Chapter 5

Impact on Materials Costs

2022 U.S. Construction Cost Trends

5 Minute Read

Construction material prices rose sharply in early 2021, poised to keep increasing in 2022

Price growth for goods and services used by construction companies has been above 15% year-over-year since early 2021 and is accelerating in 2022.

Input costs—the price paid for all goods and services, excluding labor and capital investment, used by construction firms—for new nonresidential construction were up 42.5% from March 2020 to March 2022, after falling briefly during the early stages of the pandemic. Construction output, the price charged by construction firms for completed projects, has also risen sharply, but has lagged input prices by about 6-9 months as contractors gradually adapt to new conditions and pass on more of their costs.

Given that input prices are sharply rising again in 2022, output prices for construction services are likely to follow suit and increase throughout the year.

Figure 35: Producer Price Index: inputs to construction, year-over-year changes

Note: Latest data as of March 2022.

Source: Bureau of Labor Statistics, Producer Price Index, CBRE Strategic Investment Consulting, April 2022.

Figure 36: Input vs. Output Price Index, new nonresidential construction

Note: Latest data as of March 2022, Index benchmarked to 100 in Dec. 2015.

Source: Bureau of Labor Statistics, Producer Price Index, CBRE Strategic Investment Consulting, April 2022.

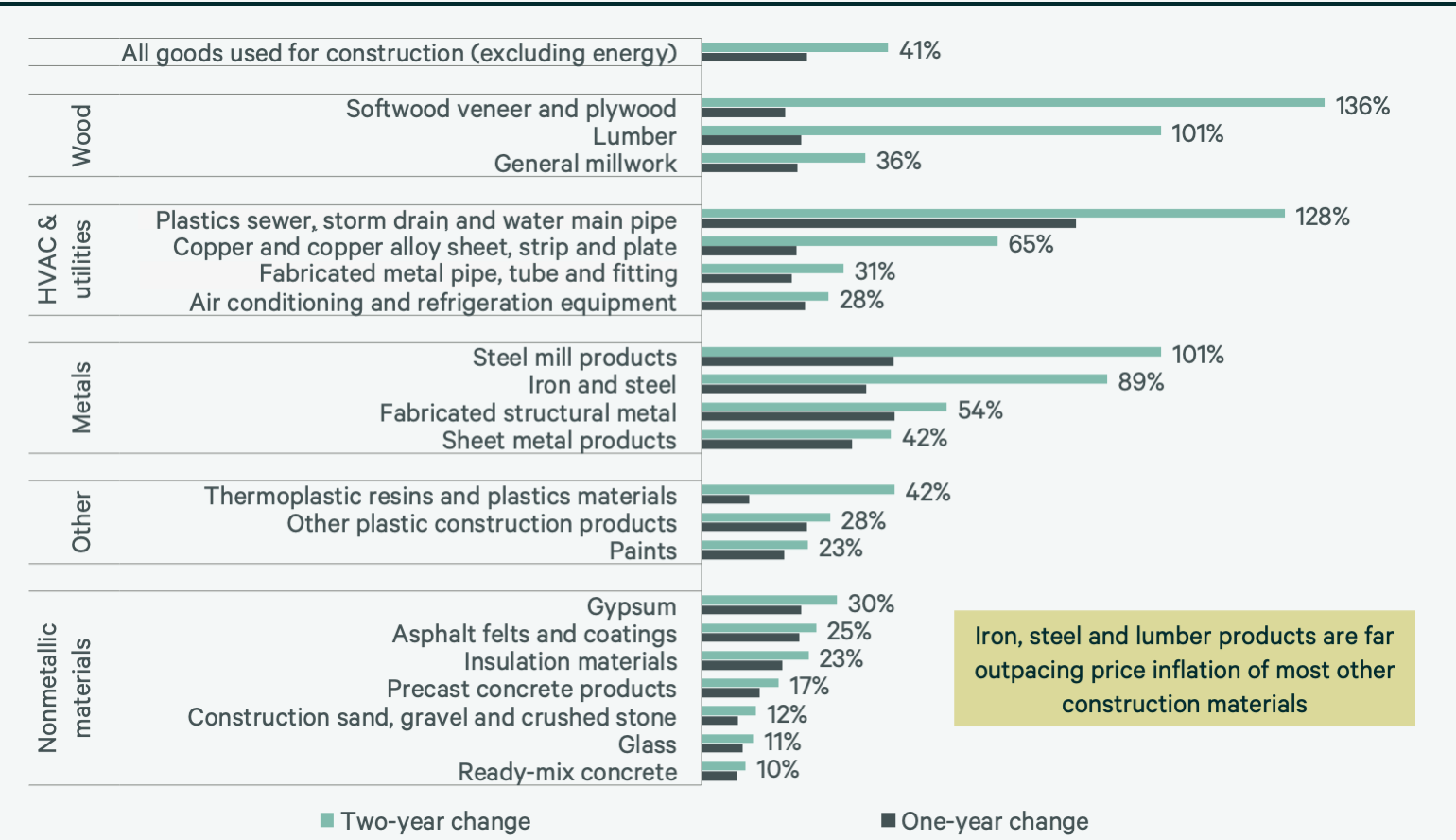

Key inputs like iron, steel and lumber logging major increases

Based on the Producer Price Index (PPI) basket of all goods used in construction (excluding energy), prices were up 41% in March 2022 from March 2020.

The cost of steel mill products, some plastic piping, and softwood veneer and plywood have more than doubled since March 2020. Prices for some materials, like ready-mix concrete, which makes up 10% of the overall goods index, have not risen as dramatically and have kept the figure slightly down, as have other non-metallic and non-wood commodities.

