Report | Intelligent Investment

2024 Asia Pacific Investor Intentions Survey

January 16, 2024 10 Minute Read

Executive Summary

Looking for a PDF of this content?

CBRE’s 2024 Asia Pacific Investor Intentions Survey was conducted in November and December 2023. Over 500 responses were received from participants who were asked a range of questions related to their buying intentions, perceived challenges and preferred strategies, sectors and markets for the coming year.

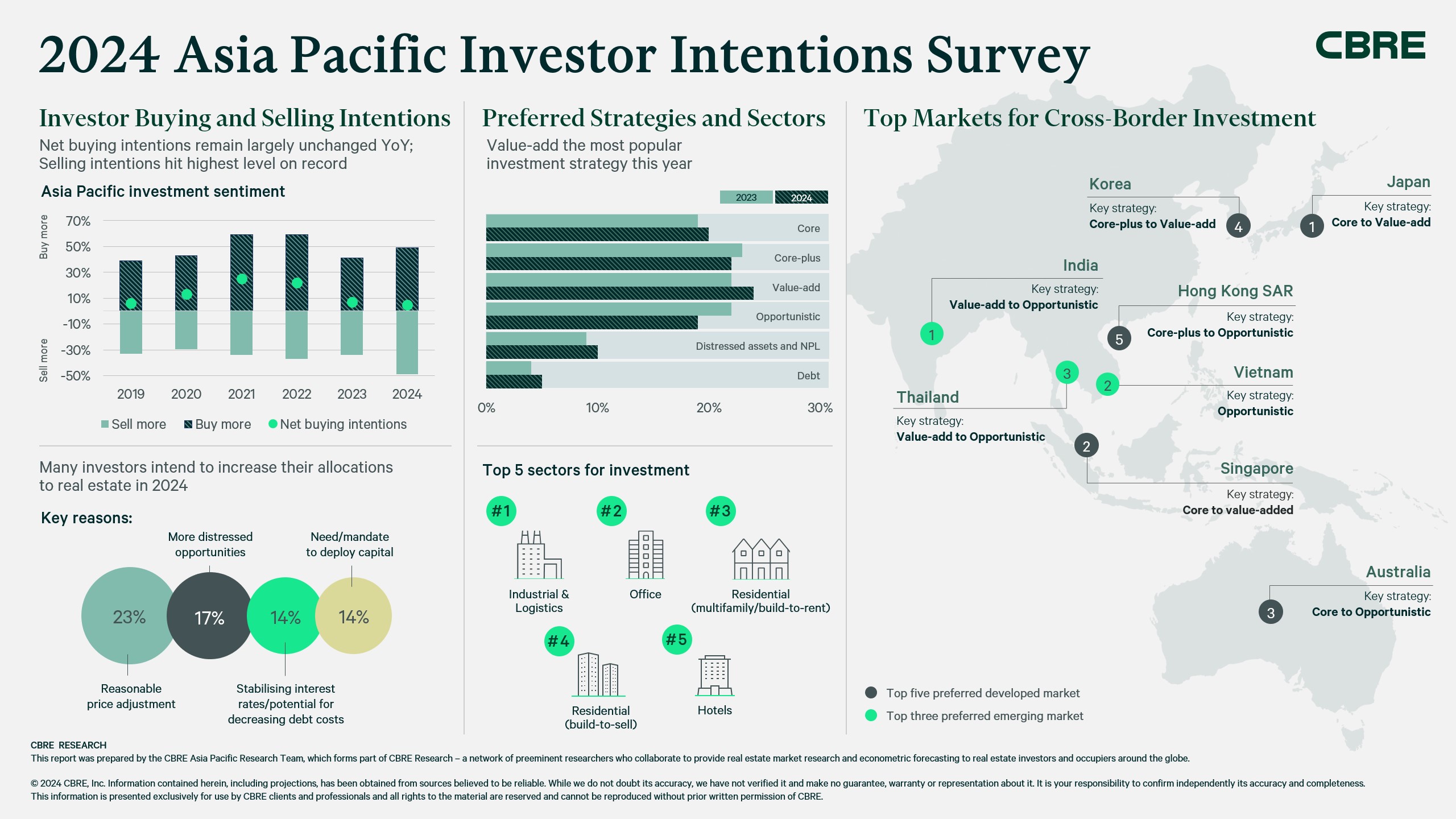

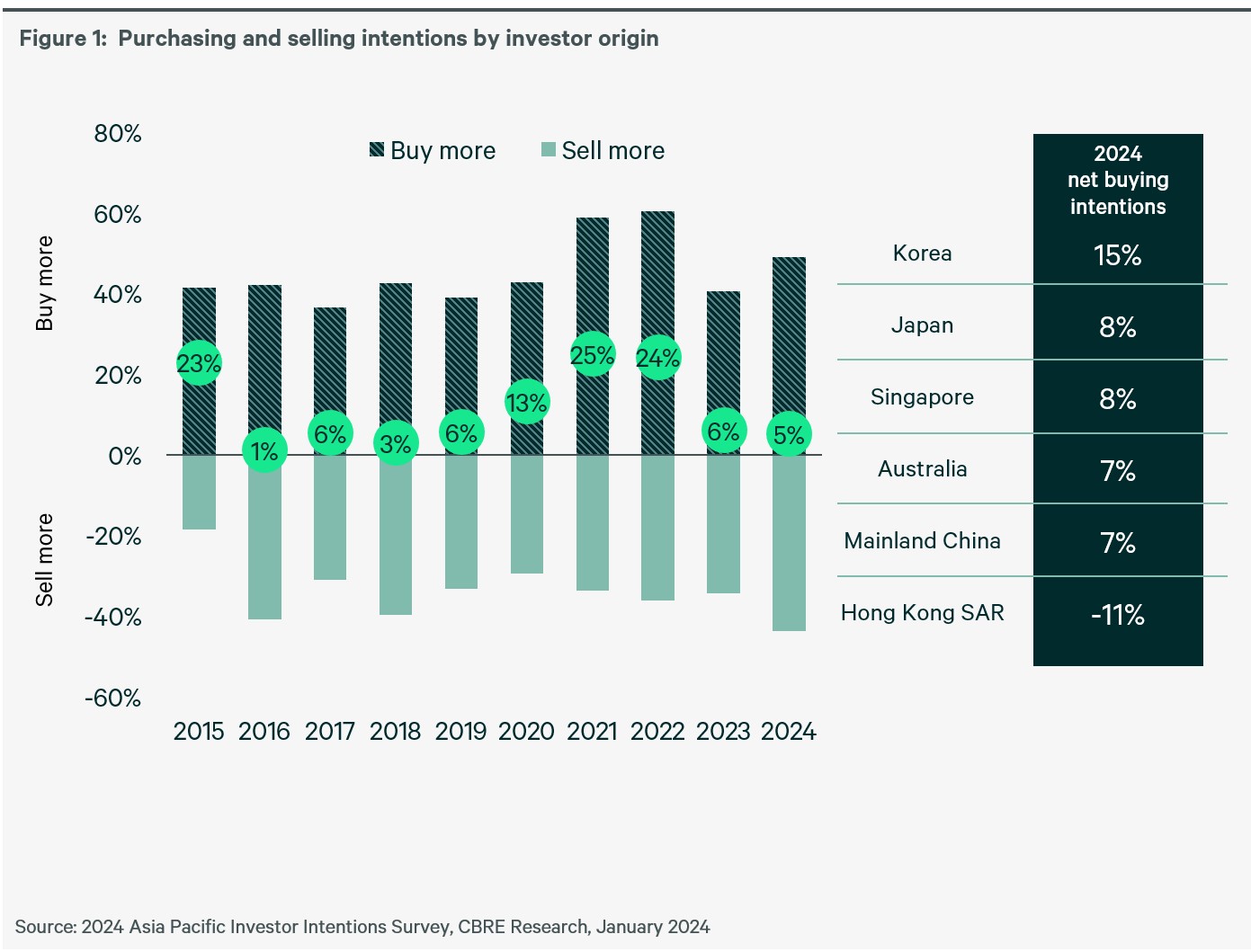

The survey uncovered persistently weak buying intentions across Asia Pacific, with selling intentions hitting the highest mark since surveys began. Whilst the rate hike cycle has come to a halt in major global markets, investors are waiting for indications that the current repricing cycle has finished before deploying significant amounts of capital.

