Intelligent Investment

Maturation of the Hotel Industry Drives Convergence with Other Sectors to Facilitate Growth

CBRE Hotels Research

January 9, 2024 8 Minute Read

Executive Summary

- As the hotel industry matures, unit growth slows, costs increase and competition for guests becomes more challenging, driving higher same-store sales becomes an important avenue for increasing returns on investment.

- To drive higher same-store sales, hotel brands and owners will need to expand services to existing customers or attract new customers beyond traditional business and leisure travelers and engage them beyond their typical peak travel years (early 30s to late 50s).

- We expect hospitality companies to partner with residential real estate companies to create trusted and amenitized living options like student housing, co-living, senior-communities and vacation homes.

- For guests, these partnerships can enhance trust given the backing of large, globally recognized brands and increase geographic and contract length flexibility. They also provide travelers with opportunities to earn and use points in all phases of life and for all travel needs.

- For the partners, the benefits are numerous. Hotel C-corps have lower costs of capital, more free cash flow, and easier access to financing; they often offer mezzanine loans or “key money.” Hotel brands bring clout, trust and reputation and more than 680 million loyalty and alliance members to whom hotel companies can cross-market.

- By partnering with companies in new industries or sectors, which may have different cyclical or secular trends, hotel companies can enhance diversification, improve returns on existing assets, extend growth, and enhance their competitive moat.

Overview

In many ways, today’s modern hotel industry, which is characterized by franchising and segmented hotel brands, benefitted from the scale, know-how and capital investment of global conglomerates that spanned multiple industries. Hotel companies were initially often bundled with brewers, casino operators, senior living managers, airport and highway concessionaires, timeshare companies, REITs, or corporate housing, to name a few.

The 1990s and 2000s brought in the modern era of hotel company specialization via spin-offs and divestitures. Today, large, robust companies specialize in hotel branding and franchising, hotel real estate ownership, and hotel operations.

The key to a successful and sustainable strategy in the hotel industry is the same as in any other sector —profitable growth. Profitable growth can be achieved by:

- Increasing your Total Addressable Market (TAM) –potential guests who buy products and services

- Expanding your product offerings by either selling existing customers new things or finding new customers

- Maintaining or increasing market share while not diluting profits

- Increasing scale or implementing profitability enhancements and efficiencies

As the traditional U.S. lodging industry reaches maturation and growth becomes more expensive, increased competition leads to the cannibalization of existing assets and increased customer acquisition costs. In response to a more difficult competitive environment, hotel brands, and management companies have expanded overseas, acquired new brands, and formed strategic alliances that provide ancillary revenues, increased their total addressable market, and grown their loyal customer base.

Until recently, these alliances had primarily focused on companies in adjacent hospitality spaces, such as airlines, car rentals, condo developers and timeshares. More recently, traditional hotel companies have expanded into partnerships with companies spanning food delivery, short-term rental management, cruise lines, social membership clubs, and, in some cases, health clubs and spas.

The industry’s continued maturation will require brands and owners to expand their TAM by moving beyond alliances with immediately adjacent industries. Eventually, they will need to find ways to engage with potential guests outside of the traditional peak travel ages (the early 30s to late 50s) and during shoulder periods and find ways to engage with both core and potential customers more frequently.

Signs of the maturation of the U.S. lodging industry are abundant. Traditional hotel room unit growth is slowing, margins and profits are under pressure, revenue per available room (RevPAR) growth is not keeping pace with inflation, and there is increasing competition from short-term rentals, cruise lines, and other forms of lodging (i.e., glamping, camping, “van life”).

At the same time, the industry is experiencing a convergence in the short-term rental, branded residential, and more traditional residential (single and multi-family) real estate markets. Services and amenities are more important than ever in traditional residential real estate, as are improvements in shared spaces and the desire for more communal activities for all ages to instill a sense of belonging, something that had historically been more common in active adult communities and senior living.

Today, individuals rent out their homes via short-term rental platforms. Sovereign wealth funds and large real estate investors lower their costs, increase capacity utilization (particularly in shoulder periods), and increase their returns by selling luxury residences as part of new resort developments. What were once primary residences are now rentals, and what were once rentals are now homes.

