Intelligent Investment

Multifamily Rent and Demand Vary Among Classes and Regions

April 1, 2022

Learn more about our Global Forecasting Platform.

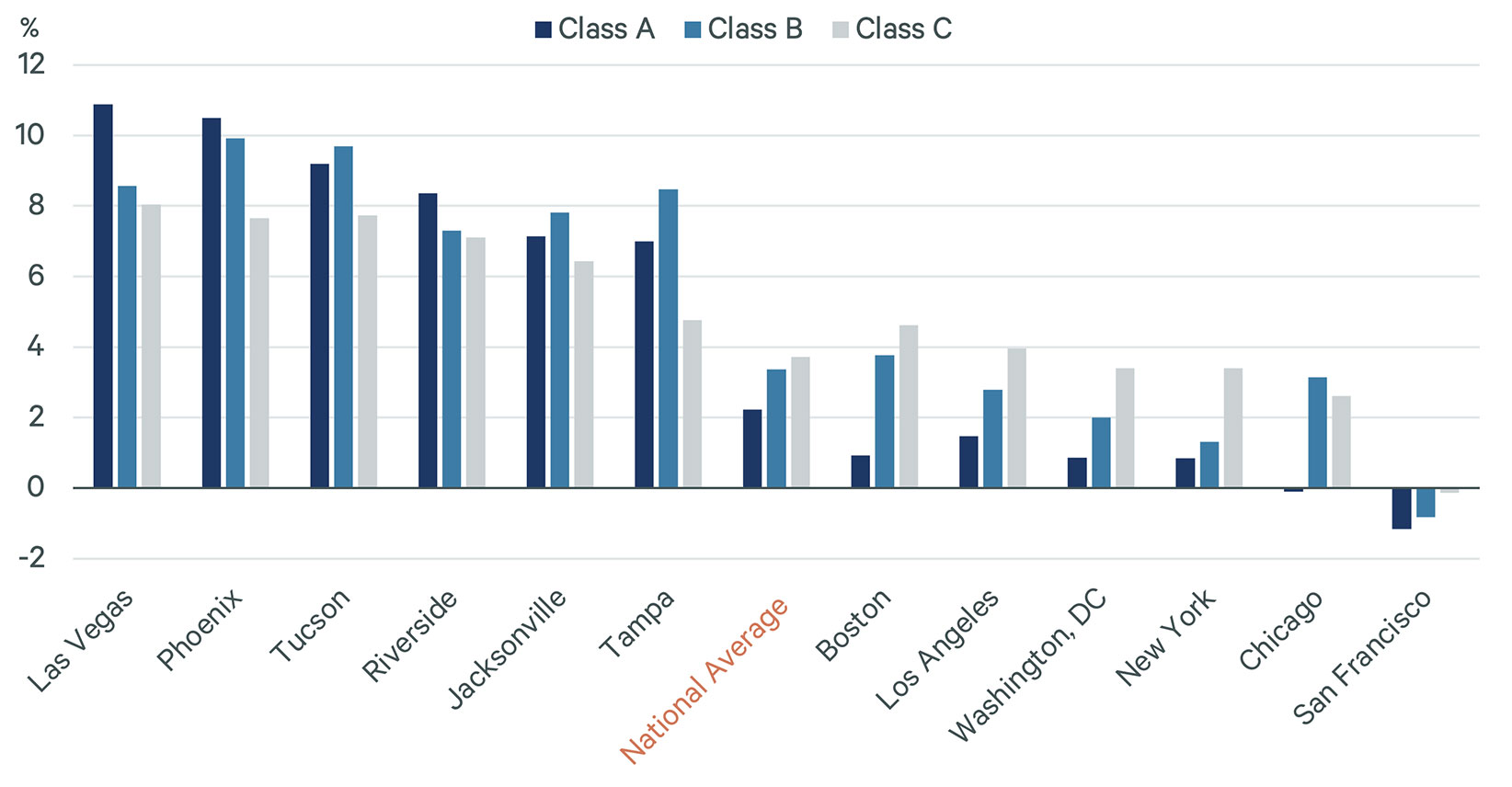

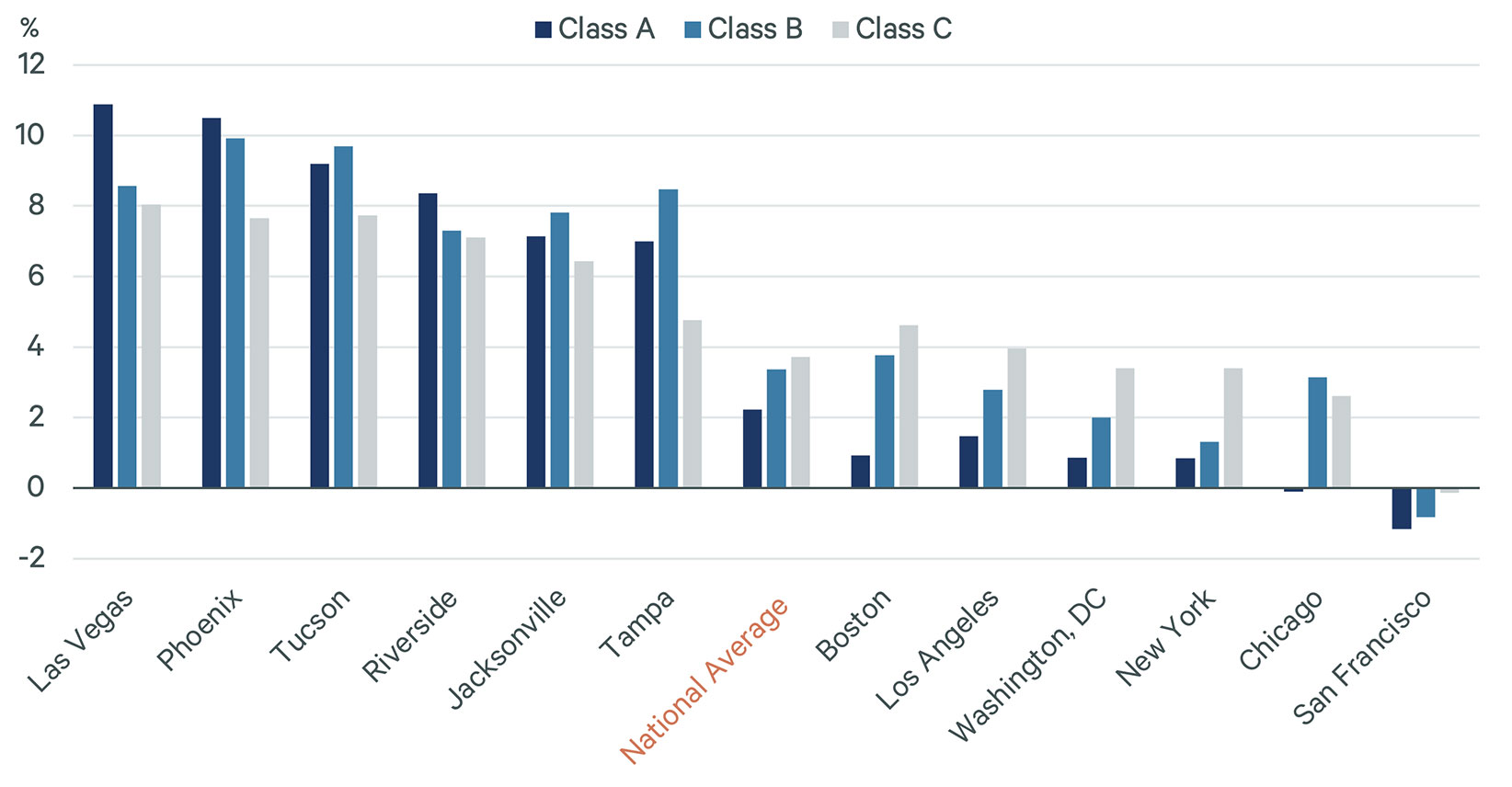

Nationally, Class C multifamily properties have set the pace for rent growth, outstripping Class A or B properties. However, the national average is heavily influenced by large, coastal metro markets, where renters compete for a limited supply of value-add Class C units.

Class A and B rents are growing faster than C rents in many Sun Belt markets. This has been fueled by an influx of new residents into these markets, where they can rent higher-quality space more affordably than in the large metros. Resident migration has incentivized new construction and value-add renovations in the Sun Belt.

CBRE Econometric Advisors, RealPage Inc.

CBRE Econometric Advisors, RealPage Inc.

Class A and B rents are growing faster than C rents in many Sun Belt markets. This has been fueled by an influx of new residents into these markets, where they can rent higher-quality space more affordably than in the large metros. Resident migration has incentivized new construction and value-add renovations in the Sun Belt.

FIGURE 1: Top 6 Sun Belt vs Gateway Metros, 5-year Rent Growth, CAGR (%, 2016-2021)

CBRE Econometric Advisors, RealPage Inc.

CBRE Econometric Advisors, RealPage Inc.Let's Talk

Dennis Schoenmaker, Ph.D.

Executive Director & Principal Economist, CBRE Econometric Advisors