Investors in most markets (ex. Japan) will therefore continue to adopt a wait and see approach in H1 2024. However, amid growing expectations that the U.S. Federal Reserve will begin cutting rates in H2 2024, and Asia Pacific’s central banks following suit, commercial real estate investment activity should accelerate in the back half of the year.

Other key findings:

- Overall investment sentiment is at the expected level of CBRE’s in-house estimates. Despite similar net buying intentions, more than 40% of investors said they would dispose of more assets in 2024 to realise returns and repay debt. The strongest selling intentions were observed in Australia, Singapore and Hong Kong SAR.

- The survey revealed that value-added investment strategies will gain momentum in 2024 as investors look to hit target returns in markets where negative carry continues to persist.

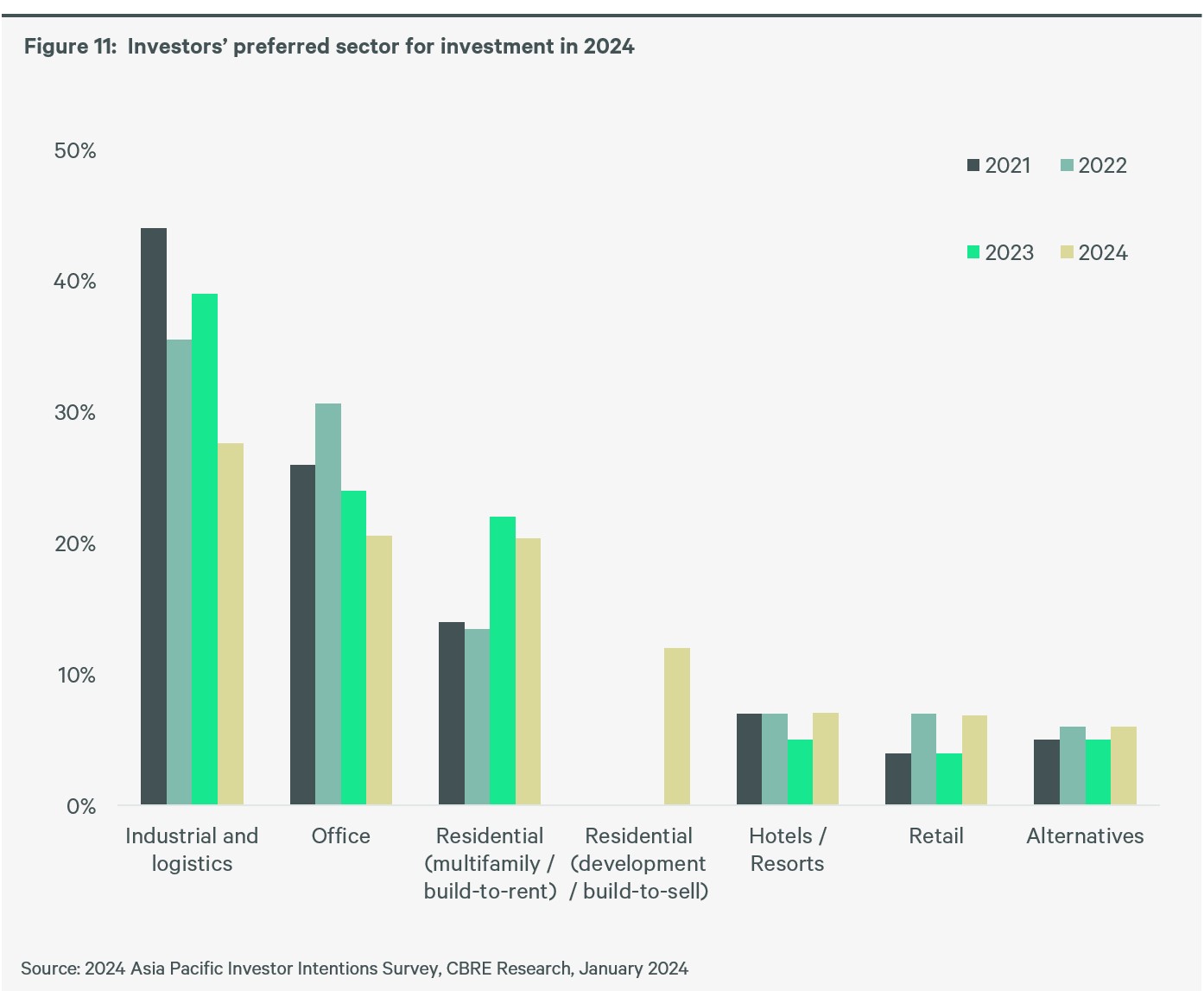

- Residential assets (especially multifamily and built-to-rent) logged the strongest uptick in interest, particularly among investors considering value-add strategies. Industrial and offices are still the top property type among core investors.

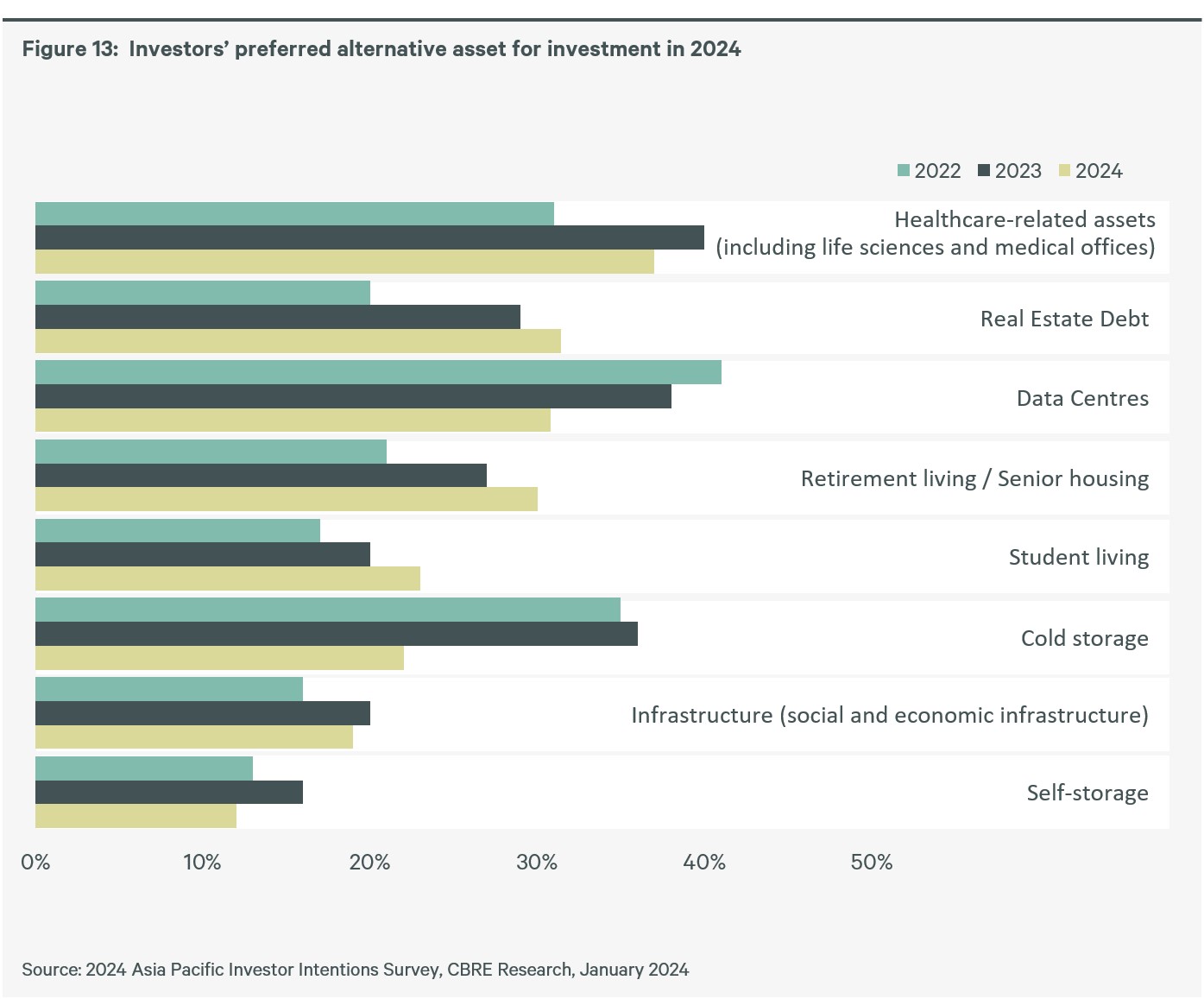

- Healthcare assets remain top of mind for investors looking at alternative assets. Real estate debt climbed to second place in this year’s survey, while a greater emphasis on the living sector (retirement living and student accommodation) was observed.

