Intelligent Investment

U.S. Seniors Housing & Care Investor Survey H2 2024

November 27, 2024 4 Minute Read

About Our Survey

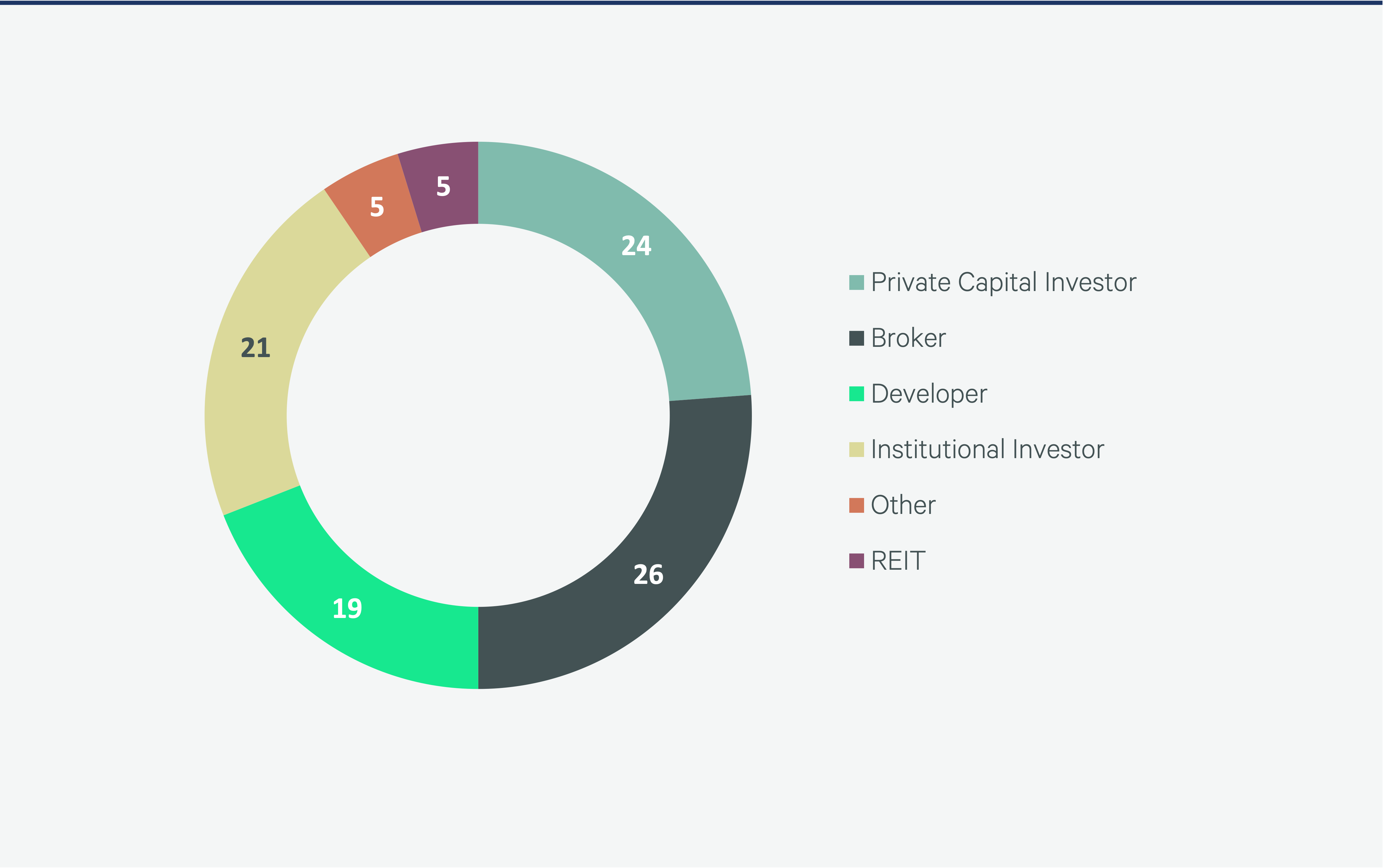

This 15th edition of CBRE’s Senior Housing & Care Investor Survey, conducted in October 2024, polled the same group of senior housing real estate professionals and investors as our last survey in April and had a 96% response rate.

A clear majority of respondents reported either no change or a decrease in capitalization rates from the prior survey and more respondents predicted flat rent growth in the year ahead.

