Evolving Workforces

Law Firm Benchmarking Survey Highlights 2025

Law Firm Practice Group and Americas Consulting

April 16, 2025 7 Minute Read

Executive Summary

The post-pandemic market for law firm space continues to take shape. More firms are applying firmwide attendance policies. Space-sharing is fading. Unlike last year, respondents now agree: Professional opportunities favor those who spend time in the office. Firms are evaluating costs and relying primarily on badge swipes to track attendance and utilization. Overall footprints are stabilizing, as most firms don’t expect significant changes in their real estate portfolio in the next three years.

Key Findings

- Law firms expect continued high attendance, with most encouraging at least three days a week in the office. In a departure from last year’s survey, firms agree remote work means less professional opportunity.

- For law firms, attracting and retaining top talent is the leading driver of real estate decisions. But cost savings are getting a closer look and firms are tracking data on space utilization.

- More progressive space strategies are no longer gaining new adherents. Firms “not interested” in space sharing jumped 16 percentage points in a year.

This output summarizes key findings from CBRE's annual Law Firm Benchmarking Survey. The full 30-page report is available exclusively to survey participants. To take the survey, click here.

Office Policy and Culture

Law firms expect continued high attendance. Most encourage working in the office at least three days a week by fostering an attractive firm culture rather than using mandates.

Key Findings

Real Estate Priorities

Law firms are balancing talent needs with cost savings, focusing on the efficient use of existing office space. Firms are no longer focused on future-of-work strategies, but on implementing new real estate goals.

Key Findings

Space Planning Trends

As lawyers spend more time in the office, more progressive space planning strategies, such as hoteling, are not gaining new adherents. Other emerging trends in real estate and talent strategy, such as sustainability and AI, aren’t yet having a major impact on law firms’ decision making.

Key Findings

Methodology

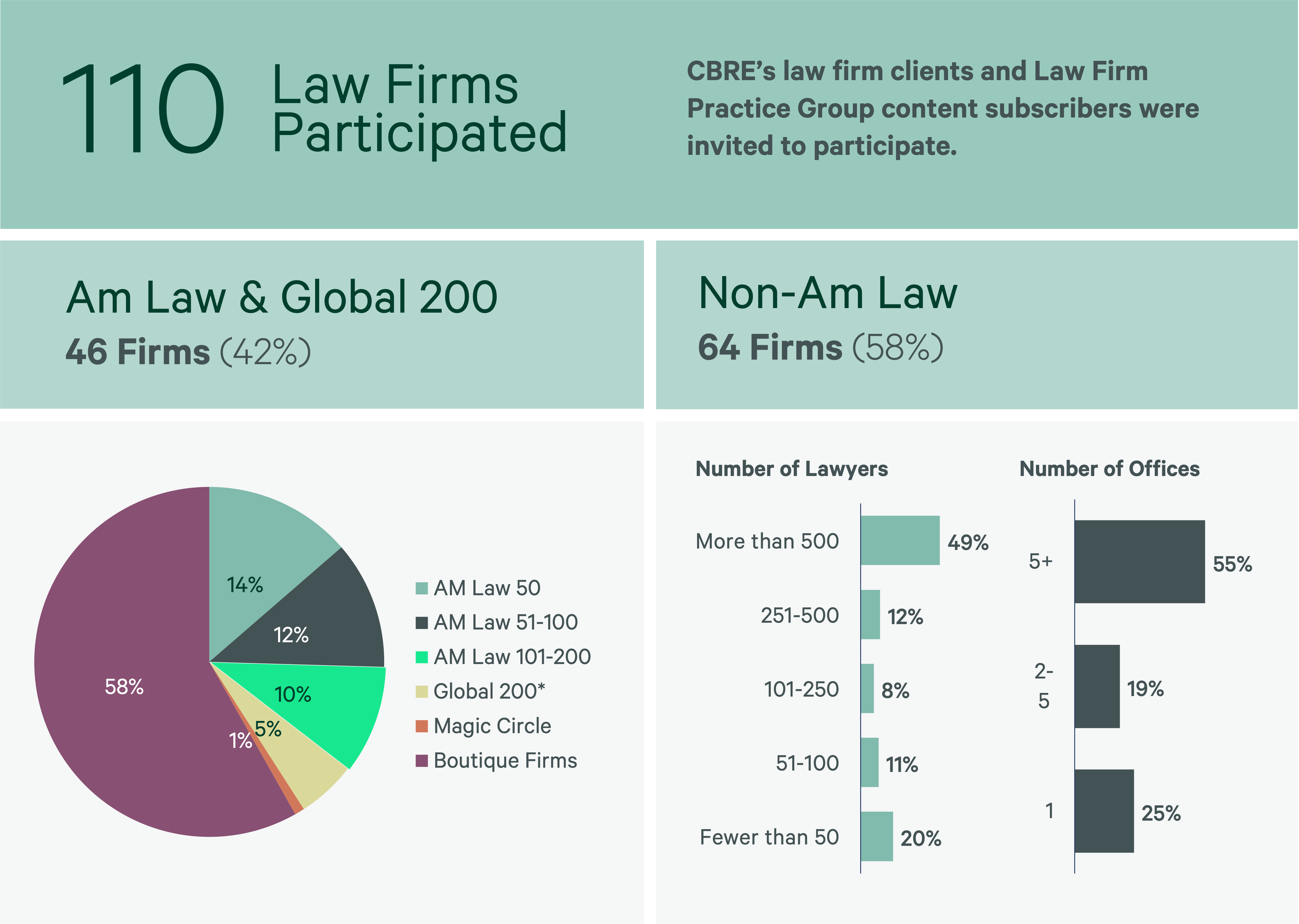

In November 2024, CBRE conducted an annual benchmarking survey to analyze real estate priorities among law firm leaders. The responses represent a range of law firm and portfolio sizes.

The 2024 survey garnered 88 responses from firms with U.S. headquarters and 22 responses from firms headquartered outside the U.S. Thirty-three U.S. cities are represented in responses. The HQ markets with the most responses are New York, London, Los Angeles, Seattle, Chicago and Boston.

Note: Throughout this report, “all firms” means “all firms who responded to the survey,” and “Am Law” references include Global 200 firms. Responses received after November 2024 are not included.

Full Survey Report

Available exclusively to survey participants, our full report includes 30 pages of detailed results, data and observations including:

- The largest data set in the real estate industry (110 firms)

- Results shown by Am Law vs. Non-Am Law Firms and select results for the Am Law 50

- 2023 vs. 2024 YoY data trends

- Details on shifting metrics for rentable sq. ft./lawyer from 2017-present

- Five law firm trends to watch in 2025

To take the survey and get access to the full report, click here.

Related Insights

Related Services

- Transform Business Outcomes

Consulting

Gain comprehensive guidance on insightful, executable real estate strategies for both investors and occupiers.

- Industries

Law Firms

Develop real estate and business strategies for your law firm using our comprehensive, proprietary market research and decades of experience advising ...

Contacts

Emily Botello

Managing Director, Americas Consulting

Sarah Gibbons-Scheets

Managing Director, Americas Consulting