- Japan retained its position as the most preferred market for cross-border investment for a fifth consecutive year. Singapore and Australia followed in second and third place, respectively. Investors remain attracted to highly liquid markets with stable income.

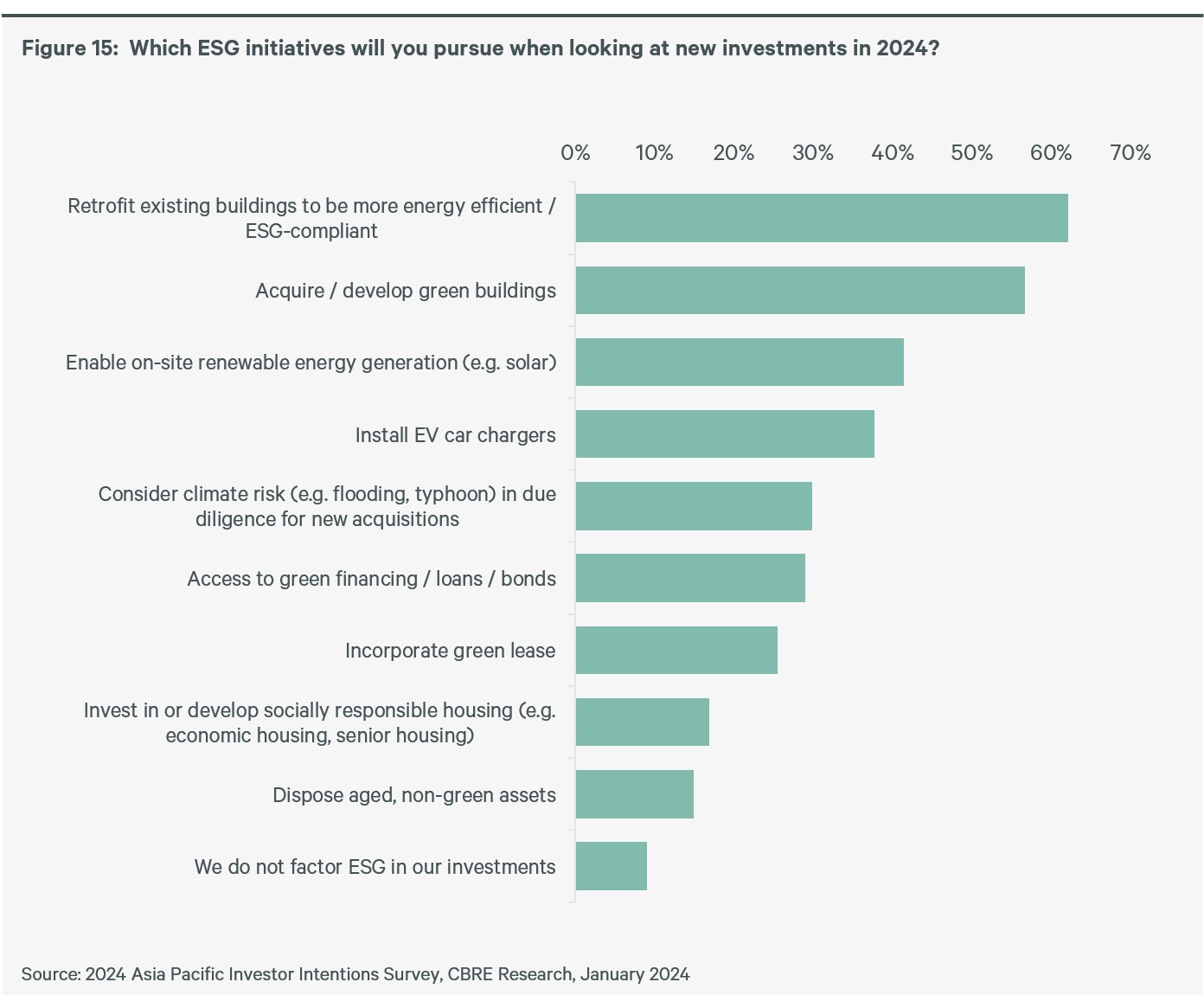

- Just over 60% of investors, the bulk of which are private equity funds, real estate funds and REITs, intend to retrofit existing buildings to be more sustainable or ESG-compliant in 2024; a trend ensuring value-added strategies are their preferred approach.

Click to enlarge

Investor Buying and Selling Intentions

Selling intentions reach highest level on record

Despite net buying intentions remaining largely unchanged from the previous year, more than 40% of investors stated they intend to dispose of more assets during 2024 to realise returns and repay debt. Selling intentions were strongest in Australia, Singapore and Hong Kong SAR.Korean domestic investors displayed the strongest buying intentions in 2024 despite high borrowing costs, with many buyers targeting core office assets with strong rental growth prospects. Japan was in second place, although buying intentions weakened ahead of widely anticipated interest rate changes in H1 2024. Singapore ranked third.

Following significant capital value declines in their home market, Hong Kong investors exhibited the weakest buying intentions. Negative carry deepened and investment appetite shrank by half, hitting a 15-year low as financing costs reached a 22-year high. However, Hong Kong’s economy is expected to recover in 2024 on the back of stronger growth in mainland China, while potential interest rate cuts will improve investment sentiment.

Mainland Chinese investors continued to exhibit weak net buying intentions despite the People’s Bank of China’s (PBOC) and the China Banking and Insurance Regulatory Commission’s (CBIRC) implementation of a series of measures, including interest rate cuts, to support cash-strapped developers and boost residential market sales.