Given the large number of renters across the globe, we see an opportunity for hospitality owners and brands to grow their footprints and their loyal customer bases by expanding into, merging, or partnering with residential real estate companies to create trusted and amenitized co-living, student housing, vacation home and senior-living communities.

Imagine if a company like Marriott could begin to capture a large share of future guests’ wallets at 18 by entering student housing or co-living, offer them corporate housing or serviced apartments as those individuals secure and change jobs in new cities, and if that brand loyalty and trust could be extended into the later stages of life. Marriott, or any globally recognized hotel brand family, could then capture a larger share of guests’ wallets from “college to grave”, so to speak.

It's not that this idea is new. In fact, Marriott used to be in the senior-housing, corporate housing, and timeshare businesses; however, those were all spun off as the differing public market investment bases looked for “specialization.” They now have an alliance with Marriott Vacation Club, a separate publicly traded company, and they recently re-entered the corporate housing space, primarily outside the U.S.

Our view is that this is likely to come full circle as the brands look for growth. Will growth into these areas—senior housing, multifamily rentals, student housing—come in the form of 100% ownership? It’s unlikely, but direct investments and additional partnerships are likely.

Maturation Will Drive Convergence

Higher cost of capital, increased competition from alternative lodging sources, and proliferation of hotels and hotel brands over the past several decades will force both public and private hotel companies to pursue new avenues of growth.

