Intelligent Investment

Low Supply, Changing Consumer Preferences Lead to Longer Retail Lease Terms

November 12, 2024 3 Minute Read

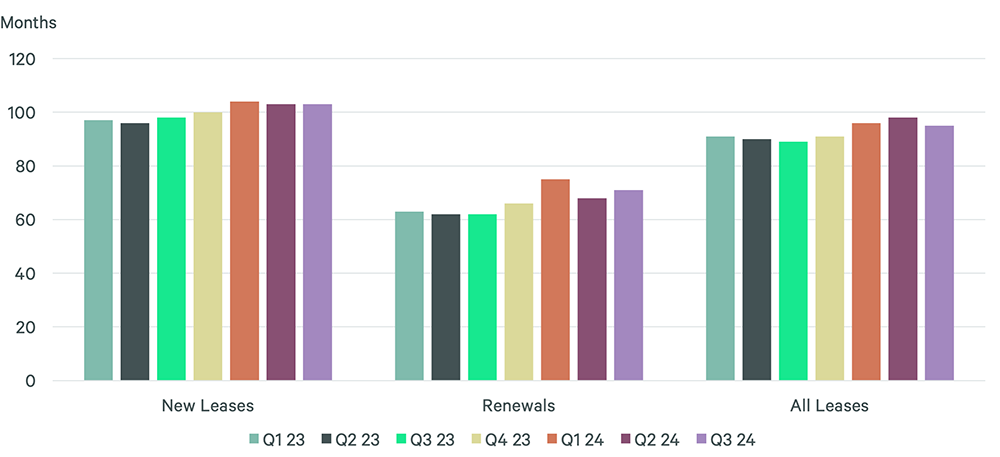

Many retailers are signing longer-term leases to limit the degree of potential rent increases, accommodate shifts in consumer preferences and firmly establish themselves in locations closer to where consumers live. Through the first three quarters of 2024, the average retail lease term rose to 96 months, six months longer than in the same period last year.

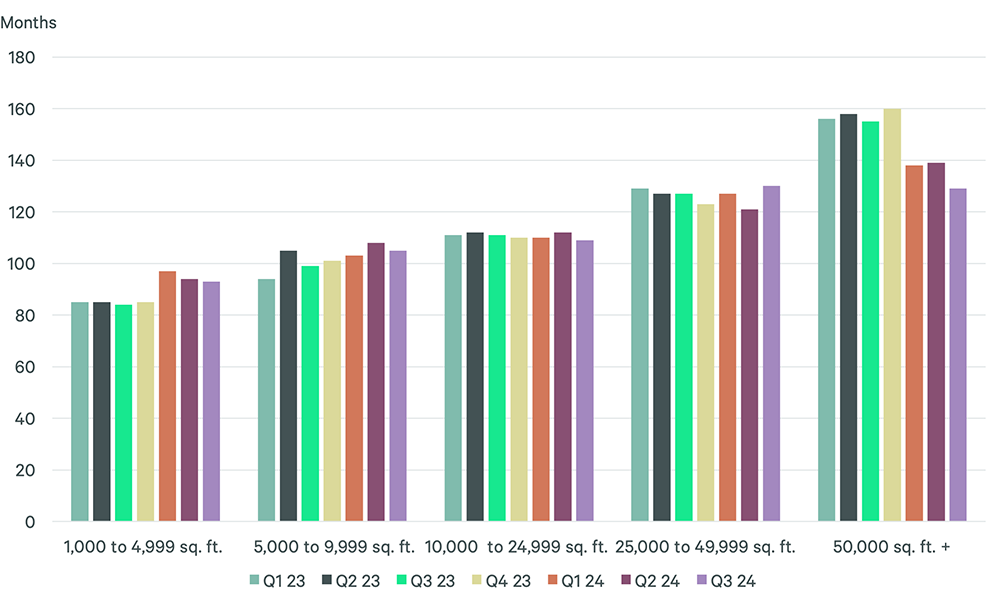

Lease term growth varies by lease size, property type and location. Retailers generally have signed longer lease terms for smaller footprints over the past year to open more locations in retail centers that are closer to where consumers live. The average lease term for a 1,000- to 4,999-sq.-ft. space as of Q3 was 95 months, nearly a year longer than the 84-month average through the first three quarters of 2023.

Figure 1: Average Lease Term by Lease Type

Source: CBRE Research, Q3 2024.

Figure 2: Average Lease Term by Size

Source: CBRE Research, Q3 2024.

