Intelligent Investment

U.S. Senior Housing & Care Investor Survey H1 2024

June 10, 2024 4 Minute Read

About Our Survey

This 14th edition of CBRE’s Senior Housing & Care Investor Survey, conducted in April 2024, polled the same group of senior housing real estate professionals and investors as our last survey in October and had a 98% response rate.

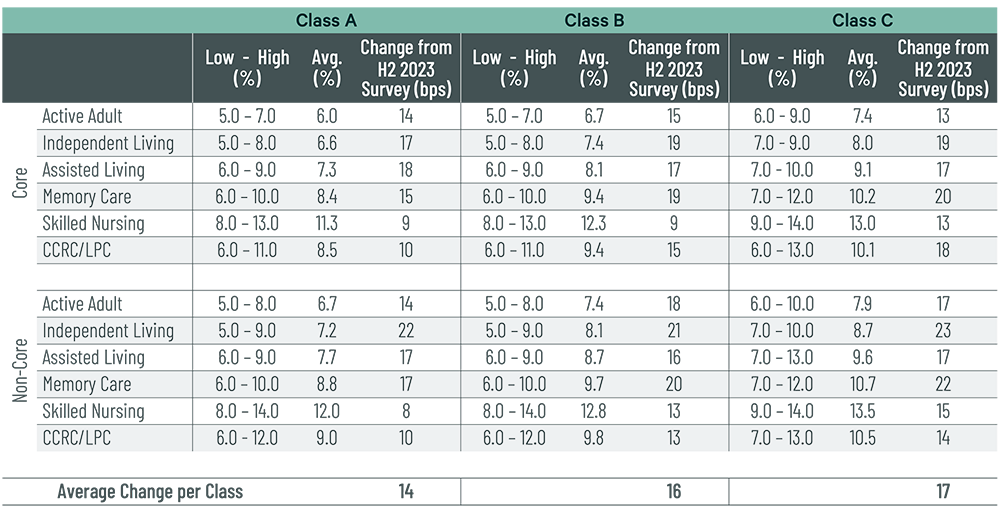

While the previous survey generated a consensus view of increasing capitalization rates due to inflation and staffing shortages, nearly half of respondents to the current survey reported no change in cap rates.

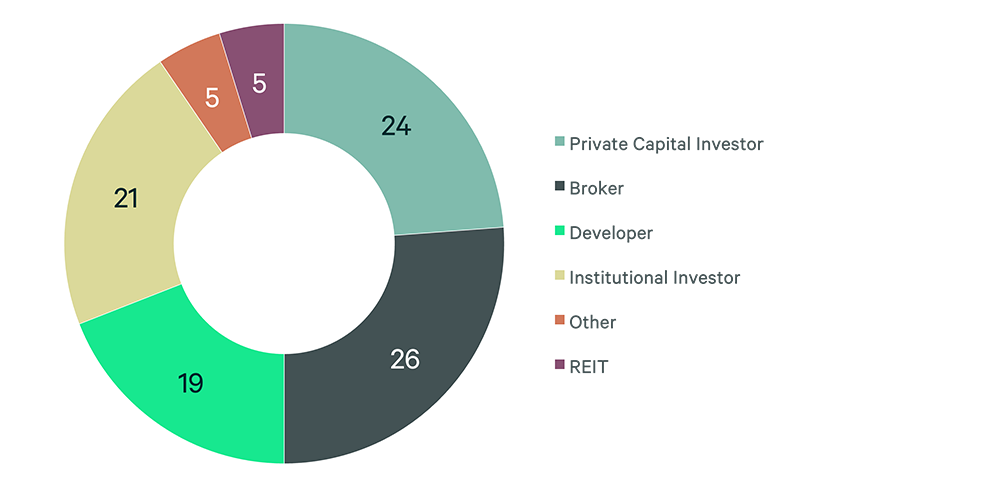

Figure 1: Percentage of Survey Respondents by Type

Senior Housing Trends

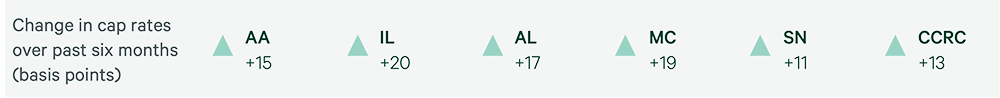

- Skilled Nursing (SN) cap rates increased by 11 basis points (bps) between October 2023 and March 2024, after increasing by 71 bps over the previous six months.

- The average cap rate for Active-Adult (AA) communities increased by 15 bps between October and March.