Still, inflation has been abnormally high for essentially all construction materials, since the onset of the pandemic and, for most materials, most of the price change has happened in the past year (lumber and softwood are the major exceptions, with steep price hikes in 2020 as well).

Iron and steel prices have inflated dramatically over the past two years, but prices began to soften in late 2021. Since prices peaked in November 2021, the PPI for iron and steel has fallen 8% through March 2022.

Figure 37: Price inflation for select construction commodities, March 2020-March 2022

Source: U.S. Bureau of Labor Statistics, CBRE Strategic Investment Consulting April 2022.

Labor, public health, tariffs and demand swings affecting commodity pricing

Lumber and wood:

The boom in residential construction and do-it-yourself renovations through the pandemic pressured lumber suppliers struggling to rebuild sawmill capacity amid rising demand.

Coupled with import regulations and tariffs, which remain in flux, as well as transport challenges, this has caused major price spikes and volatility that will likely persist in the near term.

Iron and steel:

The U.S. has softened its tariffs on EU steel to help relieve skyrocketing costs and demand. Delayed shipments and global supply chain issues will continue to drag on the supply side of steel products while U.S. steel factories are unable to fully sustain the current demand.

Concrete:

Concrete prices tend to be steadier than other construction inputs, but even concrete has seen unusually steep inflation since the start of 2021 as long lead times, strained manufacturing and labor shortages drive costs upward. With a new infrastructure bill signed and construction beginning this year, cement and concrete commodities are expected to be in even higher demand moving forward.

Figure 38: Historical price inflation for major construction commodities

Note: Latest data as of March 2022.

Source: U.S. Bureau of Labor Statistics, Producer Price Index, CBRE Strategic Investment Consulting, April 2022.

