Intelligent Investment

H1 2022 Sets Record for 1 Million-Sq.-Ft. Industrial Leases

August 4, 2022 4 Minute Read

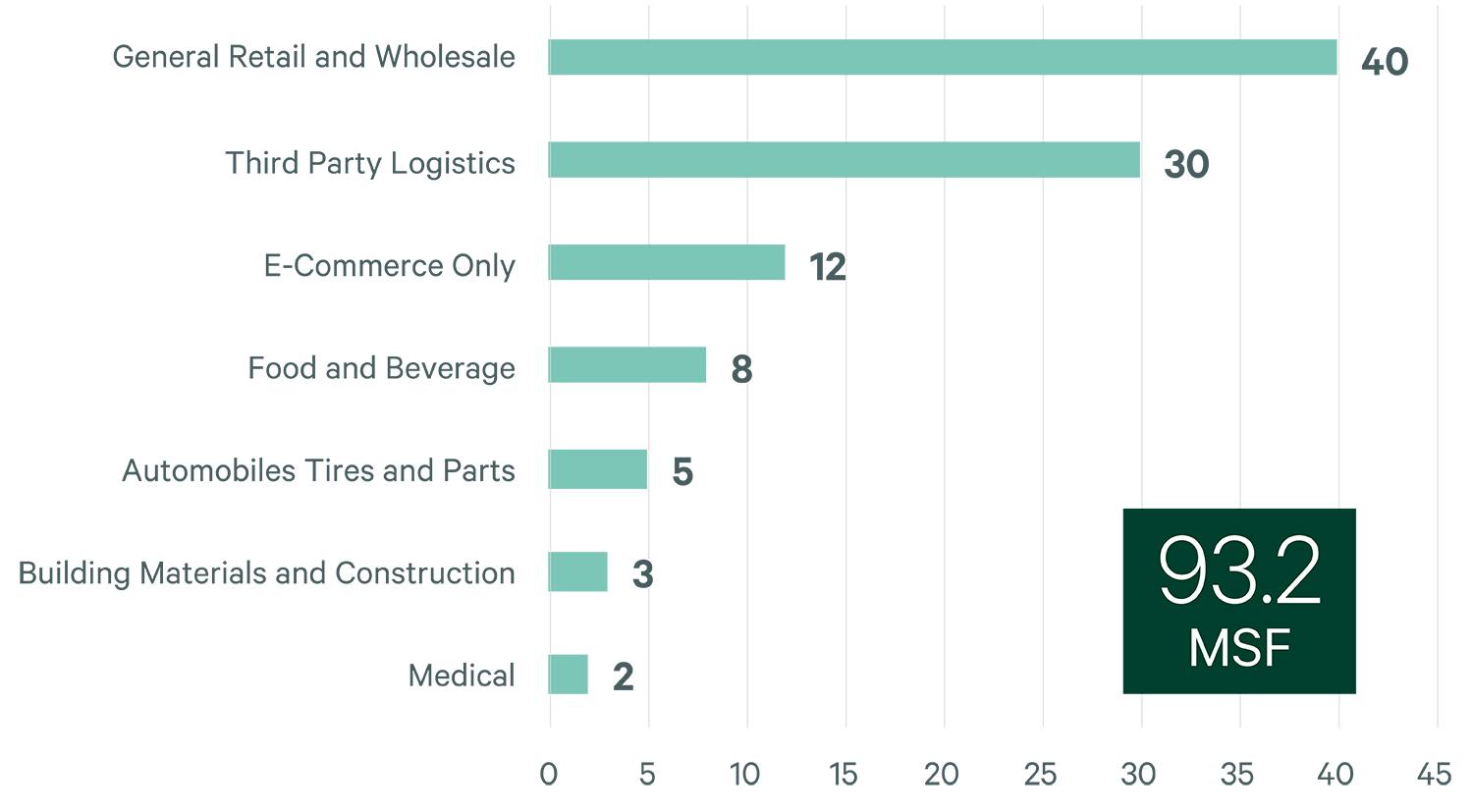

Traditional retailers/wholesalers were most active, accounting for 40 of the top 100, followed by third-party logistics (3PL) operators with 30—seven of which were for 1 million sq. ft. or more, compared with none in H1 2021. E-commerce companies took 12 of the top 100, down from 27 last year.

Figure 1: Industry Share of Top 100 U.S. Industrial Leases in H1 2022

Source CBRE Research, H1 2022.