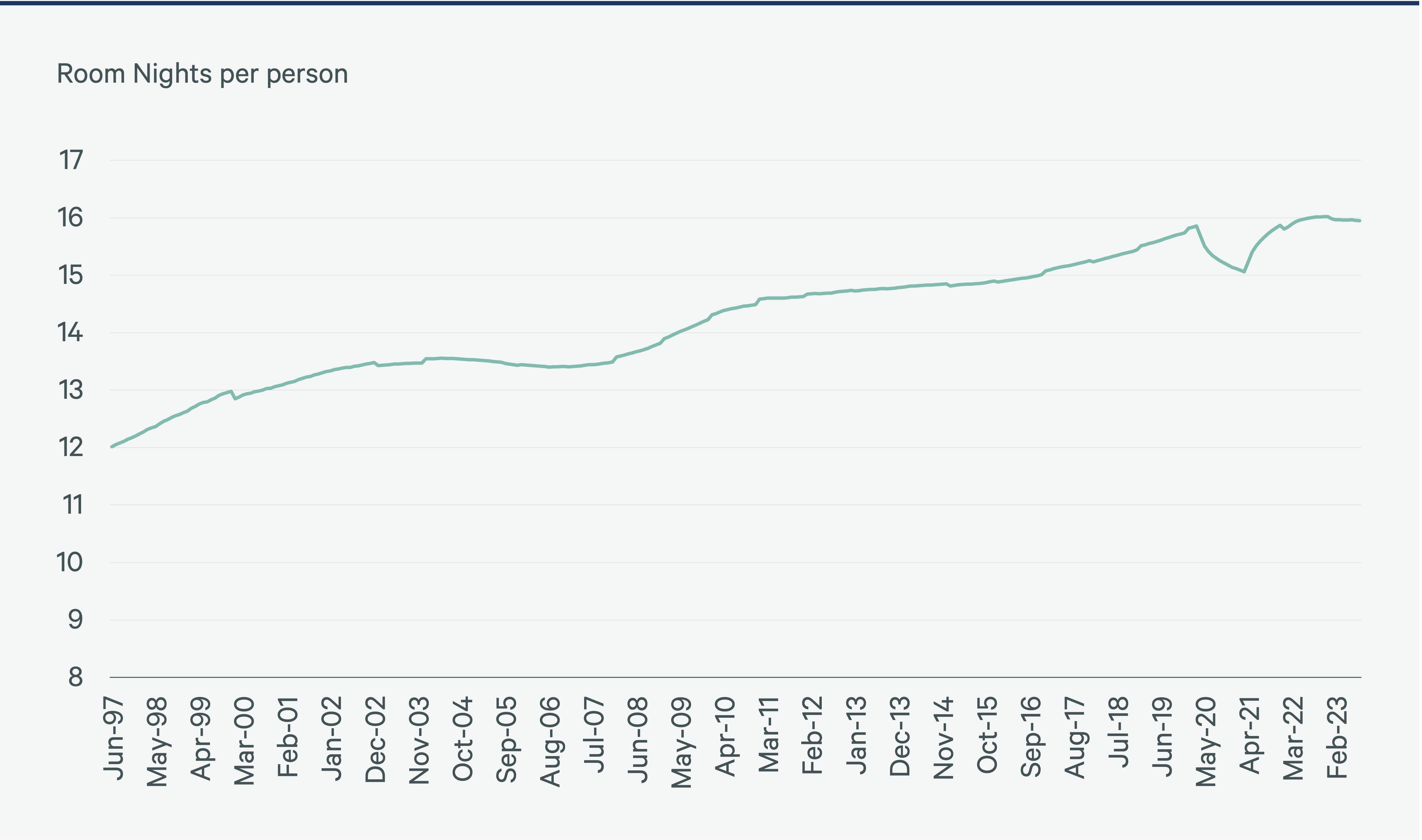

With nearly 16 room nights per person in the U.S. and an average of 14 brands per brand family, it is becoming harder to slice and dice the existing population into new target guest segments.

Figure 1: Number of Room Nights Per Person (Aged 25-54)

There are already brands that target everything from traditional corporate travelers, “hipsters,” leisure travelers, all-inclusive resorts, design-centric, luxury experiences, budget travelers, etc. Creating additional brands or niche segments to attract new customers is possible, but the new segments will be smaller (brands have gone after the “big rocks” already), making it more difficult to move the needle on growth. Key industry players must respond to evolving user preferences highlighting the need for flexibility and adaptability in accommodations.