Click to enlarge

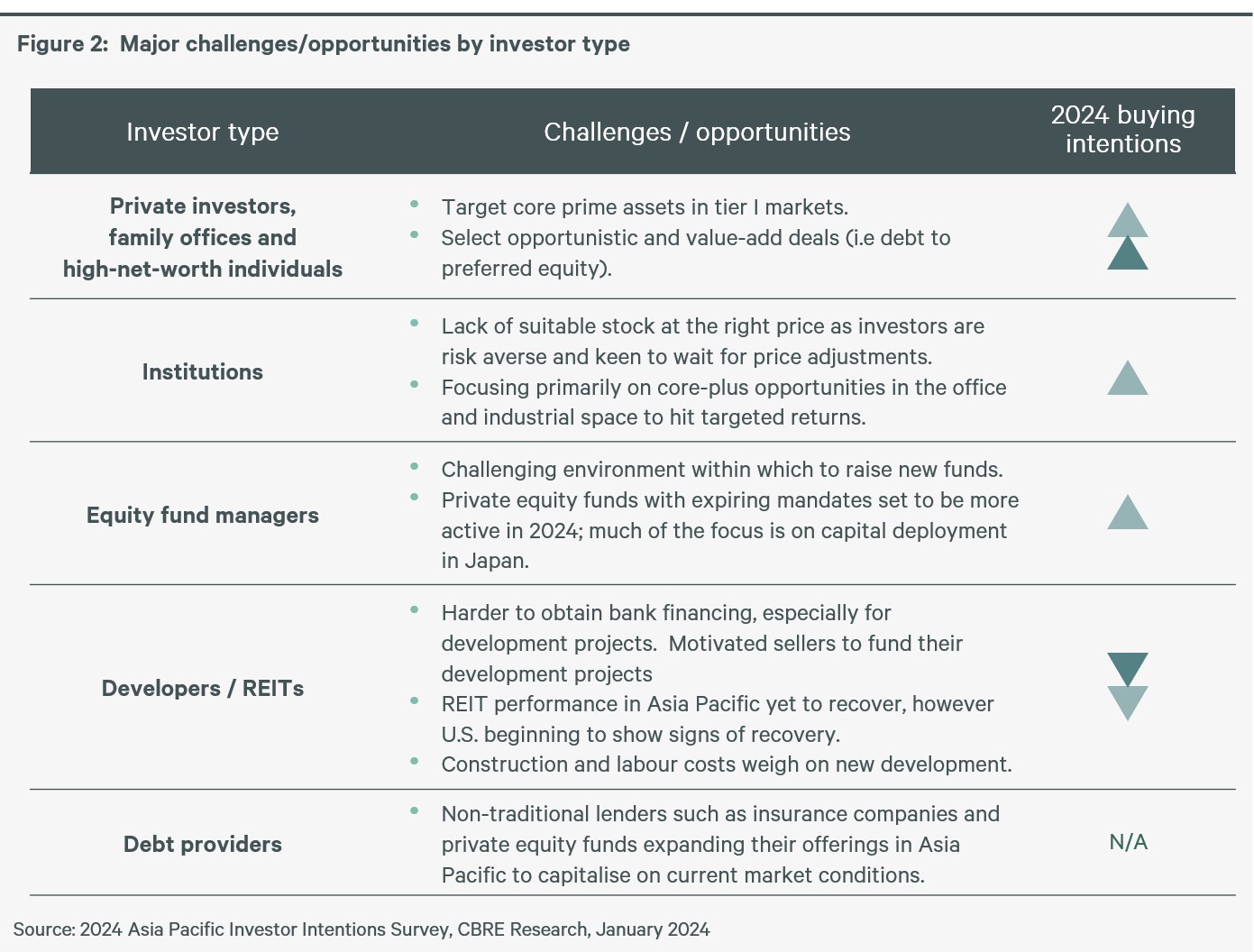

Private investors remain most active

For the second year in a row, high-net worth/private investors were the most active buyers, followed by institutional investors. During a market downturn, high-net worth/private investors are typically the most active in capitalising on price dislocation to secure the best quality assets, while other types of investors see a decrease in activity. Net buying intentions for these types of investors stood at +15%.Institutional investors including insurance companies, pension funds and sovereign wealth funds expect their buying intentions to remain at a similar level in H1 2024, before gaining traction in the second half. With the fear of a denominator effect somewhat easing in H2 2023, many institutional investors intend to launch global real estate investment programmes. Overall, net buying intentions for institutional investors were measured at +4%.

Despite lukewarm investment activity by property funds in 2023, this cohort of investors intends to purchase more this year than in the previous 12 months. This is due to the limited window for investment as many funds approach the end of their investment period.

The higher cost of financing and correction in the public market will ensure developers stay on the sidelines until conditions stabilise.

With banks adopting a more conservative stance towards lending for real estate by offering higher rates and lower LTV ratios, there will be opportunities for non-traditional debt providers to bridge the funding gap at higher rates.

Click to enlarge

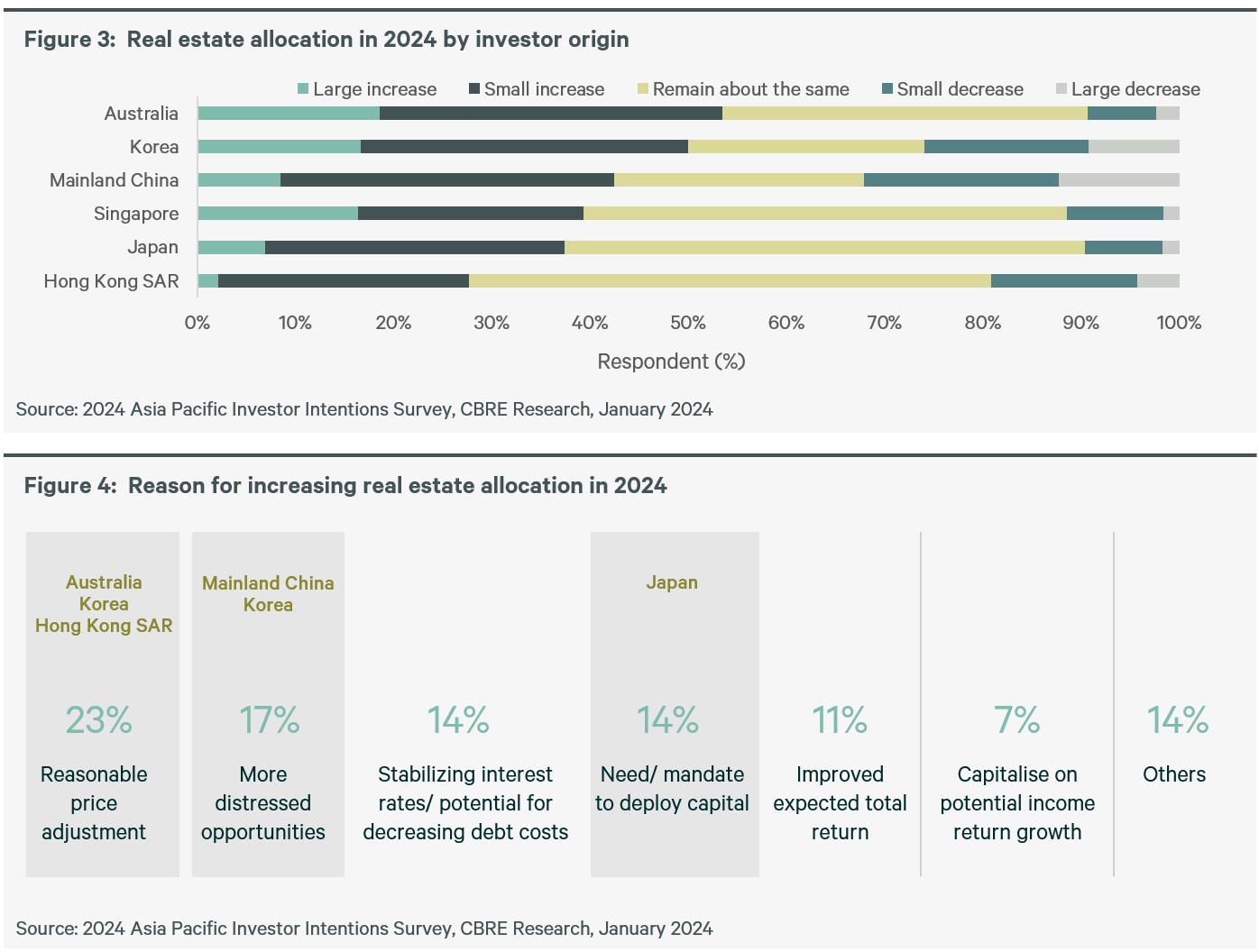

Australian and Korean investors keen to increase allocations

Most investors in Asia Pacific indicated their intentions to either increase or keep their real estate allocations the same. With further price adjustments expected in H1 2024, more than half of Australian and Korean respondents said they would look to increase their allocation to real estate. Most public report filings for both these markets indicated that overall book values for commercial real estate dropped 5-10% over the course of 2023.Singaporean, Japanese and Hong Kong SAR investors said that their allocations would remain stable in 2024. Whilst Japan and Singapore have seen minimal changes in asset pricing during the current cycle, uncertainty surrounding income returns for office and industrial assets in Hong Kong SAR will weigh on real estate investment decisions in this market over the next 12 months.

Mainland Chinese investors exhibited mixed attitudes for real estate allocation in 2024. Most investors from this market expect to see more distressed opportunities emerge in the coming 12 months.