- Average cap rates for Independent Living (IL), Assisted Living (AL) and Memory Care (MC) facilities increased by 17 to 20 bps over the past six months, with greater increases for Class C assets than Class A and for non-core markets than core. This is a reversal from the prior survey, which reported the biggest increases for Class A assets and core markets.

- For AA, IL, AL and MC facilities, 63% of survey respondents said they expect rental rate increases of 3% to 7% over the next 12 months.

- Despite these average increases based on total survey responses, 45% of survey respondents reported no change in senior housing cap rates from the prior survey.

- The percentage of respondents who reported underwriting rent growth above 7% fell to 3.9% in the April 2024 survey from 15.6% in the October 2023 survey.

Investor Survey Results

The average senior housing cap rate based on total survey responses increased by 16 bps between October and March.

Cap rates for Non-Core Market Independent Living Class A and Class C assets increased the most, up by 22 bps to 7.2% and by 23 bps to 8.7%, respectively.

Cap rates for Non-Core Skilled Nursing Class A increased the least, up by 8 bps to 12.0%.

Figure 2: Senior Housing & Care Cap Rates, H1 2024

Capitalization Rate Trends

Nearly half of respondents reported no change in senior housing cap rates over the past six months.

Figure 3: Cap Rate Change from Prior Survey

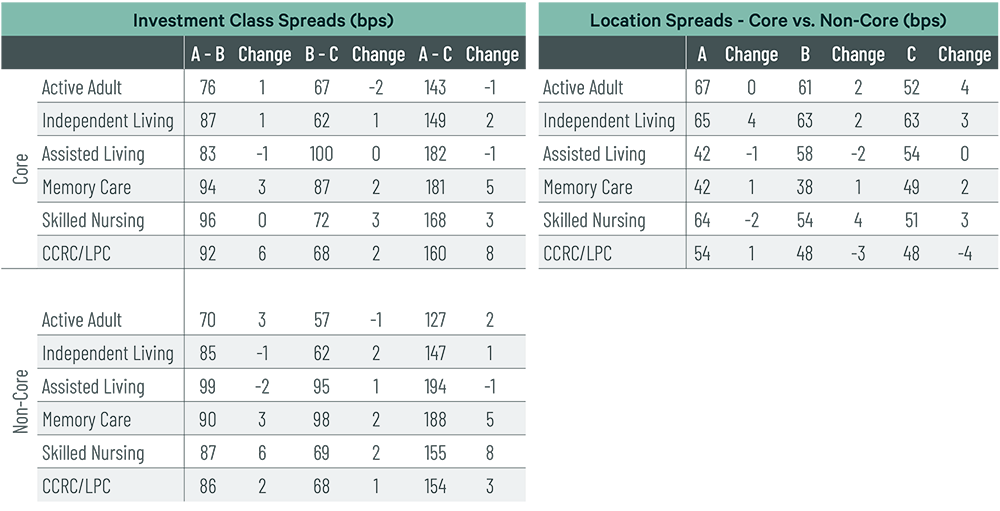

Cap rate spreads between asset classes were essentially unchanged.

The average spread between core and non-core assets was essentially unchanged at 54 bps.

Figure 4: Senior Housing & Care Cap Rate Spreads; Investment Class & Location

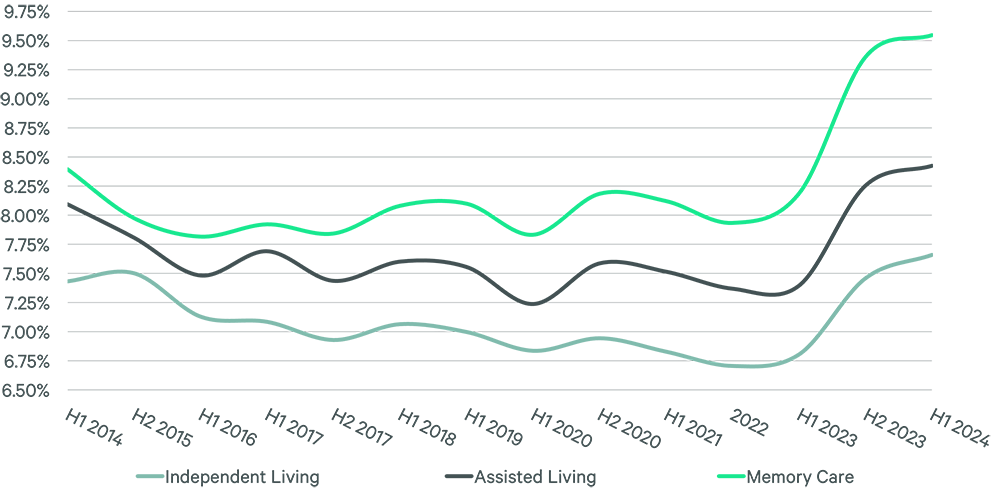

Figure 5a: Senior Housing & Care Cap Rate Trends — Independent Living, Assisted Living & Memory Care

Source: CBRE Senior Housing Investor Survey results, 1H 2024.