Figure 1: 2024 Survey Respondents by Type (%)

Senior Housing Trends

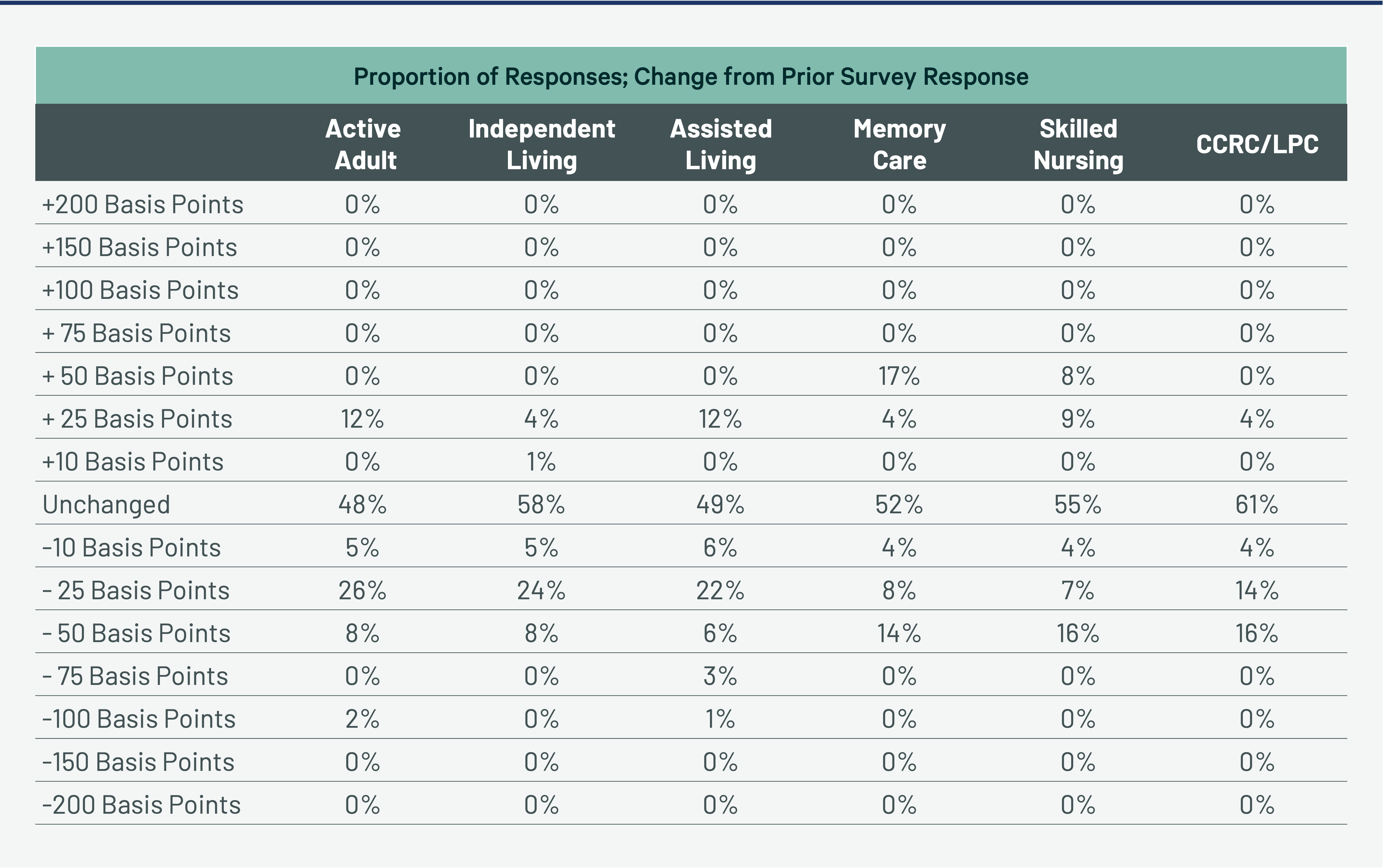

- Fifty-four percent of survey respondents reported no change in senior housing cap rates from the prior survey.

- Based on total responses, the average senior housing cap rate fell by 8 basis points (bps) over the past six months.

- Skilled Nursing (SN) cap rates decreased by 7 bps on average between April and October, after increasing by 11 bps over the previous six months.

