Intelligent Investment

Fewer Mega Industrial Leases Signed in 2023

January 25, 2024 2 Minute Read

Economic uncertainty and less need for additional product inventory resulted in fewer industrial leases of 1 million sq. ft. or more in 2023 versus 2022. Among the top 100 industrial leases last year, 43 were for at least 1 million sq. ft., compared with 63 the previous year.

Last year’s top 100 industrial leases totaled 98.6 million sq. ft., down by 8% from 2022’s 106.9 million total. The average lease size among the top 100 fell to 986,744 from 1.07 million sq. ft. Thirty of the top 100 were renewals—six more than in 2022.

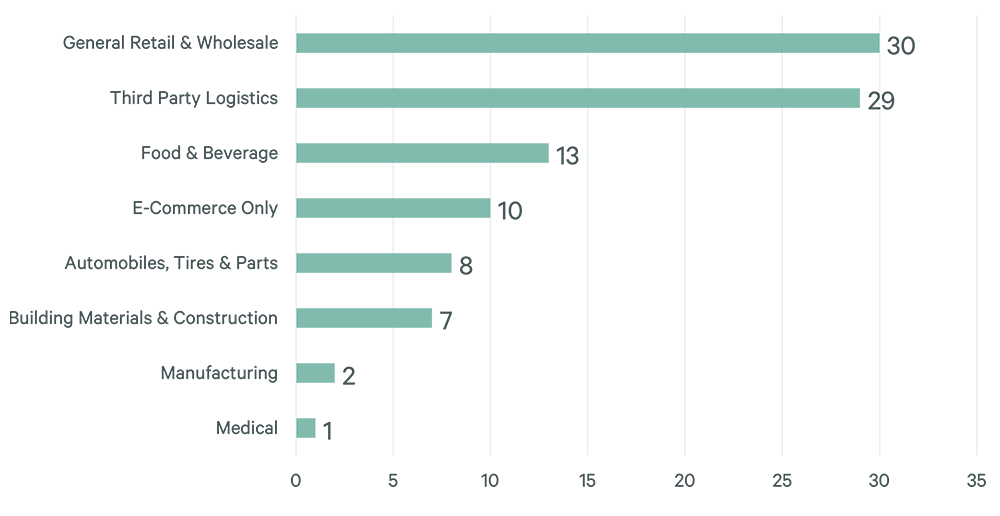

A more diverse mix of tenants made up the top 100 last year than in 2022. The share by traditional retailers/wholesalers fell to 30 from 53, while that of third-party logistics (3PL) operators rose to 29 from 11. The food & beverage, auto, building materials, manufacturing and medical sectors all had a larger share of the top 100 compared with 2022.

