Intelligent Investment

Acquisition by ALDI Should Strengthen Performance of Winn-Dixie- & Harveys-Anchored Retail Centers

August 30, 2023 2 Minute Read

Investors in Winn-Dixie and Harveys Supermarket grocery-anchored retail centers may be breathing a sigh of relief now that a new, more financially stable owner will take over those brands.

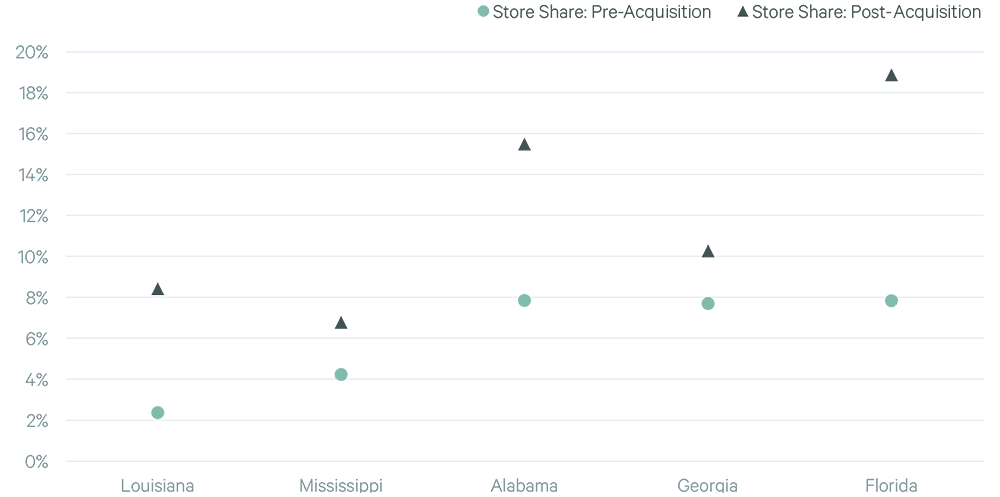

German grocery discounter ALDI recently announced plans to expand its U.S. presence by acquiring the Winn-Dixie and Harveys Supermarket divisions of Southeastern Grocers. The portfolio totals an estimated 394 stores across Alabama, Georgia, Louisiana, Mississippi and Florida. The transaction is expected to close in H1 2024, pending regulatory approval.

Southeastern Grocers has had mixed financial results lately, with a withdrawn IPO in 2021 and a bankruptcy filing in 2018 that resulted in 94 closed stores. ALDI is regarded by many retail real estate professionals as a solid, higher-credit tenant, which could draw renewed investor interest in retail centers that it occupies. Lenders are expected to be much more amenable to refinancing these centers with a stronger creditworthy anchor tenant.

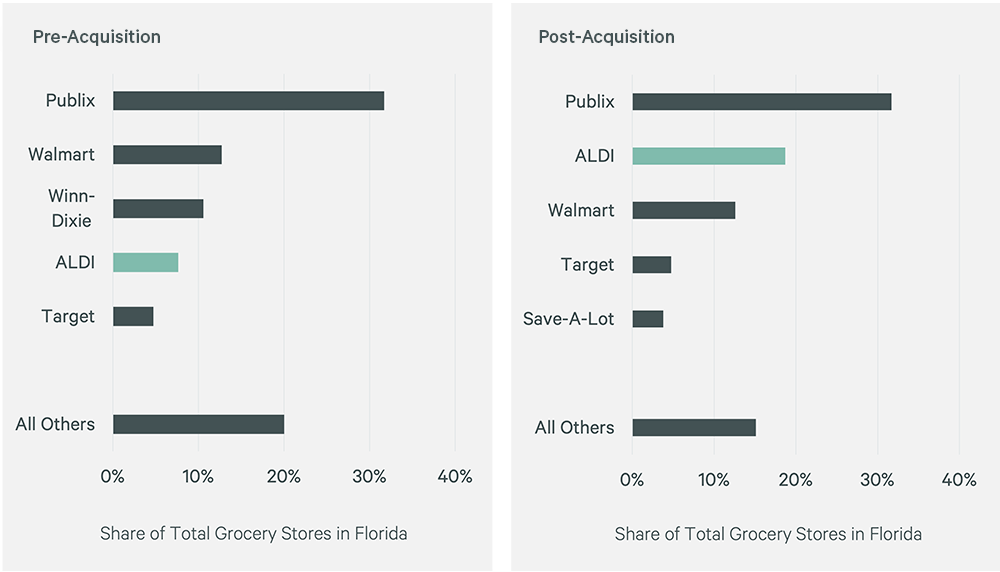

This acquisition extends a period of strong growth for ALDI, which increased its number of U.S. stores by 15% between 2019 and 2022. With the pending acquisition of Winn-Dixie and Harveys, CBRE estimates ALDI’s U.S. store count would increase by 18% to about 2,700 and its footprint by 48% to 60+ million sq. ft. In Florida alone, ALDI’s store count would more than double to 506, accounting for 19% of all grocery stores in the state—second to Publix with 32%.

ALDI store performance has also been strong, with average sales per store up by 7% year-over-year in 2022 and by more than 13% since 2019, according to retail data provider Creditntell.

Retail analytics company Placer.ai reports that ALDI stores have been growing foot traffic at a fast clip. For the first seven months of 2023, average ALDI store visits increased by 2.7% vs. the same period a year ago. Winn-Dixie stores, which saw a 0.6% reduction in foot traffic over the same period, likely will see a boost in average store visits under ALDI’s ownership.

ALDI’s planned acquisition will ensure that it remains among the top five grocers by number of stores nationally.

Figure 1: ALDI Share of Total Grocery Stores by State, Pre- & Post-Acquisition

Source: Creditntell, ALDI, CBRE Research, Q3 2023.

Figure 2: Share of Total Grocery Stores in Florida, Pre- and Post-Acquisition by ALDI

Source: Creditntell, CBRE Research, Q3 2023.

Retail Insights

Timely trends, research and analysis of the exciting changes and opportunities in this dynamic sector.

Related Services

- Property Type

Retail Services

With integrated solutions, unique insight, and unmatched experience, we deliver successful outcomes for retailers, restaurateurs, investors, owners, a...

- Property Type

Food and Beverage

Achieve exceptional outcomes for your operation with real-time consumer insights, proprietary data on restaurant brands and hands-on experience in loc...