- The average cap rate for Active-Adult (AA) communities decreased by 11 bps on average between March and October, nearly offsetting the increase recorded during the prior survey.

- Independent Living (IL) and Assisted Living (AL) cap rates both fell by an average of 10 bps, while those for Memory Care (MC) facilities had no change.

- For AA, IL, AL and MC facilities, 48% of survey respondents said they expect rental rate increases of 3% to 7% over the next 12 months, down from 63% of respondents in the prior survey. Approximately 26% of respondents expect no rent growth for AA communities in 2025.

- No respondents reported underwriting rent growth above 7%, compared with the 12% of respondents who did in the April 2024 survey.

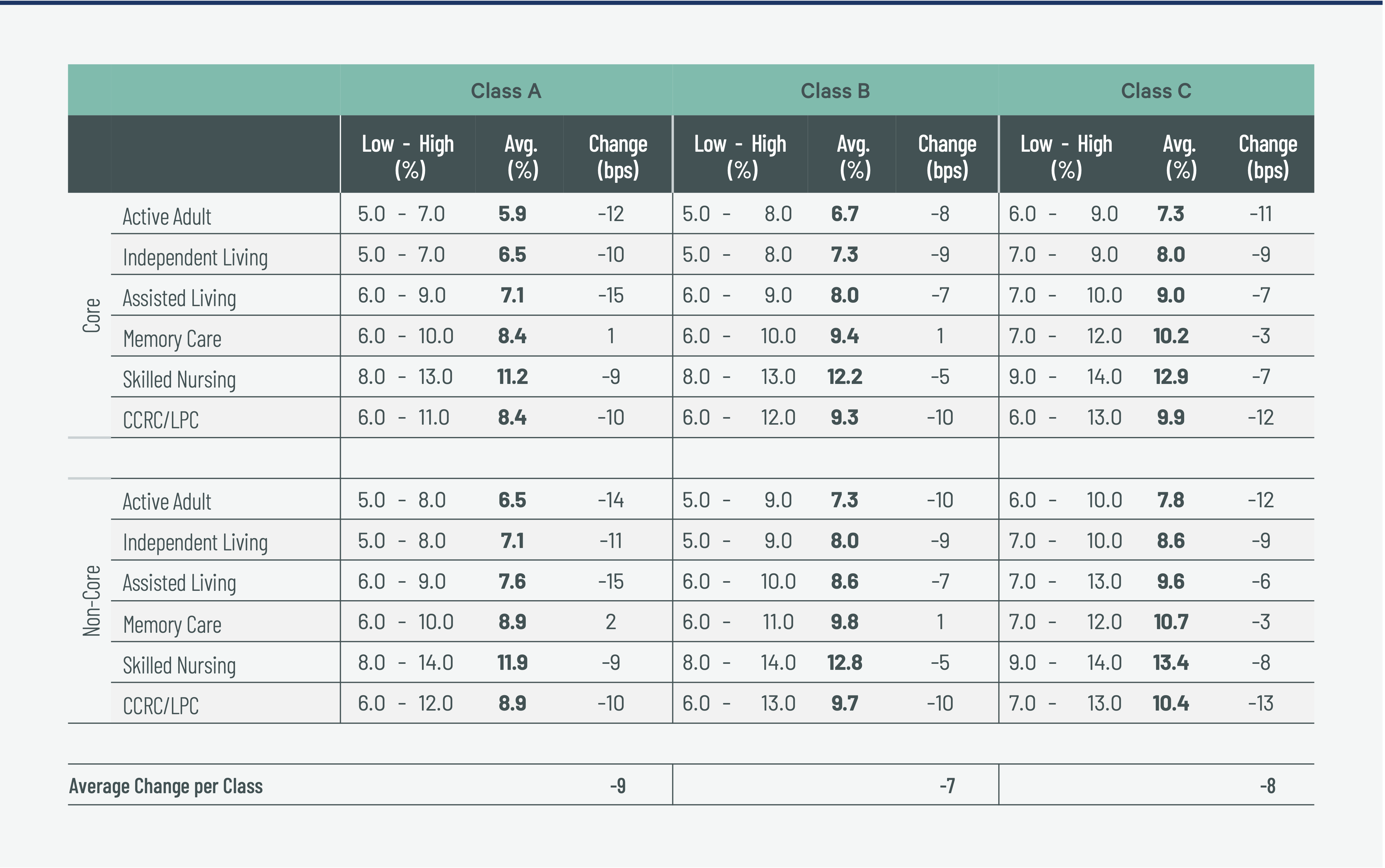

Investor Survey Results

Cap rates for Non-Core Market, Class A Active-Adult and Assisted Living decreased the most, down by 14 bps to 6.5% and by 15 bps to 7.6%, respectively, on average.