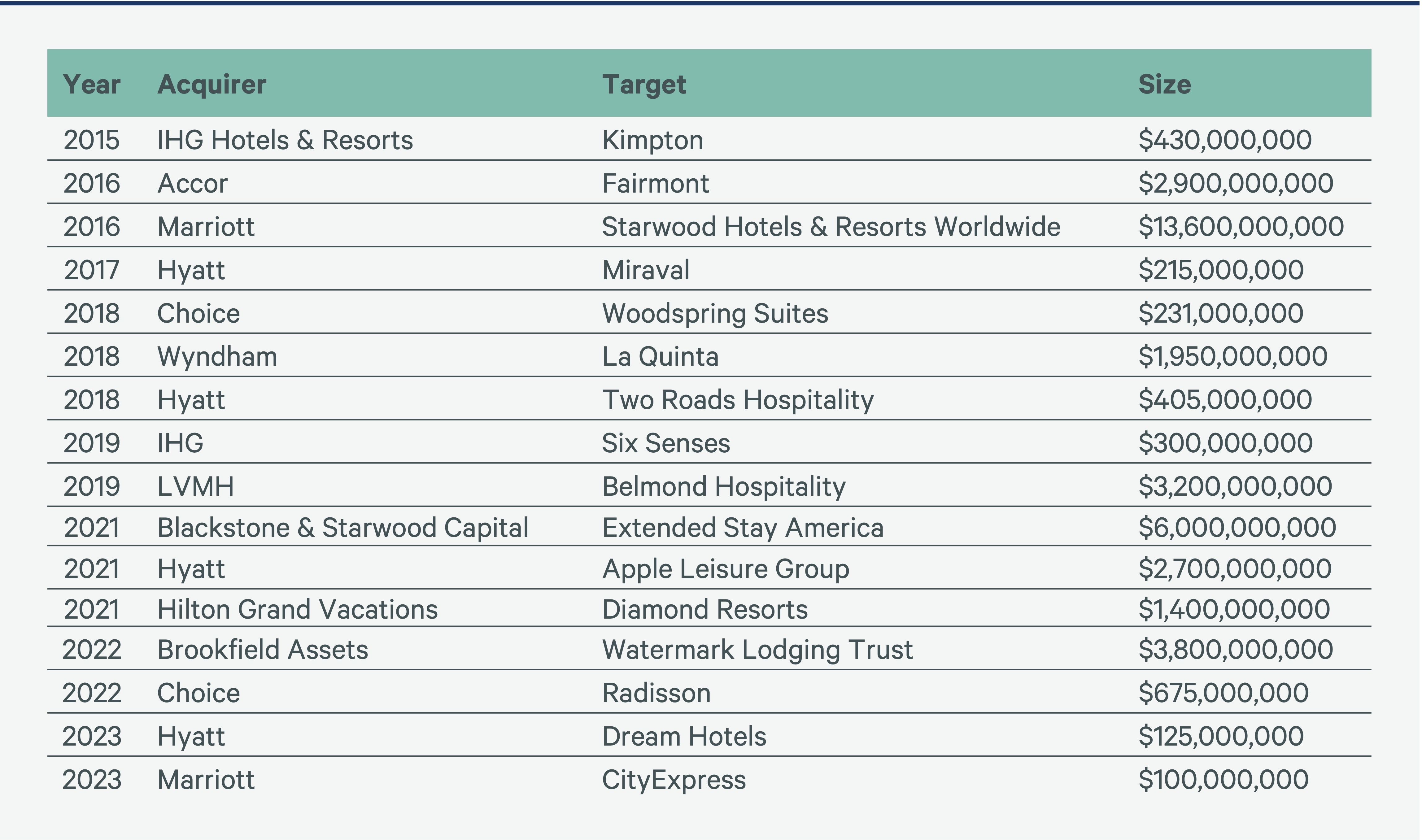

After decades of organic growth, lodging companies – REITs, brands, and operators pursued mergers and acquisitions to build scale, increased geographic footprints and TAM, enhanced partnerships, and built complex loyalty programs and partnerships while working to leverage General & Administrative expenses and protect margins.

Figure 2: Major Mergers and Acquisitions since 2015

As the industry matures, competition increases, and development, financing, and remodel costs increase, driving same-store sales growth becomes more important, as it is increasingly difficult to generate ROI through unit growth.

Increasing TAM

To build more direct relationships with guests, reduce customer acquisition costs and provide “occupancy insurance” in the softer periods, over the past 15 or so years, hotel brands have formed alliances with credit card companies, car rentals, airlines, short-term rental management companies, spas, and cruise lines.

This growth has been critical in expanding branded loyalty programs and increasing market share of consumers’ hotel expenditures; however, these strategic alliances will only carry the globally recognized brand families so far as they do not necessarily increase the TAM given many of these customers are already hotel guests. For example, if you rent a car, or take a flight, you were already likely to stay in a hotel. In short, these alliances may enable a company to increase its share of dollars spent in hotels, but it doesn’t necessarily create new customers.

To grow the TAM of potential guests or customers, hotel companies must attract guests outside of the traditional business and leisure travel use cases and outside of their peak travel years, often thought to be 25 to 55.