Figure 1: Industry Share of Top 100 U.S. Industrial Leases in 2023

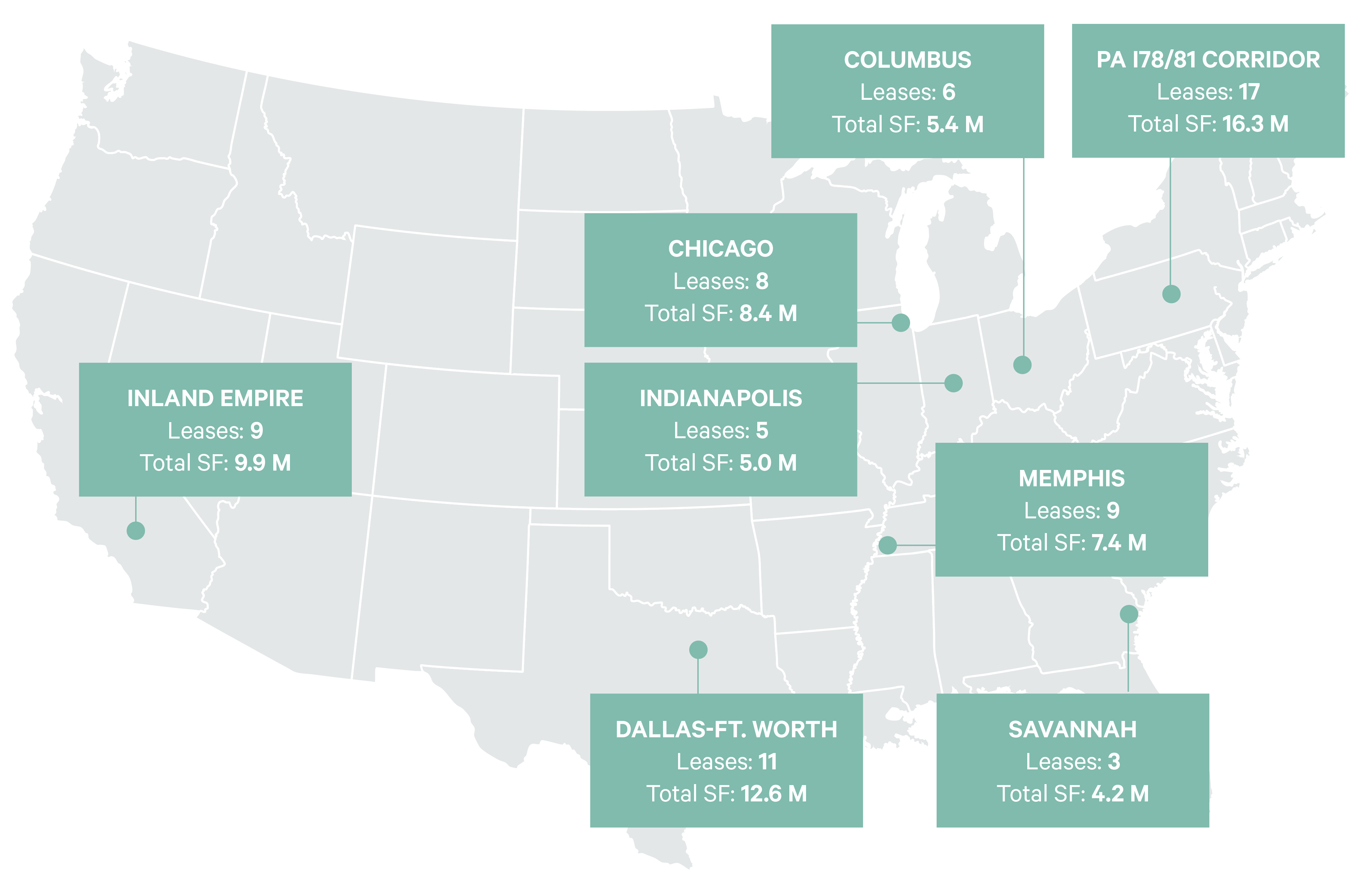

The Pennsylvania I-78/81 Corridor led all markets with 17 of the top 100 leases, followed by Dallas-Fort Worth (DFW) with 11. Memphis was the top emerging market with nine of the top 100 leases, up from four in 2022. DFW led the nation for industrial leases of 1 million sq. ft. or more with eight, followed by the Inland Empire with seven.

Demand for mega distribution centers is expected to rise in 2024 as the economy and rental rates stabilize. The large increase in construction last year will provide more opportunities for expansion, particularly in markets with the highest rates of speculative development: DFW, Atlanta, Phoenix, Indianapolis and Columbus.

Figure 2: Leading Markets for Top 100 Lease Transactions in 2023

Related Services

- Property Type

Industrial & Logistics

We represent the largest industrial real estate platform in the world, offering an integrated suite of services for occupiers and investors.

- Property Type

Industrial & Logistics Investor Services

Purchase, lease, and manage and sell your assets with proven real estate strategies for industrial investors, property owners, developers and landlords.

- Property Type

Industrial & Logistics Occupier Services

We help businesses drive sustainable value through the entire real estate lifecycle to meet clients’ objectives, mitigate risk and optimize performance.

Contacts

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services