Click to enlarge

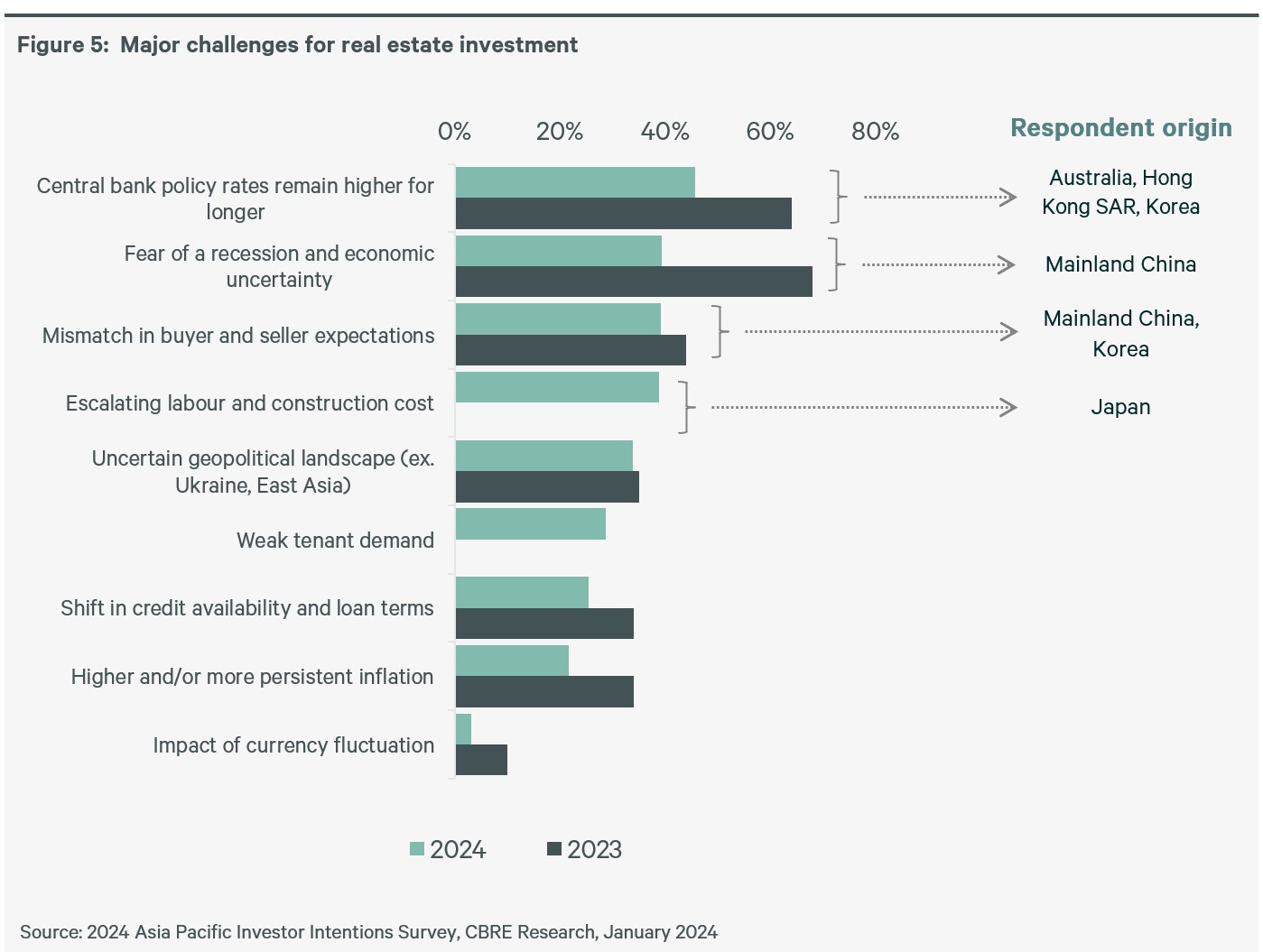

Central policy rates and economic uncertainty remain major challenges

Fears of a recession and further policy rate increases once again ranked as investors’ top two concerns in this year’s survey, although worries around these issues weakened significantly compared to last year. While economic growth for most markets in Asia Pacific is forecasted to fall below trend, greater certainty around borrowing costs and the prospect of rate cuts in H2 2024 in many global markets somewhat eased concerns.The mismatch in pricing expectations between buyers and sellers remains a major concern for investors. Whilst repricing occurred in most markets and sectors in Asia Pacific in 2023, investors retain the belief that some further price adjustment is required for investment volumes to pick up in the next six to 12 months.

Escalating construction and labour costs ranked high on investors’ list of challenges in 2024. This issue is especially pertinent in Japan, where Turner & Townsend data show overall construction costs for commercial real estate have risen by more than 30% since the beginning of 2020.

Click to enlarge

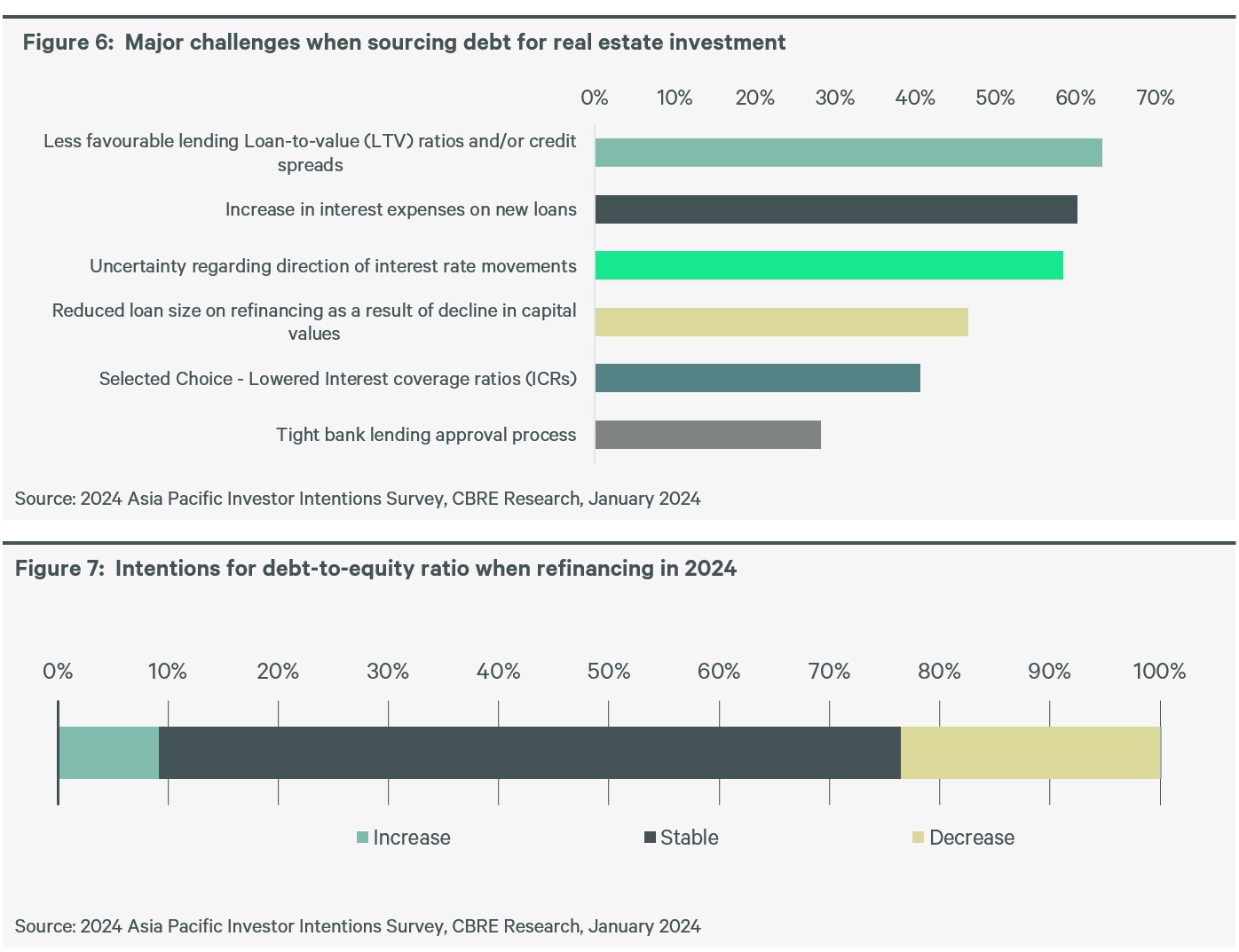

LTVs and credit spreads have the biggest impact on debt

Whilst Loan-to-Value (LTVs) and credit spreads in Asia Pacific remain largely unchanged, investors remain mindful of these factors when considering debt solutions. LTVs have shifted significantly in other regions, with those for office assets in the U.S. (72% to 57%) and Europe (61% to 53%) having moved significantly in the last 12 months.Investors are placing a greater emphasis upon both increasing interest expenses, while banks are paying extra attention on Interest Coverage Ratios (ICRs). For example, increases in interest expenses on refinance in 2024 for Singapore will be 3.4x that for a loan originated in 2020. Incremental interest expenses are 2.9x higher in Australia and 2.0x higher in Korea.