Free-standing Memory Care was the only category with increased cap rates, up by 1 to 2 bps to 9.5% on average.

Figure 2: Senior Housing & Care Capitalization Rates, H2 2024

Capitalization Rate Trends

Figure 3: Capitalization Rate Change from Prior Survey

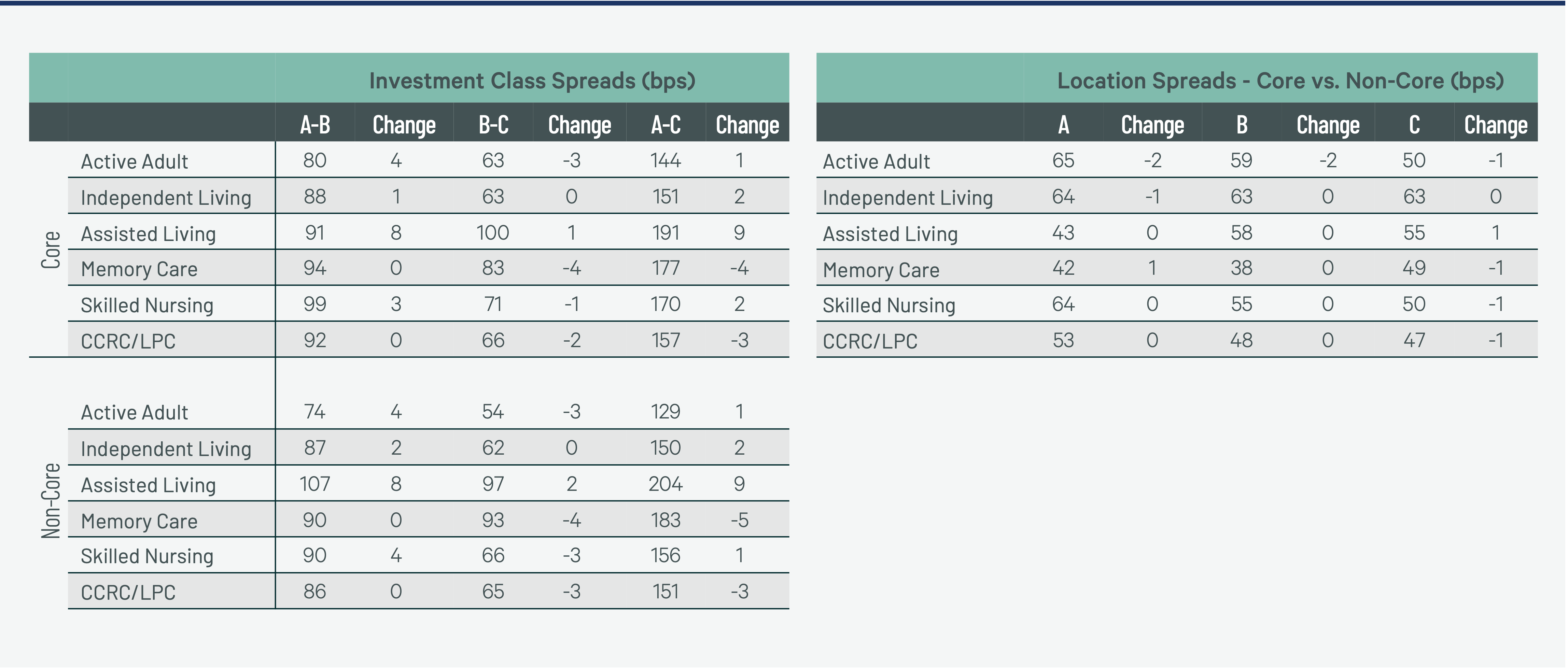

Cap rate spreads between asset classes were unchanged at zero bps.

The average spread between core and non-core assets remained at 54 bps.

