Chapter 1

Transforming Your Approach to Space

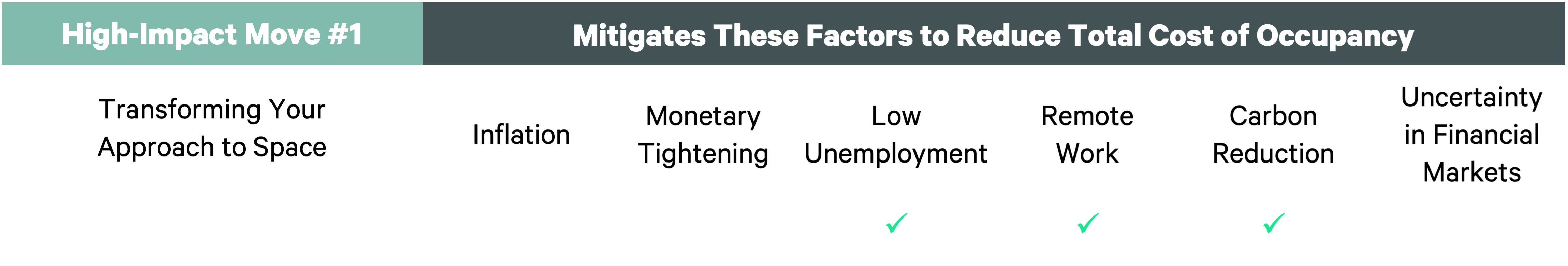

10 High-Impact Moves to Reduce Total Cost of Occupancy

5 Minute Read

Revisit your space standards to reflect new hybrid work realities and prioritize capital spend accordingly.

While “portfolio optimization” may often appear at the top of a list of cost savings strategies, understanding business goals and priorities is a key first step. Before shedding significant amounts of space, Corporate Real Estate & Facilities (CRE&F) leaders must first examine how hybrid work impacts the demand for space across the portfolio.

This process begins with establishing new space standards based on hybrid work styles and utilization patterns. It’s likely that less private workspace (i.e., “me space”) and more shared, collaborative team space (i.e., “we space”) will be required in your future workplace. CBRE’s Occupancy Management benchmarks reveal a 25% reduction in ”me” space across the globe already within the last year1.

Traditionally, utilization data collected through badge swipes and sensors could measure how efficiently a space is used, with the added benefit of appropriately setting service levels within the occupied space. However, since most organizations have not fully implemented their return-to-office plans, pandemic utilization rates may not provide CRE&F leaders with a good benchmark for the future. New utilization data is needed to understand pandemic-era work styles and habits.

Without utilization data you are making extremely important real estate decisions with only guesses and an opinion.

CBRE Institute tracks the publicly stated return-to-office plans of global occupiers, and research shows a trend of corporations implementing more formal guidance for their employees to work in the office at least part of the week, beginning in September of 2022.

Having the ability to monitor these increasing levels of utilization in real-time—by location, day of the week and hour of the day—will be incredibly beneficial in this “living lab” of return to office. CRE&F leaders can then make informed, data-based decisions to revise design standards, reduce underutilized space and prioritize capital spend to create a more efficient portfolio.

How to Begin?

- Most RE&F departments do not have building utilization sensors unilaterally deployed across their portfolios. As a starting point, CBRE Institute recommends collecting data from existing sources such as badge swipe and Wi-Fi/ network connection data to extrapolate median and peak utilization levels across days and sites. In fact, these are the two most common means CBRE clients use to measure office utilization (91% and 32%, respectively1).

- The sophistication of insights and strategy—across an entire workplace or portfolio—may require more accurate and detailed data than existing sources can provide. Occupancy sensors harvest and provide this data, but their selection and implementation is complex. A comprehensive program to select, implement, manage and analyze sensor data delivers each organization deeper and more advanced insights and outcomes.

Why Now?

Understanding how hybrid work impacts the demand for space will allow CRE&F to make smart, insightful changes to space standards. This knowledge will help mitigate the risk of giving up too much space only to have to re-lease at higher rates, while equipping companies with the right data to thoughtfully consolidate locations to drive occupancy cost reductions.

High-Impact Examples:

CBRE conducted a three-month sensor-based utilization study that identified an average daily peak utilization rate of 59%—26 points lower than the daily utilization rate of 85% that had been calculated using access control data for the same period of time. Using the more accurate peak utilization data, CBRE identified an opportunity to consolidate the existing space from 8 floors to 6, with a potential annual savings of £240K.

1 CBRE’s 2022 Workplace & Occupancy Benchmarking Program.

Explore all 10 High-Impact Moves to Reduce TCO

Discover strategies for resilience amid economic uncertainty

Contacts

Susan Wasmund

Executive Managing Director, Americas Consulting | Global Occupancy Management