Refinancing pressure remains top of mind for investors and lenders alike, with changing lending criteria and declining capital values significantly influencing investor decisions. Despite expectations for interest rate stabilisation, banks have become more cautious when lending to commercial real estate investors amid heightened vigilance for signs of potential economic volatility.

A slightly higher share of investors indicated they will try and decrease their debt-to-equity ratio in 2024 amid higher borrowing costs. With lending increasingly harder to source, lenders are increasingly aware of current debt-to-equity ratios in the current environment.

Click to enlarge

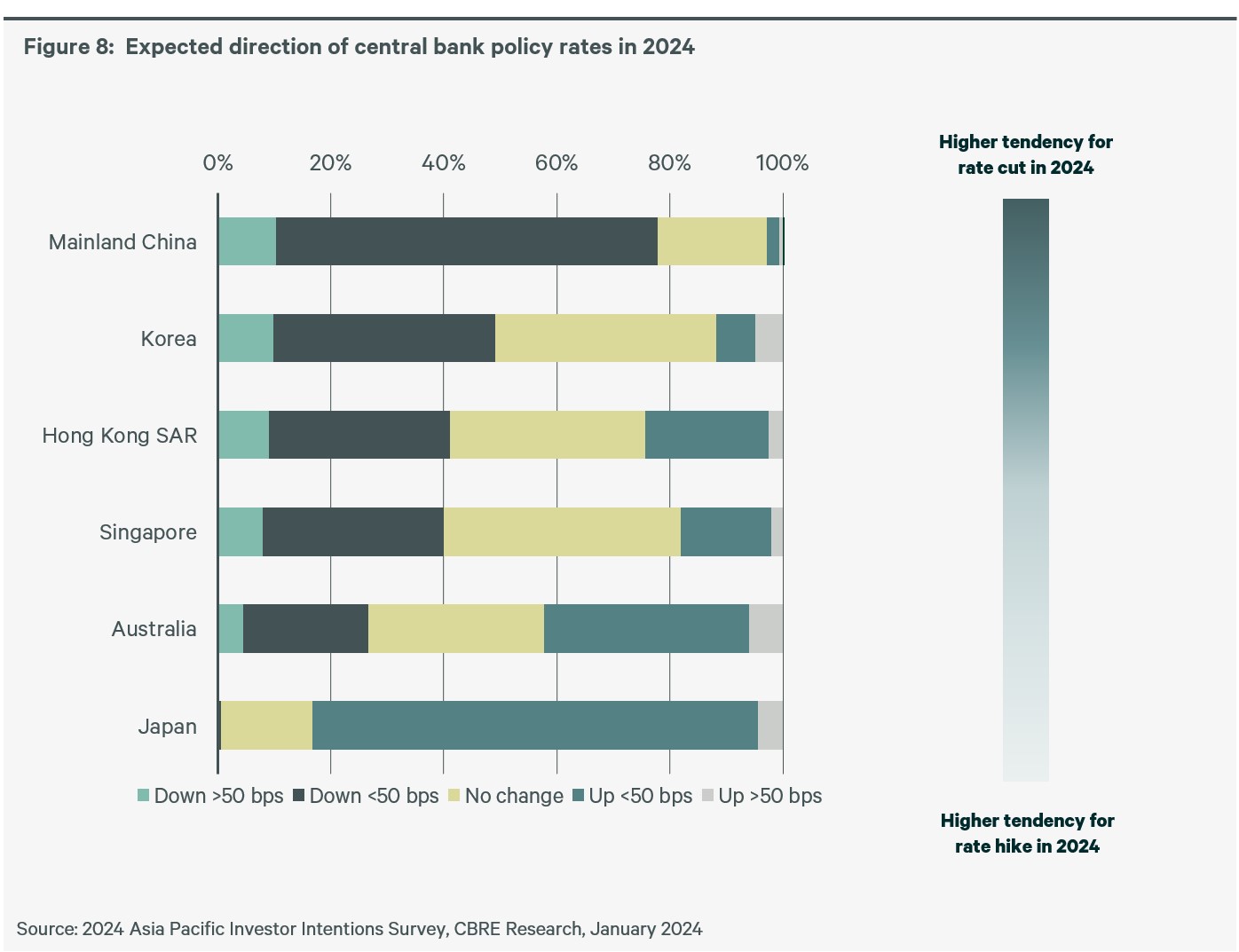

Limited expectations of rate cuts in 2024 outside of mainland China

Most central banks in Asia Pacific have either ended or are considering ending the current cycle of interest rate hikes. Major central banks in countries such as New Zealand, Korea, and India have already halted interest rate hikes in Q4 2023.Although significant levels of stimulus have been provided by the PBoC, the impact has yet to filter through to the economy. Investors believe that there will be further rate cuts in mainland China in 2024, resulting in widening positive cap rate spreads in China’s commercial real estate market.

Despite the weaker yen, Japan has opted to maintain negative interest rates. While the Bank of Japan (BoJ) has made slight adjustments to its yield curve control target, market consensus is that the BoJ will increase central policy rates in H1 2024. Cap rate spreads in Japan are expected to narrow on the back of rate rises.