Figure 4: Senior Housing & Care Capitalization Rate Spreads; Investment Class & Location

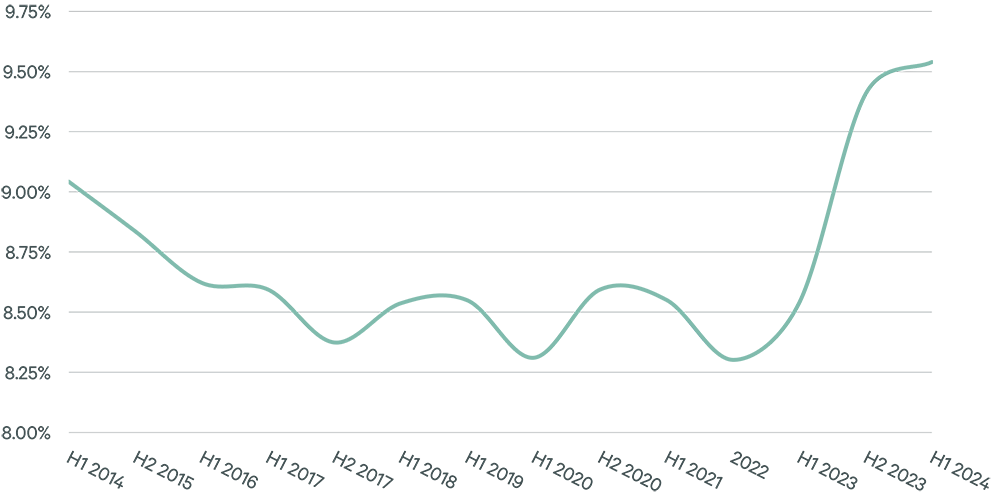

Figure 5a: Senior Housing & Care — Historical Capitalization Rate Trends

Source: CBRE Senior Housing Investor Survey results, H2 2024.

Figure 5b: Skilled Nursing

Source: CBRE Senior Housing Investor Survey results, H2 2024.

Figure 5c: CCRC/LPC

Source: CBRE Senior Housing Investor Survey results, H2 2024.

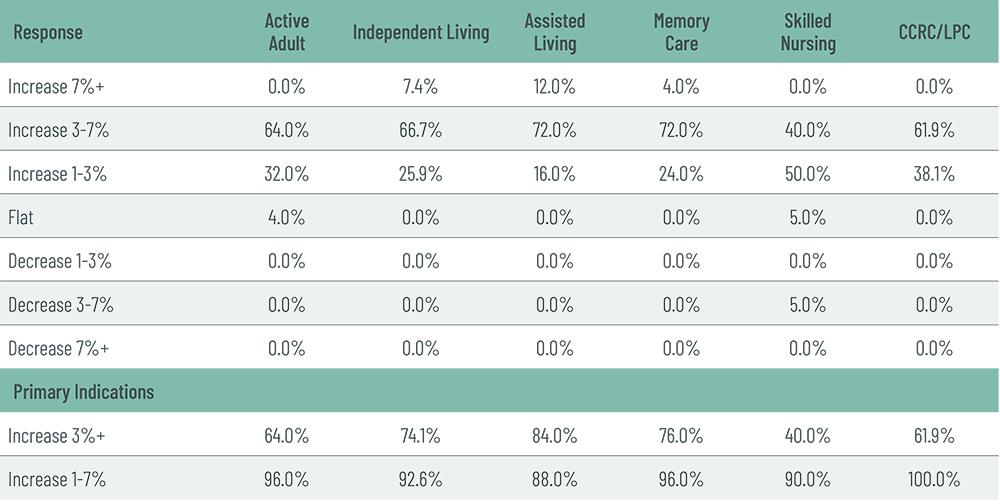

Rent Growth Expectations

Unlike our April survey with consensus expectations of a 3% rise in rental rates over the next 12 months, there was no clear consensus in our current survey. No respondents expected rent decreases for any asset class except Skilled Nursing, while the number of respondents expecting no change in rental rates increased to approximately 20% in October from nearly none in April. The percentage of respondents who reported underwriting rent growth above 7% fell to zero in our October 2024 survey from 12.0% in the April 2024 survey.

Figure 6: 2025 Rent Growth Expectations

Research Contacts

Matt Vance

Vice President and Americas Head of Multifamily Research

Valuation & Advisory Services

Daniel Lincoln

VAS - Executive Vice President

Andy Kepchar, MAI

Senior Vice President