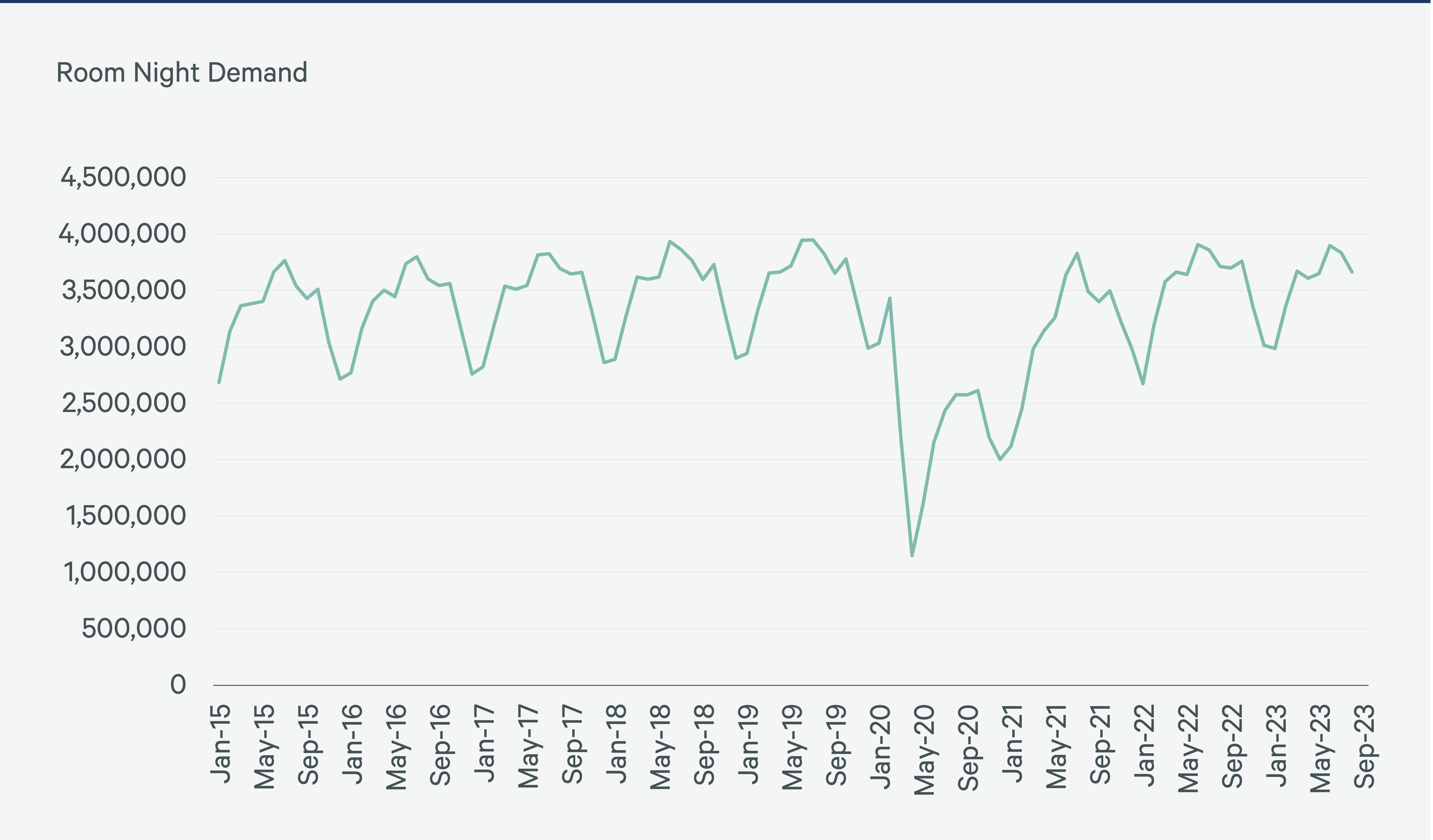

Figure 3: U.S. Room Night Demand

Options include branded:

- Senior living: The aging of our population, which in demographic terms is increasingly older but far from the usual stereotypes, enjoying a higher quality of longevity, higher education levels, and more comfortable economic resources.

- Co-living: (called Flex Living in Spain) is part of a larger umbrella of flexible housing that offers services and a community element.

- Traditional single-family rentals (build-to-rent)

- Student Housing

- Residential (Condos) outside of resort developments

- Short-term rentals/corporate housing/ timeshare

- Fractional ownership in specific cities and/or leisure focused locations

- Coworking properties

- Membership clubs

- Serviced apartments and mix-use buildings

The Global Financial Crisis catalyzed the growth of these asset sharing companies following steep job losses and increasing credit constraints. People are now comfortable sharing nearly any asset with strangers: their home, their car/strangers’ cars, their RVs, and even their pools. We have seen an explosion in membership and subscription services. What used to be the realm of gym memberships and country clubs has bled into streaming services, vacation clubs, and even luxury real estate membership subscriptions.

Growth into these additional verticals is supported by several secular trends.

- Increases in flexible, remote and hybrid working, making the integration of coworking, hotel, and membership clubs even more attractive. Several hospitality companies have entered this arena. For example, Accor with Ennismore and the Hoxton coworking brand, and Selina with its hostel/coworking/co-living community.

- Flexible work arrangements facilitate incremental leisure travel and work-from-anywhere arrangements that can bring guests in-house during what would have previously been considered non-peak periods. (e.g., digital nomads, “workation”)

- Increases in mobility, driven by the democratization of the traveler between cities and even countries.

From a purely cost perspective, rising housing costs (rents, down payments and mortgages), make asset-sharing and co-living communities, with smaller rooms and larger common areas, more attractive. These dynamics converge with delayed family formation, sustainability goals and incentives, and local policymakers’ desires to keep locals local and housing costs affordable in key leisure and urban markets like Aspen, Colorado, Honolulu, Hawaii, and New York City, New York.

