Intelligent Investment

Three Trends Driving Resurgent 3PL Industrial Demand This Year

November 11, 2024 3 Minute Read

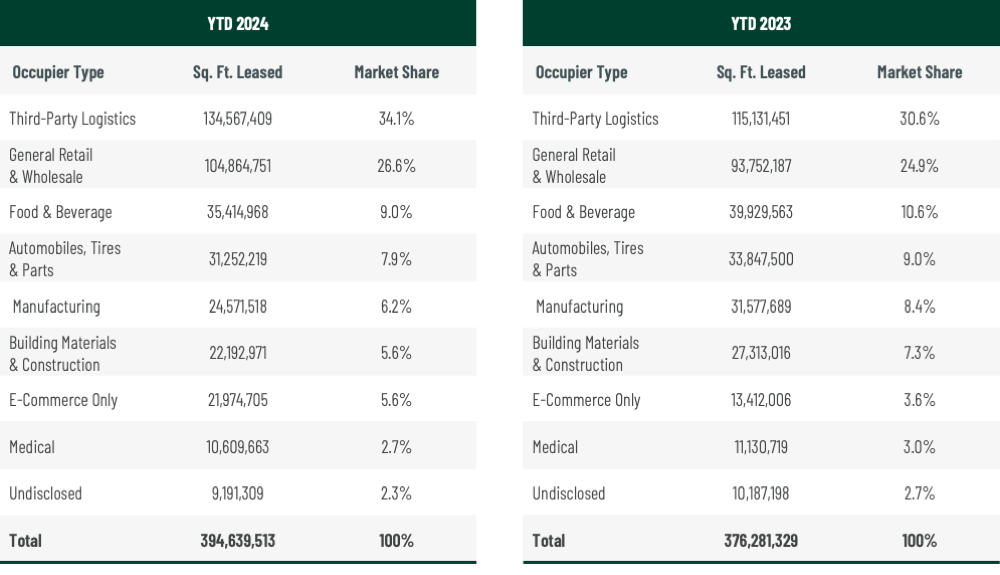

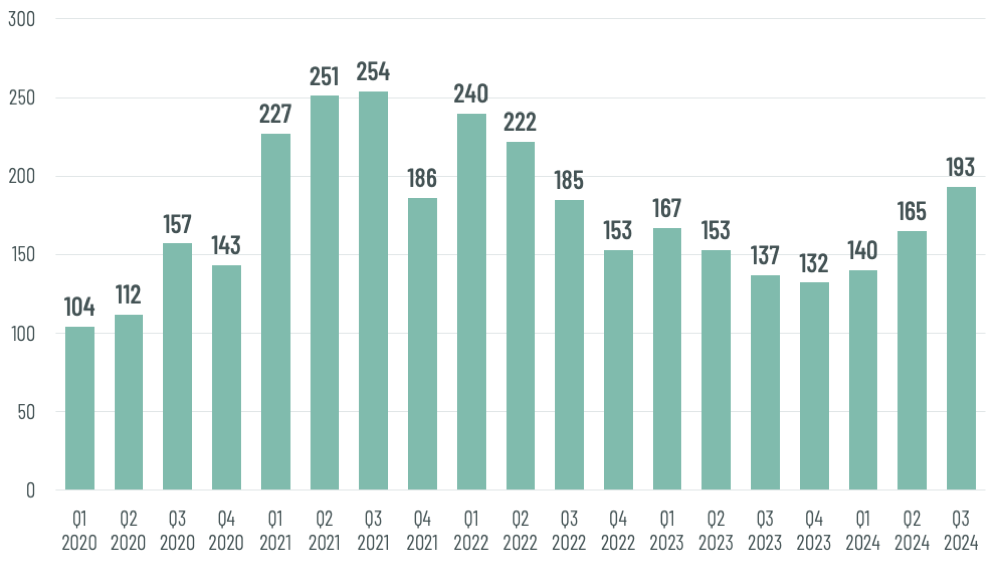

Third-party logistics (3PL) providers’ share of bulk industrial leasing activity (leases of 100,000 sq. ft. or more) rose to 34.1% through Q3 of this year from 30.6% through Q3 last year. 3PLs have accounted for 498 bulk leases so far this year, up by 9% from the 457 at this time last year. On a quarterly basis, bulk leasing by 3PLs has steadily increased this year, reversing the steadily decreasing trend of 2023.