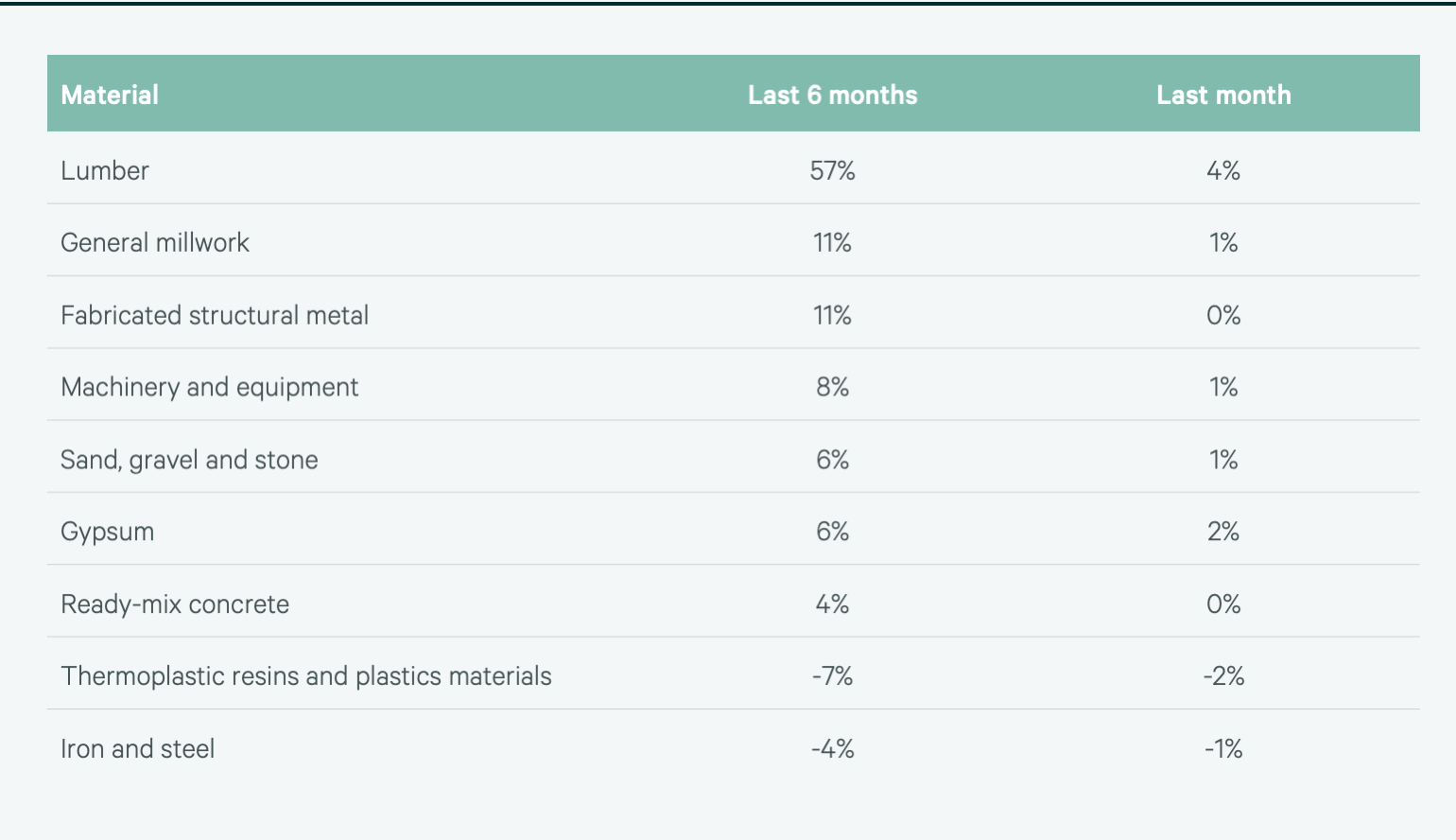

Costs for most materials are inflating rapidly, but a few are starting to decline

Prices for materials have been extremely volatile since the onset of the pandemic, with largely unprecedented rates of inflation in 2021.

In a Q4 2021 survey from the U.S. Chamber of Commerce, essentially all (97%) contractors reported that material cost fluctuations have had a moderate to high impact on their business. Respondents had the highest concerns about the prices of steel and wood products.

In general, materials prices will likely continue to rise in the near term. Although the pace of inflation is largely easing (as seen for most of the commodities highlighted in Figure 39) and expected to continue to cool, most prices will not reset to pre-pandemic levels. Impacts will vary by material and depend on several factors. For heavily imported goods, like lumber and iron, prices depend on transportation costs (i.e., fuel) and ongoing tariff negotiations, while other materials like stainless steel could see ongoing impacts from the Russia-Ukraine conflict.

Figure 39: Recent price changes for key construction materials through March 2022

Source: U.S. Bureau of Labor Statistics, Producer Price Index, April 2022.