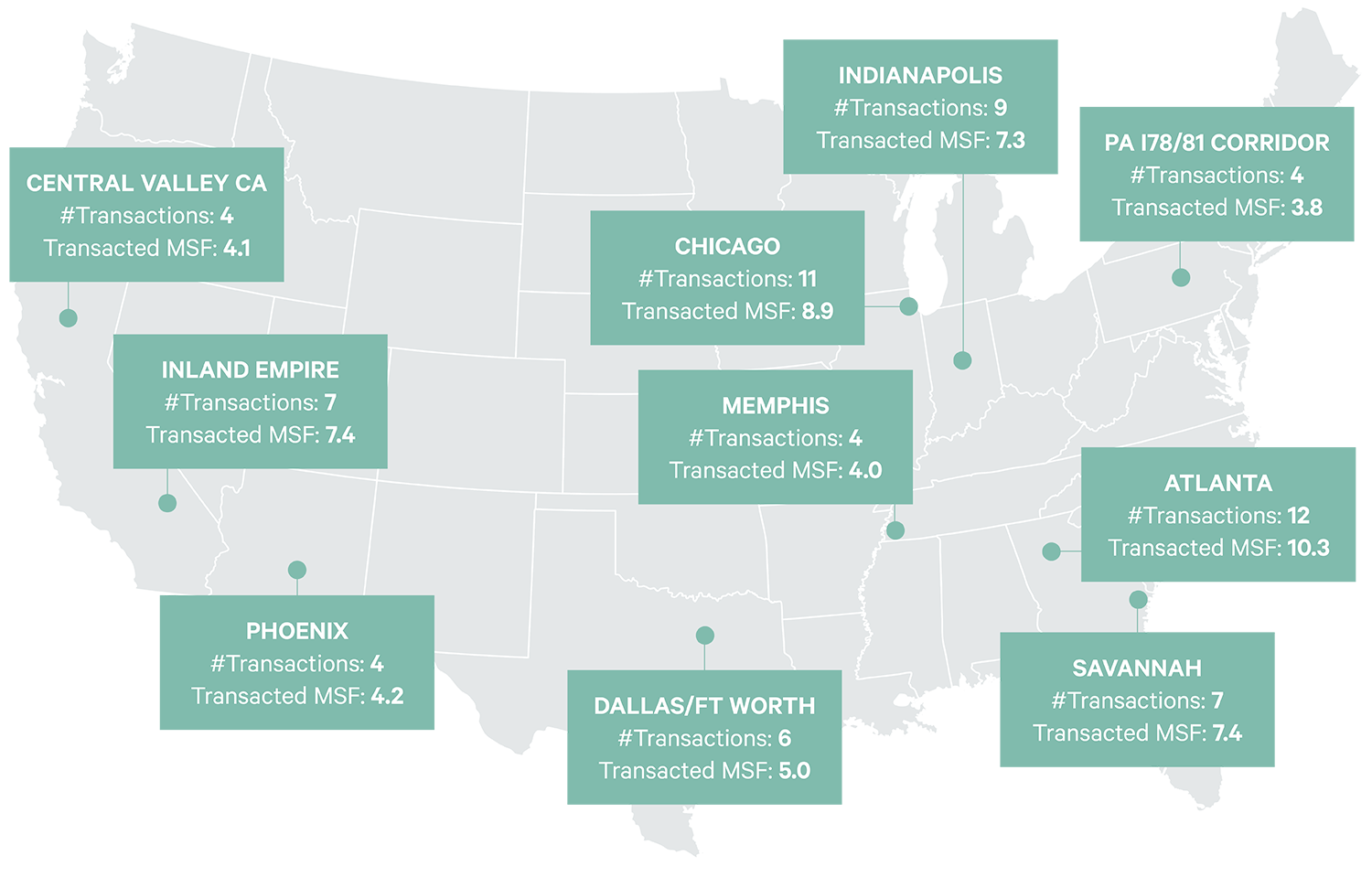

Atlanta led all markets with 12 of the top 100, five of which were for 1 million sq. ft. or more, followed by Chicago with 11 of the top 100. Savannah was the top emerging market with seven of the top 100, up from two a year ago. Continued demand for mega distribution centers is expected in the second half of 2022. A large increase in construction from a year ago will fuel more leasing activity, particularly in markets with the highest rates of speculative development like Dallas-Fort Worth, Atlanta, Chicago, Phoenix and Indianapolis.

Figure 2: Leading Markets for Top 100 Lease Transactions in H1 2022

Source CBRE Research, H1 2022.

Overall U.S. industrial fundamentals remained solid in H1 2022, with a record low vacancy rate and record high rent growth. Leasing activity for all size ranges totaled 454 million sq. ft., down by 5.4% from a year ago but 44% higher than in H1 2020. The slight year-over-year decline was a result of a 21.1% drop in demand for light-industrial space (under 25,000 sq. ft.). Leases for 700,000 sq. ft. or more increased by 24.6%.

Contacts

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services

Related Insights

- Report | Future Cities

Explore the 2022 North America Industrial Big Box Report

February 11, 2022 60 Minute Read

This report provides an in-depth overview of supply-and-demand fundamentals, demographics, logistics drivers, labor and location incentives for the top 23 core, gateway and emerging markets in North America.

Related Services

- Property Type

Industrial & Logistics

We represent the largest industrial real estate platform in the world, offering an integrated suite of services for occupiers and investors.

- Property Type

Industrial & Logistics Investor Services

Purchase, lease, and manage and sell your assets with proven real estate strategies for industrial investors, property owners, developers and landlords.

- Property Type

Industrial & Logistics Occupier Services

We help businesses drive sustainable value through the entire real estate lifecycle to meet clients’ objectives, mitigate risk and optimize performance.