Figure 1: Bulk Leasing by Occupier Type

Source: CBRE Research, Q3 2024.

Figure 2: Total 3PL Bulk Lease Transactions

Source: CBRE Research, Q3 2024.

Much of this resurgent demand is being driven by more retailers and wholesalers outsourcing their warehouse and distribution operations to 3PLs for three main reasons:

-

Import Flexibility

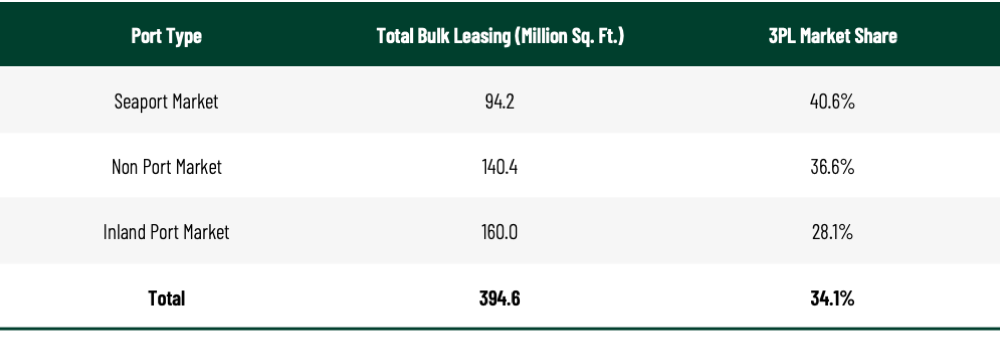

Labor disruptions, extreme weather patterns and geopolitical uncertainty have led many companies to diversify their import locations. Utilizing 3PLs allows for more inventory flexibility, a key component to retailer success in times of uncertainty. 3PLs have accounted for 41% of bulk leasing activity in seaport markets so far this year, the highest share of all three port market types. While California’s Inland Empire and Pennsylvania’s I-78/81 Corridor are not port markets, their relatively close proximity to major West and East Coast seaports, along with their convenient access to the largest population concentrations in the U.S., has led to 3PLs accounting for 45% and 50% of their total bulk leasing activity, respectively, so far this year.

Figure 3: Bulk Leasing by Market Type

Note: includes new leases and renewals for 100,000 sq. ft. or more.

Source: CBRE Research, Q3 2024. -

Capital Allocation/Preservation

Warehousing and distribution of goods is expensive. Whether it’s transportation costs, rent or labor, supply-chain-related capital expenses can drain resources. Outsourcing to 3PLs provides companies with more flexibility to increase or decrease their inventories without any risk of signing their own lease commitments. Using a 3PL also allows companies to switch supply chain costs from capital to operational expenses, which helps reduce upfront costs, increase capital flexibility and improve budget predictability.

-

Focus on Core Competency

Another benefit of outsourcing their logistics operations to 3PLs is that it allows companies to focus on core business competencies that drive revenue, such as product development, sales and customer service. Capital expenses that drive revenue are more likely to be approved by company leadership than those that are supply chain related.

Economic, geopolitical and supply chain uncertainty will remain prevalent in the coming quarters but will not diminish the need to effectively manage inventory levels. These trends will continue to drive 3PL warehouse demand.

Related Service

Optimized, data-led real estate solutions that enable 3PL providers to reliably serve their clients and more efficiently meet the multifaceted demands...

Contacts

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services

Ruben Ramirez

Senior Managing Director