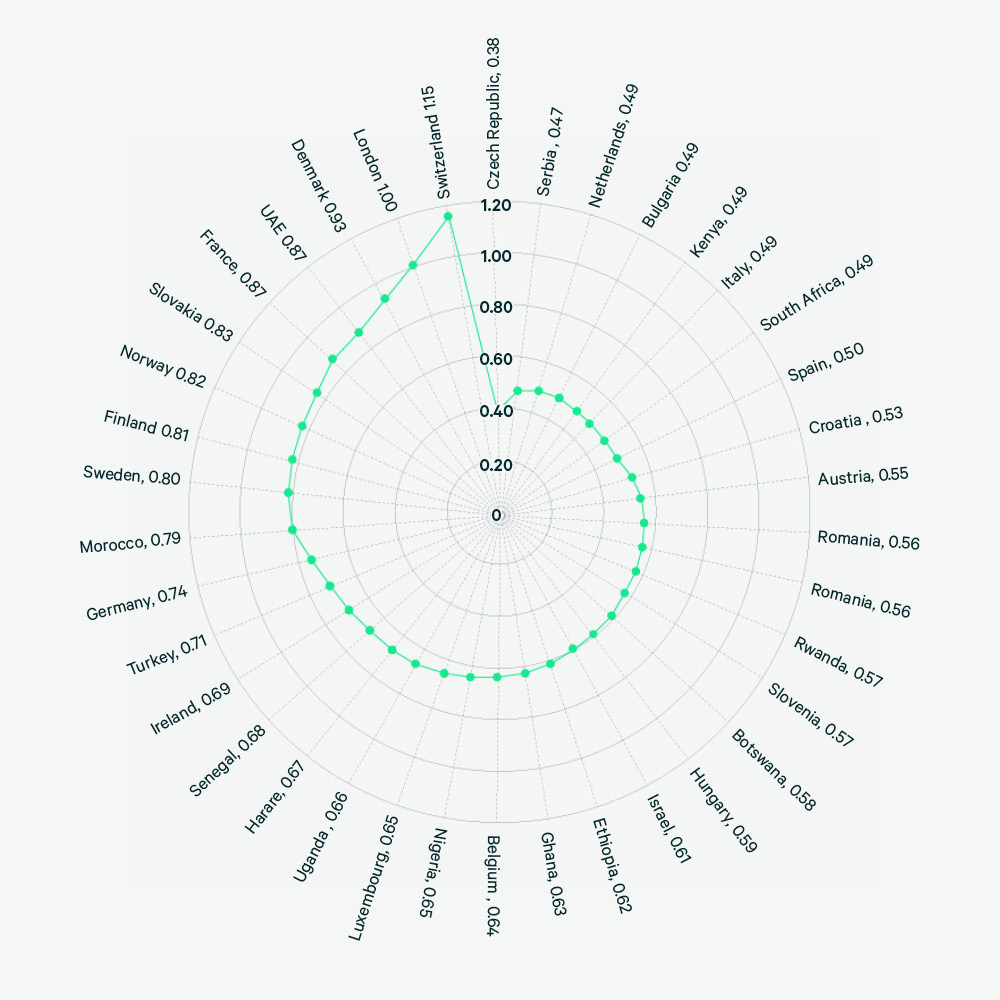

Using London as a point of deviation, this radar shows each city’s average project cost in relation to other locations.

Figure 25: Global Radar Graph

Figure 26: Latin America Radar Graph

Figure 27: North America Radar Graph

Figure 28: APAC Radar Graph

Figure 29: EMEA Radar Graph

Related Services

- Design & Build

Cost Advisory

We empower clients to plan and control spending, estimate project costs, manage risk, eliminate waste, and identify tax and procurement process savings.

- Design & Build

Project & Program Management

Deliver projects seamlessly with an integrated team that manages everything from schedules and budgets to the entire construction process.

- Design & Build

Design

Create intentional spaces that fit your vision, brand and culture—and deepen connections between people and the built environment.

- Design & Build

Buildings & Systems

Design and commission all aspects of your building, including systems, envelope and structure using the latest facilities best practices.

- Design & Build

Supply Chain Sourcing

Leverage our global scale and buying power to get the best pricing with Partner Excellence Program, our proprietary supply chain sourcing technology.

- Design & Build

Principal Delivery

Our teams deliver every aspect of your project or program, from managing contracts with the construction supply chain to taking on full health and saf...

- Design & Build

Move & Decommissioning

Manage your complex relocation, decommissioning and dilapidation projects with a consistent approach focused on minimal downtime and zero disruption.