Today’s Players

Examples of these trends already exist or are emerging in a corporate/institutional format:

- Hotel brands partner with residential real estate management companies

- Marriott – Vacasa, Accor – One Fine Stay, Hyatt – Homes & Hideways in partnership with Lowe, Rhodium

- Multifamily housing companies partner with short-term corporate and leisure housing providers/hotels

- Sonder, Mint House, Kava, aka

- Luxury lodging membership clubs

- Inspirato, Rosewood’s Carlyle & Company, Exclusive Resorts, Membership Collective Club (SoHo House)

- Fractional residential homes

- Without hotel services — Pacaso, August

- With hotel services — Timbers, Ritz, Four Seasons, Rosewood

- Hospitality-branded residential developments

- Storyliving by Disney/Margaritaville/Canyon Ranch senior living

- Gym/wellness retreats/hotel companies

- Miraval/Exhale/Hyatt, Equinox and Equinox hotel company

- Coworking/Club membership/Hotel company

- Accor/Ennismore/Hoxton, Birch

- Coworking/co-living/lodging

- Selina, Locke, Zoku Hyrid hotel

- Traditional branded timeshare

- Marriott and Marriott Vacations, Hilton and Hilton Grand Vacations, Wyndham and Club Wyndham

- Corporate housing

- Marriott Executive Apartments

- Serviced apartments

- Be Mate of Room Mate, Adagio Premium, Accor's aparthotel brand par excellence, or Cheval, which is a mixed-use complex where there is room for both the co-living resident and the tourist flat guest in different buildings (e.g. Cheval's Three Quays in London).

- Short-term rental companies facilitate longer-term stays and sell hotel rooms

- Airbnb and VRBO

It is worth noting that we have categorized the above into separate groups, although there is already tremendous overlap. For example, timeshare and fractional ownership, corporate housing and short-term apartment rentals share many similarities to the point that the terms can sometimes be interchangeable. Over time, we believe the key players will consolidate further, and there will be a few big brands with a presence in most, if not all, of the segments.

The Benefits of Convergence

Partnerships, JV, or brand alliances benefit both parties in many ways.

From a hotel perspective, they can:

- Grow the brand’s loyal client base to increase market share and improve the yield of existing hotels.

- If a hotel company partners with an airline, they could be more likely to increase their share of travel spend but not necessarily attract new travelers, as someone flying is already a traveler.

- If a hotel company partners with a non-travel-related company, they can potentially attract an entirely new customer.

- Give the hotel company an economic interest in a new company, which may have different cyclical or secular patterns, thereby enhancing diversification.

- Improve returns on existing assets and elongate the runway for growth by introducing new business lines and partnerships.

- Enhance a company’s competitive moat vs. online travel agencies (OTAs) and lodging competitors, as well as increase direct bookings.

- Potentially increase the number of members in non-U.S. locations and build loyalty in markets where the membership points/redemption model is less prevalent.

From the guest’s perspective they can:

- Provide opportunities to earn and utilize points in all phases of life and for all need states (use cases) – business travel, leisure travel, etc.

- Enhance trust driven by the backing of large, globally recognized brands.

- Guests are more confident in the products and services they will receive because of the brand.

- Potentially receive better service, lower costs through economies of scale, and enhanced access to amenities.

- Gain increased geographic flexibility and contract length flexibility.

- Have access to spaces that generate experiences, with a wide offering of services.

Benefits to partners in overlapping and adjacent spaces include the following:

- Hotel C-corps have lower costs of capital, more free cash flow, and easier access to financing. They often offer mezzanine loans or “key money.”

- Hotel brands have more than 680 million loyalty and alliance members to whom hotel companies can cross-market.

- Hotel brand families are easily recognized, and they bring clout, trust and reputation.

- Hotel brands offer possibly more experience and scale in operations, technology and marketing.

- Hotel companies could bring data and forecasting expertise to bear to reduce leasing costs and improve yield management.

- Hotel companies can help to leverage technology to customize the guest experience and drive operating efficiencies.

Related Service

- Property Type

Hotels

CBRE Hotels delivers bottom-line impact to hotel clients globally by providing advisory, capital markets, investment sales, research & valuation s...