Click to enlarge

Preferred Investment Strategies and Sectors

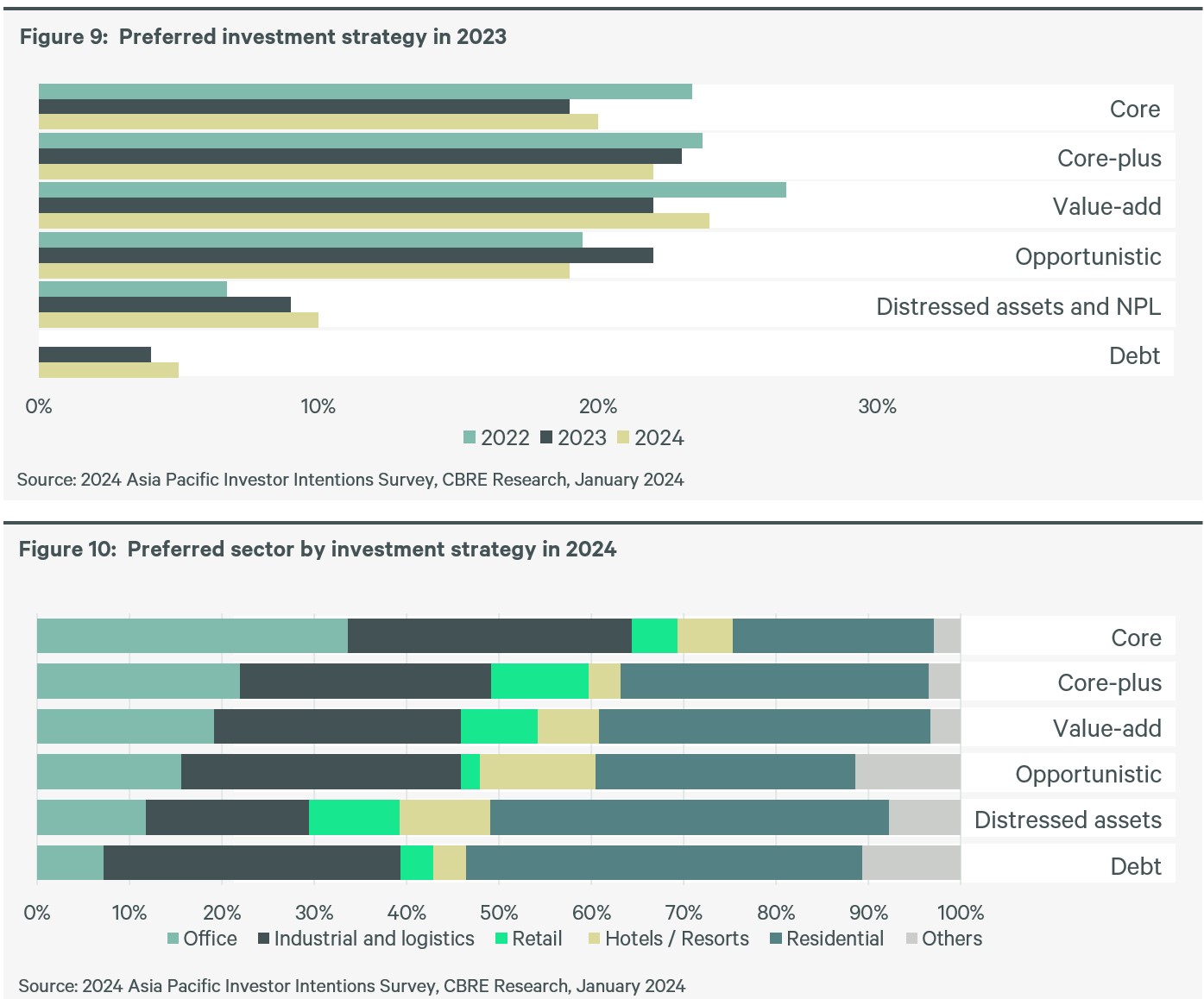

Value-add the most popular real estate investment strategy this year

While core assets in tier I markets remain sought after, investors in Asia Pacific (ex. Japan) retain the view that repricing for these assets is insufficient to match the change in both the cost of finance and the degree of repricing witnessed in EMEA and the U.S.With most investors in Asia Pacific looking for double digit target returns, investors have turned to value-added and distressed assets/debt solutions. Value-added strategies topped the list for preferred investment strategies in 2024.

Opportunistic strategies saw lower interest from investors in this year’s survey as repricing for these types of assets has not been significant enough for investors, and development activity remains limited.

Vintage credit strategies such as distressed and debt strategies continue to gain favour among investors. Most credit strategies focus on NPLs from developers or development loans for the living sector.

Click to enlarge

Stronger interest in residential sector but limited opportunities

The industrial and office sectors retained first and second place, respectively, as the preferred sector for investment in 2024. However, interest in both asset classes faded significantly from the previous year. CBRE expects markets which are forecasted to register stronger rental growth over the next 12 months, such as Singapore, Sydney and selected Indian cities, and properties with strong lease covenants to be most sought after by investors.The living sector is set to attract more capital in 2024, with build-to-rent and build-to-sell attracting strong interest. Despite prolonged economic uncertainty, the living sector remains resilient, with ongoing structural change continuing to underpin demand, although the size of the market remains relatively small. Investors in Japan, Australia and mainland China will be the primary markets of focus for build-to-rent development. Build-to-sell solutions will also be in demand, particularly from Hong Kong SAR and Taiwanese investors.

As offices are most susceptible to economic change, interest in this asset class continued to weaken relative to previous years. However, high-quality prime offices in CBDs will remain popular due to limited future supply and strong demand from corporates seeking to create attractive working environments to lure employees back to the office.

Click to enlarge

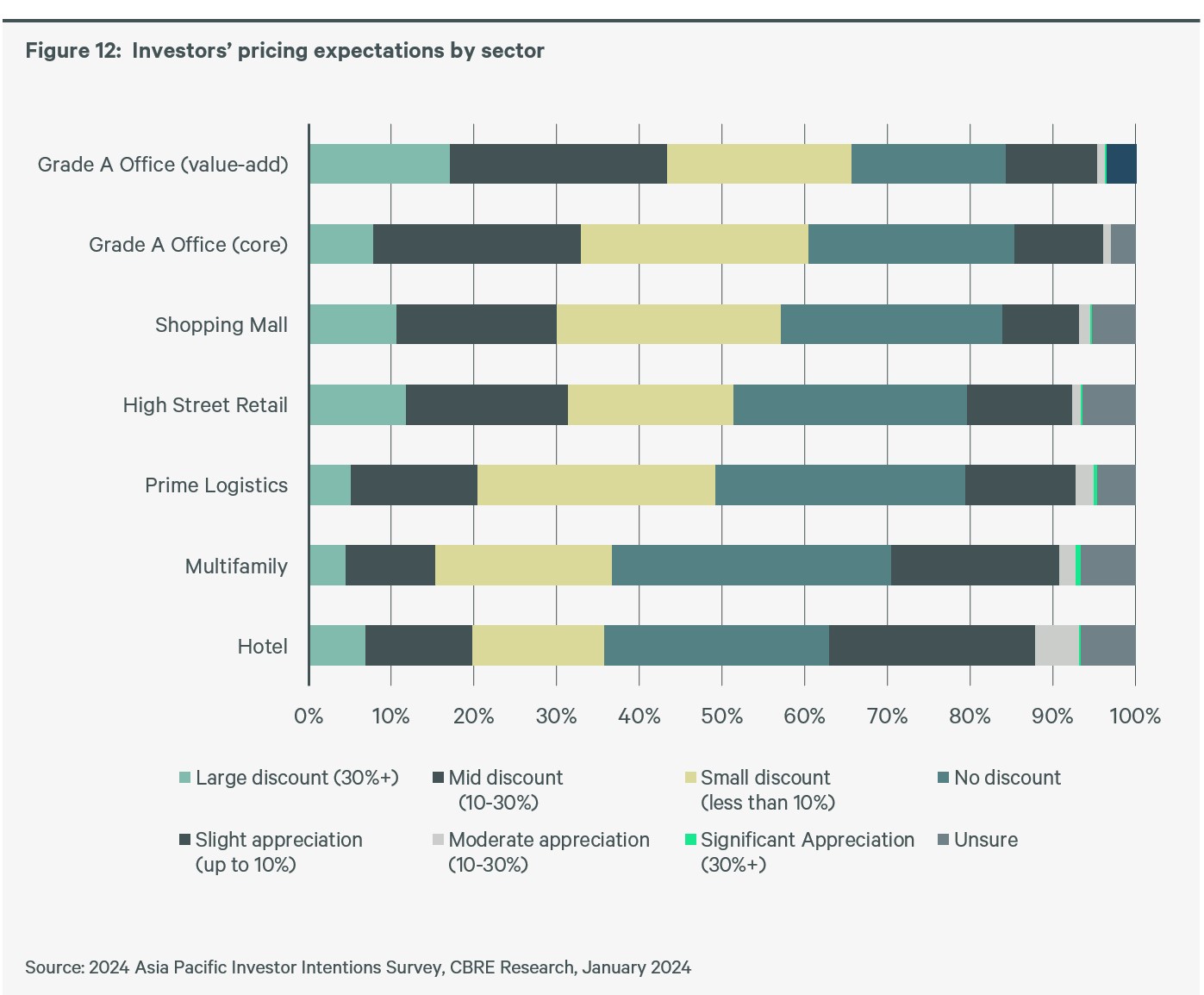

Most investors seek discounts for offices; shopping malls to see further repricing

Whilst tenant demand has been robust in Asia Pacific compared to other global markets, more than 60% of investors continue to seek discounts for value-add office acquisitions. Investors believe they would need to see further price cuts and an increase in tenant demand to justify current pricing.Surprisingly, investors also expect a certain level of discounting for core offices, largely because of the lack of repricing in the Asia Pacific office market over the past 12 months. Australia and Hong Kong SAR are expected to witness the further repricing of office assets in 2024.

After performing strongly over the past 18 months, investors anticipate further increases in pricing for hotel and multifamily assets over the course of this year. However, CBRE expects this trend to emerge only in a few select locations, and among high quality assets.