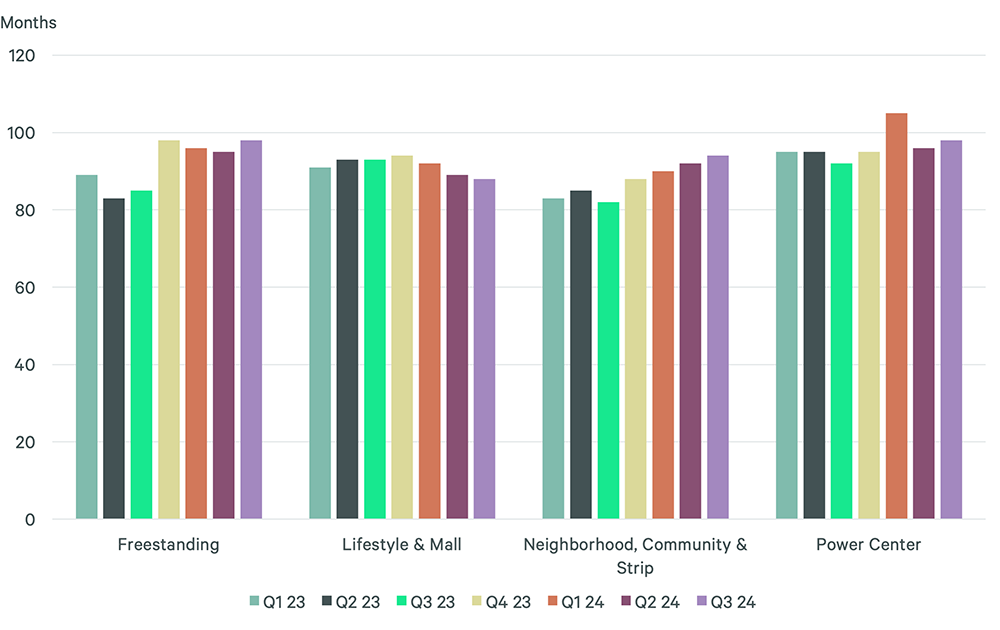

Changes in consumer preferences have led many retailers to sign long-term leases in neighborhood, community & strip centers and power centers. While retail sales remain strong, economic uncertainty and high inflation have caused consumers to become more budget-conscious, prioritizing essential goods like food. Grocery-anchored power centers continue to generate sizeable foot traffic, which attracts retailers to adjoining stores. Power center leases averaged 100 months through Q3 this year, up from the 94-month average in the same period last year.

In response to consumers’ growing preference for online buying, many retailers are utilizing stores for curbside pickup, online returns and rapid home delivery. Neighborhood, community & strip centers can act as last-mile distribution centers because of their convenient street access and close-in parking. Neighborhood, community & strip center lease terms averaged 92 months through Q3 this year, up from the 83-month average in the same period last year.

Figure 3: Average Lease Term by Retail Property Type

Source: CBRE Research, Q3 2024.

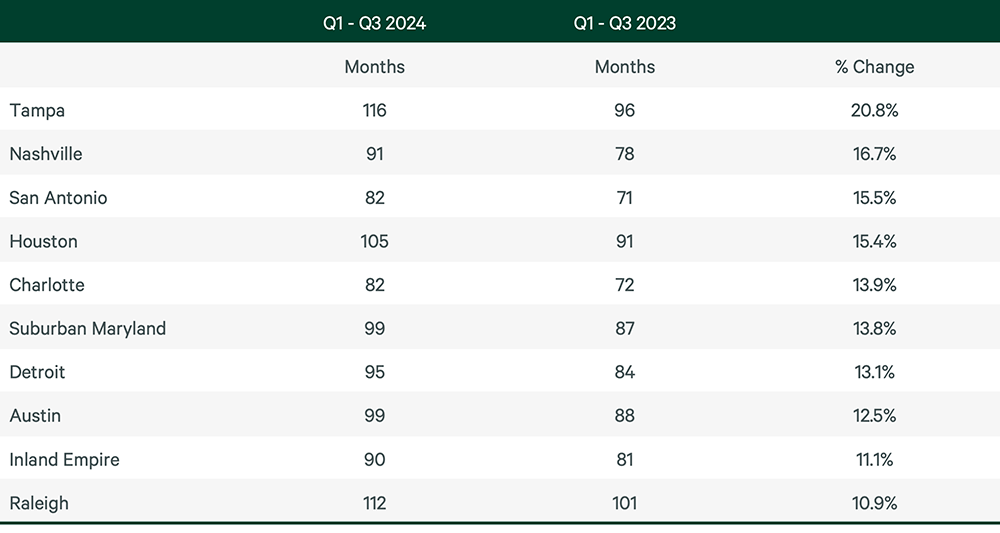

Retailers also are signing longer leases in markets with strong population growth. Through the first three quarters of 2024, Tampa, Nashville, San Antonio, Houston and Charlotte—all markets with sizeable population gains—saw the greatest increase in lease terms. Other markets with lease-term growth include Detroit, which is undergoing a revitalization of its urban core, and California’s Inland Empire, which continues to attract residents from higher-cost areas of Southern California, including Los Angeles and Orange County.

Figure 4: Top 10 Markets for Lease-Term Growth

Source: CBRE Research, Q3 2024.