Intelligent Investment

Paris Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- Paris is at the epicenter of the French life sciences cluster, benefitting from an influx of government and private funding to support healthcare initiatives.

- One of the emerging clusters is the Paris-Saclay Cancer Cluster (PSCC), which was created in 2022 by Paris-Saclay University, the Polytechnic Institute of Paris, Inserm, the Gustave Roussy Institute and Sanofi.

- The life sciences real estate market remains undersupplied, with only 2.9 million sq. ft. of existing purpose-built lab/R&D spaces in the Paris region (excluding owner-occupier spaces). Due to the lack of immediate availability, some take-up occurred in light industrial stock, and some tenants/landlords are converting such premises into lab/R&D spaces. The future development pipeline will, however, ease this position in 2025 and beyond.

- The effects of COVID-19 propelled a surge in venture capital investments in 2021. Subsequent funding momentum continued through 2023, but trailed off in 2024.

- The broader growth trend in venture capital investments reflects the strong fundamentals and the growing attractiveness of the Paris life sciences ecosystem. The long-term strategic vision of President Macron’s €7.5 billion Health Innovation Plan 2030 will likely make Paris more attractive to investors.

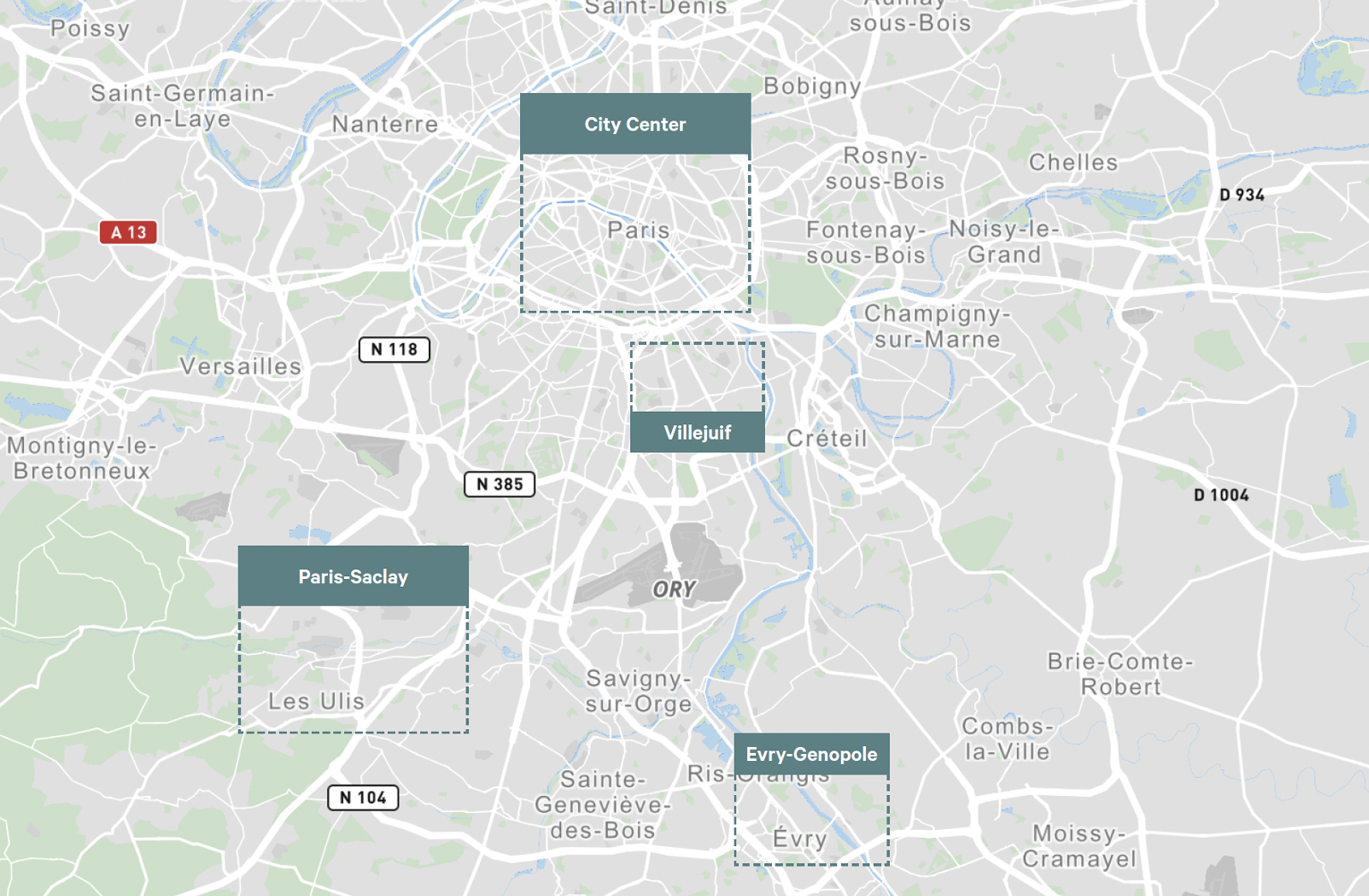

Submarkets

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Inventory Lab/R&D

Development Pipeline or Activity

Figure 3: Life Sciences Development Pipeline (sq.ft.)

- AGS Therapeutics

- Cellvax

- Eurofins

- Immutep

- Sanofi

- Safran

- Servier

- Stilla

- Svar

- Theranovir

- CNRS

- Gustave Roussy

- INRIA

- IPPG Institute

- La Pitié Salpêtrière Hospital

- Paris Saclay Hospital

- Paris-Saclay University

- Polytechnique

- South Île-de-France Medical Center (CHSF)

- University of Évry-Paris-Saclay