Click to enlarge

Real estate debt named second most popular alternative; living sector gains interest

When asked to select their preferred alternative asset for investment in 2024, healthcare related properties, including life sciences and medical offices, were named most popular for the second consecutive year, although interest declined from 2023.With an increasing number of investors looking to expand into the credit solutions space, real estate debt ranked second this year. Global investment giants such as Goldman Sachs, UBS and Blackrock continue to expand their credit offerings in the region, with a strong focus on Australia and Korea.

As with more mainstream build-to-rent and build-to-sell assets, investors displayed an interest in various types of living sector properties. Student accommodation, particularly in markets with high levels of migration such as Australia, continues to gain in popularity. Retirement living in markets with ageing populations, such as Japan and Korea, is also seeing stronger interest.

Given the slowdown in e-commerce growth and substantial new supply, investors are turning more cautious towards cold storage facilities.

Click to enlarge

Investment Destinations in 2024

Japan remains top market for cross-border investment

Japan retained its position as by far the most preferred country for cross-border real estate investment for a fifth consecutive year, with Tokyo, Osaka and regional cities the focus as investors remained attracted to the prospect of low cost of debt and stable income streams.Singapore and Australia followed in second and third place, respectively. Singapore saw a sharp increase in investors indicating a preference for value-added strategies in 2024, as core and core-plus strategies are unable to provide desired returns. In Australia, investors are largely focusing on Sydney while adopting a more selective view towards regional cities.

Mumbai and Delhi are attracting long-term investors looking to add to their real estate exposure in the world’s fastest growing economy, with India climbing to the top of the list of emerging market destinations in this year’s survey.

Investors remain cautious when looking to invest in mainland China, citing weaker than expected economic performance. Nevertheless, Shanghai remains the highlight among mainland China cities.

Click to enlarge

ESG and Commercial Real Estate Investment

Over 60% of investors plan to retrofit assets this year to be more ESG compliant

Although many investors continue to regard Environmental, Social and Governance (ESG) initiatives as costly, a greater number of investors look to augment their capabilities in this space each year.Just over 60% of investors, the bulk of which are private equity funds, real estate funds and REITs, intend to retrofit existing buildings to be more sustainable or ESG-compliant. Whilst the increase in construction costs continues to influence refurbishment decisions, the growing volume of evidence illustrating the level of cost saving resulting from sustainability-related retrofitting, combined with an increasing amount of carbon emission goal setting, is resulting in landlords being more active in pursuing green initiatives.

40% of respondents indicated plans to increase renewable energy generation or install EV car chargers in their assets, particularly in Asian markets. Worldwide sales of electric vehicles tripled in the space of two years, reaching 10 million in 2022, with Asia Pacific accounting for almost two-thirds of this figure.

CBRE believes that cost-conscious investors can consider participating in projects with shorter payback periods by using green debt financing. CBRE’s Asia Pacific Sustainable City Ranking report found that some US$148 billion of green bonds were issued in Asia Pacific in 2021, with about 21% of the money raised used for construction.

Click to enlarge

Greater emphasis being placed on ESG credentials

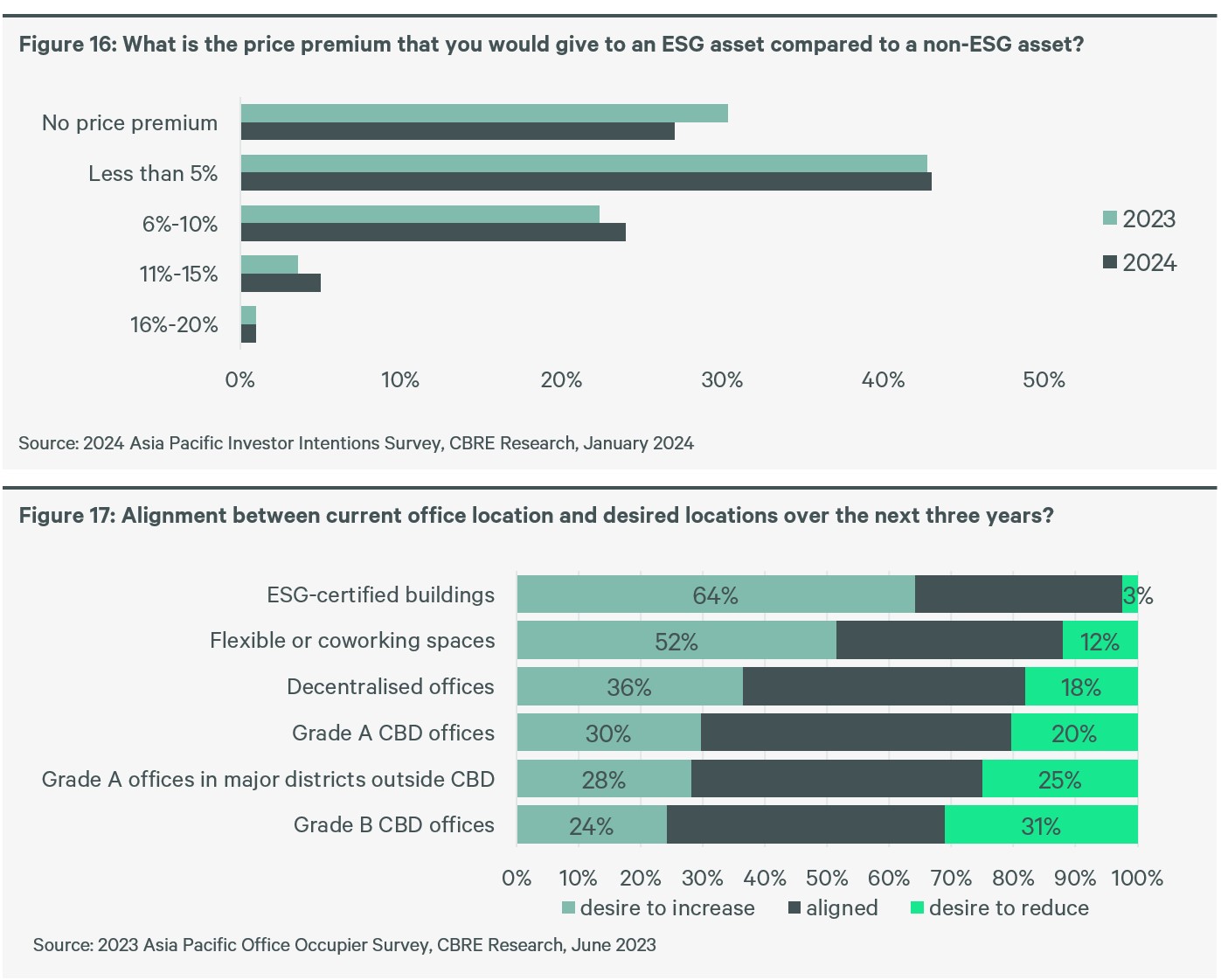

With flight-to-quality and flight-to-green trends becoming more prominent, newer premium office buildings in Asia Pacific are well-positioned to meet demand as companies look to create high-quality workspaces to attract top talent.About 27% of investors displayed little or no willingness to pay a price premium to acquire an ESG certified property, down from 30% in 2023.

Published in June last year, CBRE’s 2023 Asia Pacific Office Occupier Sentiment Survey found that 64% of corporates said they have already moved or are considering moving to green buildings - a trend that is set to continue in the coming year.

While they are more willing to move to sustainable assets, 43% of respondents indicated they would not pay a premium to move to such properties. Roughly 23% replied that they would pay a premium, but most tenants would restrict this to less than 5%.

Australia and Singapore lead the rest of Asia Pacific in green building adoption as authorities in these markets require all new buildings to be green certified. With green buildings set to become the norm across the region along with the global commitment to achieving net zero emissions by 2050, investors are strongly advised to integrate ESG criteria into investment decisions.

Click to enlarge

Research Contacts

Capital Markets Contacts

Greg Hyland

Head of Capital Markets, Asia Pacific

Callum Young

Executive Director, Capital Markets, Asia Pacific

Related Insights

- Report | Intelligent Investment

2024 European Investor Intentions Survey

February 5, 2024 10 Minute Read

.jpg)

CBRE's 2024 European Investor Intentions Survey was conducted between November 6, 2023, and November 30, 2023.