Adaptive Spaces

Retailers’ Physical Stores Becoming Integral Part of Reverse Logistics

November 25, 2024 3 Minute Read

Retailers are offering their customers more convenient store locations and designs to encourage the physical return of online purchases rather than through the mail. This push is in turn saving retailers excessive return costs and providing them with an opportunity to increase foot traffic and in-store sales.

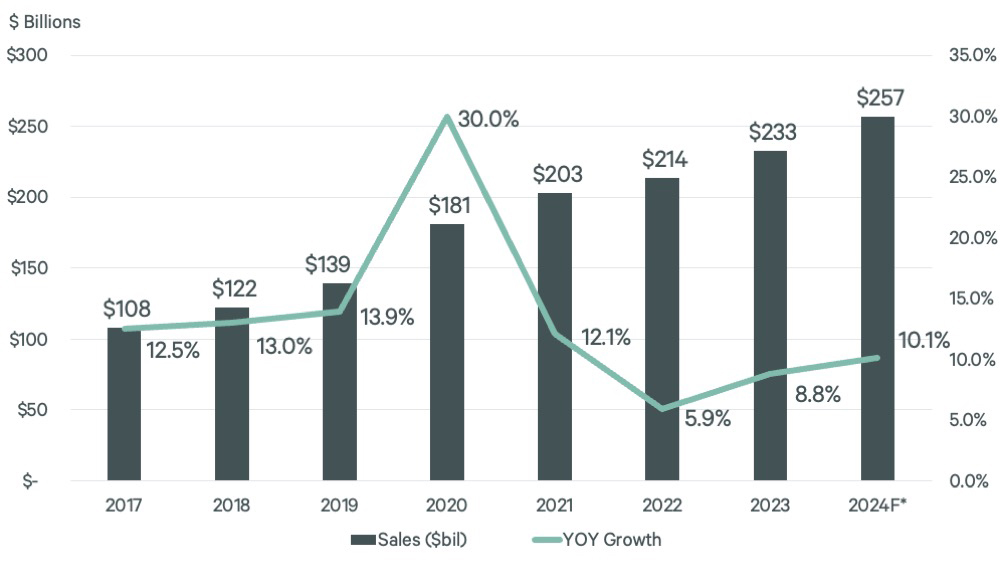

Figure 1: U.S. Online Holiday Retail Sales

Note: Data range is November through December.

Source: Forrester Research, 2024.

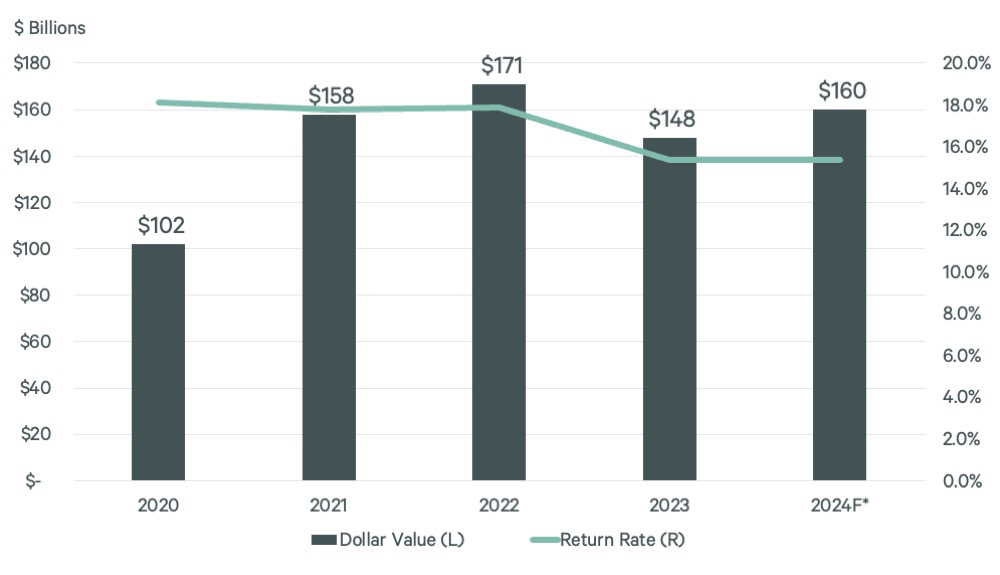

Holiday retail sales in November and December are forecast to reach a record $1 trillion, more than one-quarter of which will be conducted online, according to retail consulting firm Forrester. Sixteen percent or $160 billion of total holiday sales will be returned at an average cost of approximately 30% of each product’s total value, estimates third-party returns provider Optoro.

Figure 2: Holiday Sale Return Values & Return Rates

Note: Data range is Thanksgiving through Christmas.

