Adaptive Spaces

Telemedicine’s Impact on a Health System’s Real Estate

Will health systems ever build another building?

December 8, 2022

CBRE Healthcare Sector recently hosted a FOCUS Forum on The Future of Work—A Healthcare Perspective. The event covered the pandemic’s continued impacts, return-to-office plans and a future view of healthcare administrative offices and outpatient clinics.

Key Takeaways:

- The pandemic has accelerated telemedicine’s impact on ambulatory environments.

- Real-time interactive telemedicine affects in-person clinic utilization and health system real estate portfolios.

- Health systems will consider the pros and cons of many different approaches to deploying telehealth.

Sites of Care: Telemedicine vs. In-Facility Ambulatory Care

The COVID-19 pandemic led to a surge in telemedicine visits to 52.7 million in 2020 from 840,000 in 20191. Health systems expect telemedicine to remain a key form of patient care if insurers continue to reimburse telehealth visits2.

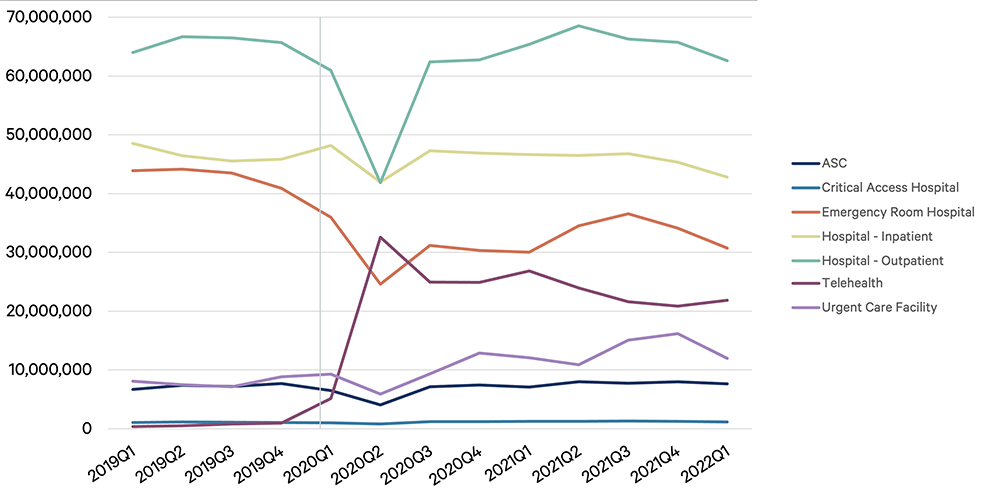

According to Stratasan, a leading provider of data analytics for healthcare systems, when considering the Site of Care (Figure 1), as the pandemic wanes, telehealth visits have declined significantly but remain above pre-COVID levels. During this same timeframe, in-person outpatient visits have, for the most part, returned to pre-pandemic norms.

Telehealth is here to stay. It's not whether telehealth will be offered, but how best to offer telehealth services as we move toward what we're terming ‘digitally enabled care’—which is not just hybrid care, but more so fully integrated in-person and virtual care based on clinical appropriateness.

Figure 1: Sites of Care: Office Removed

Note: the chart above reflects the sites of care pre-, during, and post-pandemic, eliminating office, to better demonstrate the drastic changes in outpatient and telehealth.

Source: Stratasan (2022), Stratasan proprietary claims database, presented at the SHSMD 2022 Annual Conference

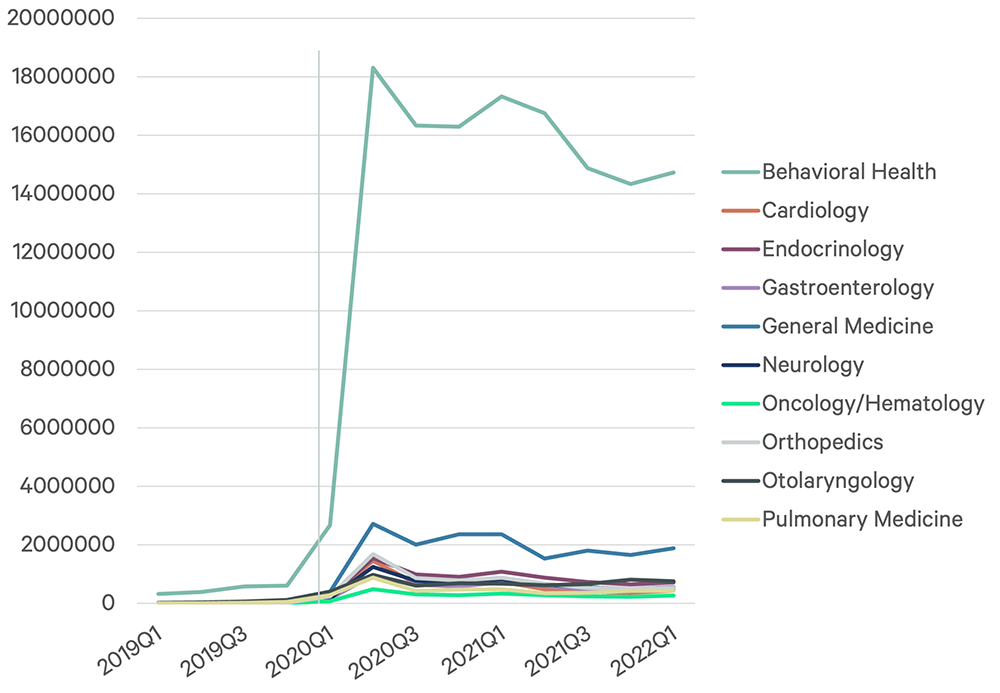

Telemedicine has had its most lasting impact on mental health visits, making up nearly 63% of telemedicine claims nationally as of May 2022 (primary care visits make up approximately 23% of telehealth visits). However, according to Stratasan, behavioral health via telemedicine has somewhat declined from a peak of 18 million claims in Q3 2020 to approximately 15 million in Q1 2022. For other specialties, the number of telemedicine visits is significantly higher than before the pandemic encounters, but below peak levels.