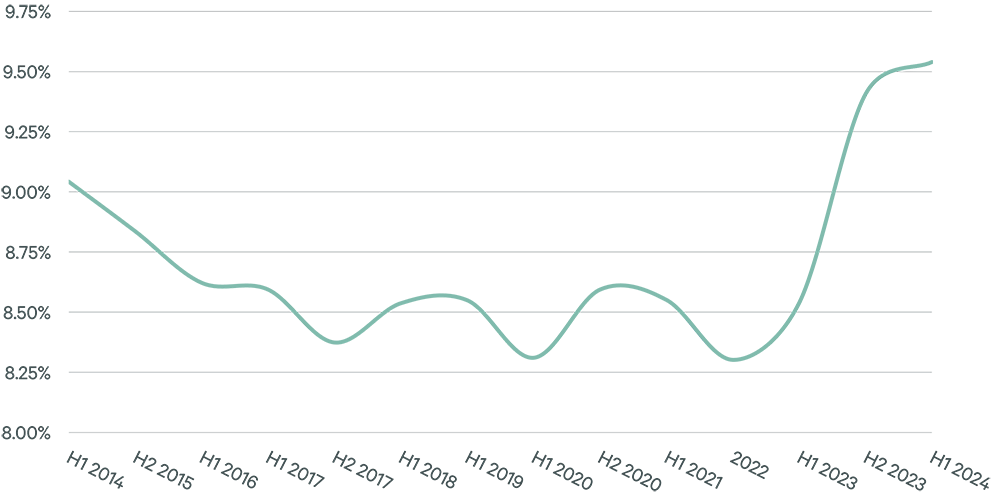

Figure 5b: Senior Housing & Care Cap Rate Trends — Skilled Nursing

Source: CBRE Senior Housing Investor Survey results, 1H 2024.

Figure 5c: Senior Housing & Care Cap Rate Trends — CCRC/LPC

Source: CBRE Senior Housing Investor Survey results, 1H 2024.

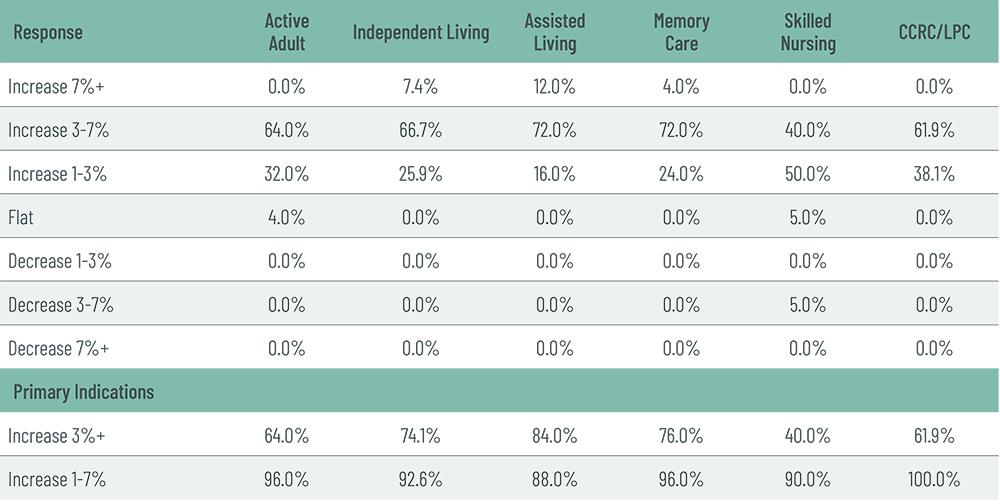

Rent Growth Expectations

A clear majority of respondents expect rental rate increases of 3.0% or more over the next 12 months for all classes except Skilled Nursing. No respondents expect rent decreases for any asset class, while the number of respondents expecting no change in rental rates increased slightly. The percentage of respondents who reported underwriting rent growth above 7% fell to 3.9% in our April survey from 15.6% in the October survey.

Figure 6: 2024 Rent Growth Expectations

Related Service

We offer a fully integrated platform of dedicated senior housing investment sales, debt and structured finance, investment banking, and valuation serv...

Valuation & Advisory Services

Daniel Lincoln

VAS - Executive Vice President

Andy Kepchar, MAI

Senior Vice President