Source: Optoro, 2024.

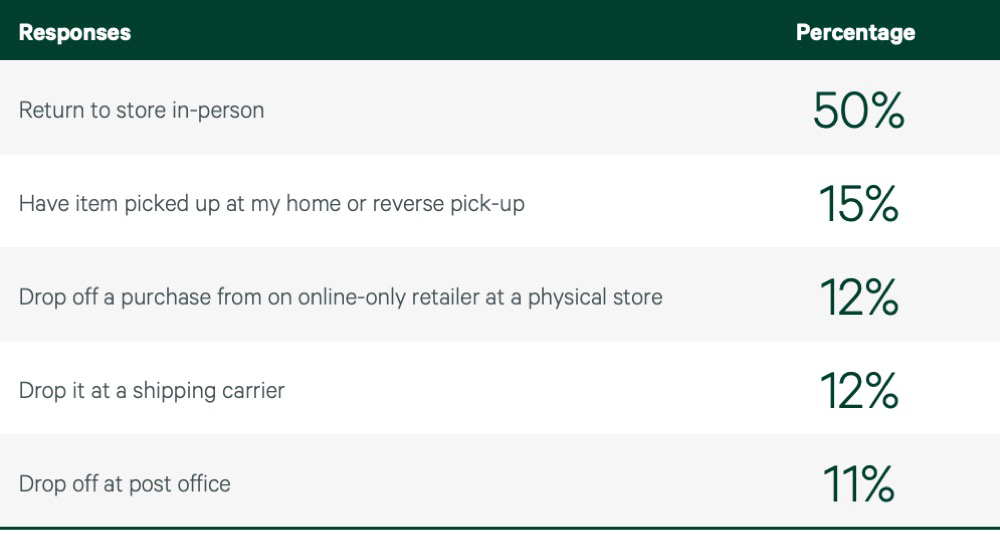

To reduce costs, retailers are guiding returns to physical stores by employing a Buy Online/Return In Store (BORIS) omnichannel strategy. BORIS accounted for 50% of online purchase returns in 2023 totaling $123 billion. Fifty percent of respondents to Forrester’s recent Retail Topic Insights Survey said they preferred to return items to a store.

Figure 3: Forrester Survey: How Do You Prefer to Return Items?

Primary benefits of BORIS include:

- Cost Savings

Returning to a store significantly reduces shipping costs back to a warehouse location and in some cases lowers the need for additional warehouse space. - Convenience

Customers appreciate the ease of returning items in-store, avoiding the need to ship the item and wait for a refund. - Customer Service

Staff can help customers find alternative products or handle refunds immediately. This can drive additional retail sales and increase brand loyalty. - Cross-Selling

Customers can explore other in-store offerings, which creates opportunities for cross-selling and up-selling. Some retailers are now accepting returns from online-only retailers to increase foot traffic and increase sales. - Inventory Management

In-store returns can be returned to inventory more quickly, reducing return stock in warehouses.

BORIS is leading retailers to shift location and store-design strategies. Making the return process more convenient for customers is a prime factor in retailers expanding in neighborhood, community & strip centers since consumers are more likely to return a good to a store if it provides close-in parking. A recent analysis by CBRE Research found that retailers are signing leases 11 months longer on average in 2024 than last year at neighborhood, community & strip centers.

Store designs are also changing to make in-store returns even easier. Nearly 45% of respondents to Optoro’s recent consumer survey said the biggest inconvenience to returning items in-store are long lines at the register. To address this concern, many retailers are designing sections of their stores solely dedicated to returns. These sections are strategically located in the middle or back of the store to increase foot traffic and the ability to cross-sell goods.

With e-commerce sales projected to increase to 35% of total retail sales (excluding autos and gasoline) by Q3 2035 from 23.2% in Q3 2024, retailers will increase their use of BORIS for returns. This will lead to increased demand for physical retail stores that can also handle the customer service and inventory management aspects of these returns.

Optoro, a Washington, D.C.-based reverse logistics provider, collaborated with CBRE on this report.

Related Insights

-

Brief | Intelligent Investment

Three Trends Driving Resurgent 3PL Industrial Demand This Year

November 11, 2024

Third-party logistics (3PL) providers’ share of bulk industrial leasing activity (leases of 100,000 sq. ft. or more) rose to 34.1% through Q3 of this year from 30.6% through Q3 last year.

Related Services

- Property Type

Retail Services

With integrated solutions, unique insight, and unmatched experience, we deliver successful outcomes for retailers, restaurateurs, investors, owners, a...

- Property Type

Industrial & Logistics

We represent the largest industrial real estate platform in the world, offering an integrated suite of services for occupiers and investors.