Figure 2: Telehealth Encounters: By Service Line

Figure 3: Telehealth Encounters: By Service Line (Without Behavioral)

Source: Stratasan (2022), Stratasan proprietary claims database, presented at the SHSMD 2022 Annual Conference

While in-person encounters are returning to pre-pandemic levels, telemedicine will continue to be a key dimension of patient encounters.

Telemedicine Challenges

But is there more to the site-of-care story and telemedicine? Henry Ford Health Systems’ (HFHS) Director of Virtual Care Courtney Stevens says “telemedicine positively contributes to the quadruple aim of healthcare: positive customer experience, positive provider experience, quality/patient safety, and it is cost effective.” But she notes the digital divide is a major barrier to telemedicine, including access to broadband internet (which impacts an estimated 42 million Americans3), preferred language and audio/visual challenges facing some patients. HFHS considers telehealth as part of their care delivery options toolbelt. Ultimately preference, of both the provider and the patient, will determine whether telemedicine is clinically appropriate.

Telemedicine Operating Models

While telehealth will continue to play an important role in outpatient care, in-facility ambulatory visits are expected to return to pre-pandemic levels. Therefore, health systems leaders expect telehealth to have minimal impact on traditional outpatient clinical space utilization. However, as telehealth becomes a permanent means of patient interaction and caregiving, healthcare providers will need to create spaces that effectively accommodate telehealth visits.

Health systems generally use one of three telehealth delivery models, each with clear advantages and disadvantages:

| Dedicated separate telehealth facilities: facilities equipped with telehealth technology and a dedicated team of clinicians | |

| Advantages | Disadvantages |

|

|

| Dedicated telehealth areas within a clinic: housed within an existing clinic with space—usually an exam room(s) or physician offices—converted to dedicated telehealth space with appropriate deployment of telemedicine technologies and room set-up | |

| Advantages | Disadvantages |

|

|

| Flexible telehealth areas within a clinic: utilizes an existing exam room or clinician’s office that has been modified to handle telehealth visit or an in-person visit | |

| Advantages | Disadvantages |

|

|

The three approaches have emerged in different forms as systems evaluate their real estate and human capital resources and the highly specific training required to facilitate telehealth caregiving. For instance, MemorialCare, a leading nonprofit system in Orange and Los Angeles counties, is using all three space design paths as they assess their current and planned facilities, as discussed with Anne LaNova, Executive Director of Digital Consumer Experience. Technology is key to deploying these new operating models, and MemorialCare is exploring how to increase the technology's efficacy. Some methods include improving network connectivity and real-time location tracking, which all need to be built into the facility. MemorialCare is also utilizing in-home technology via virtual exam kits and staffing virtual health ambassadors who travel to patients’ homes, assist in any technology set-up and train patients on using the kit so that during exam time, the clinician and patient can connect seamlessly.

In other cases, healthcare organizations have developed training centers to support telehealth. The emerging clinical role of the dedicated ‘virtualist’ requires a clinician trained in the best approaches to caregiving using virtual tools and technologies. These centers are often deployed in a health system’s underutilized office space.

Selecting the Right Telehealth Operating Model

Selecting the best operating model for delivering telemedicine services includes several factors:

- Services to be offered via telehealth

- Current utilization of clinical areas

- Long-term commitment to telehealth

- Availability of staff for dedicated in-clinic care vs telehealth visits

- State reimbursement guidelines for telehealth

This article posits whether health systems will ever build another building. The answer is “yes,” but it is unclear whether it will be a traditional medical clinic or a telehealth facility. The choice will depend on a health system’s strategic plan for telemedicine and its role in the long-term service mix, capital availability, and, ultimately, how to best serve the patients in the community.

1 Source: “Medicare Beneficiaries’ Use of Telehealth in 2020 : Trends by Beneficiary Characteristics and Location” Department of Health & Human Services, December 2021.

2 Medicare will continue to reimburse for certain telehealth visits through 2023. In July 2022, the House passed a bill that would extend telehealth benefits and reimbursements from Medicare through 2024. The bill will head to the Senate for approval next.

3 Source: “Broadband Expansion: What Are the Essential Components?” PEW, July 2022.

Related Insights

- Viewpoint | Creating Resilience

The Future of Work—A Healthcare Perspective

September 7, 2022 15 Minute Read

Discover why the return to the office and the future of work is a top priority for healthcare executives.

Related Services

- Industry

Healthcare

Create better patient outcomes and healthier communities through our total lifecycle real estate and facility solutions for the global healthcare indu...

Delivering expertise and advice to healthcare owners and occupiers across the continuum of capital planning and projects.

Creating measurably superior client outcomes by improving patient experiences through safe, engaging and high-performing environments of care.