Evolving Workforces

Finance Industry Rising Stars Opine on the Ideal Workplace

November 11, 2024 5 Minute Read

We asked future finance leaders for their take on workplace strategy. Here's what they really think about unassigned seating, remote work and their current offices.

Introduction

The finance industry has undergone a significant shift back to in-office work, with most firms now requiring employees to work in the office more than 50% of the time. We want to understand how this shift is impacting the rising stars within banking, hedge funds, wealth management, private equity and venture capital. These young workers have an important, often-underrepresented voice in the ongoing debate over the evolving workplace.

In summary, these Gen Zers and millennials value in-office time. But that value comes with a crucial caveat: Flexibility is non-negotiable. This paradigm requires organizations to think of younger employees as consumers of the workplace experience. Doing so informs important considerations regarding office attendance policies, unassigned vs. assigned workplaces, remote work arrangements, services and on-site solutions.

This article addresses the tactical considerations for creating a sustaining and compelling workplace experience that these rising stars expect.

Attendance Policy

The vast majority of finance firms are back to in-office work more than 50% of the time. According to 15 interviewees1, their office policy ranges from 3-5 days per week in the office, with four days per week being the most popular choice. And it looks like it’s working, especially when executives lead by example.

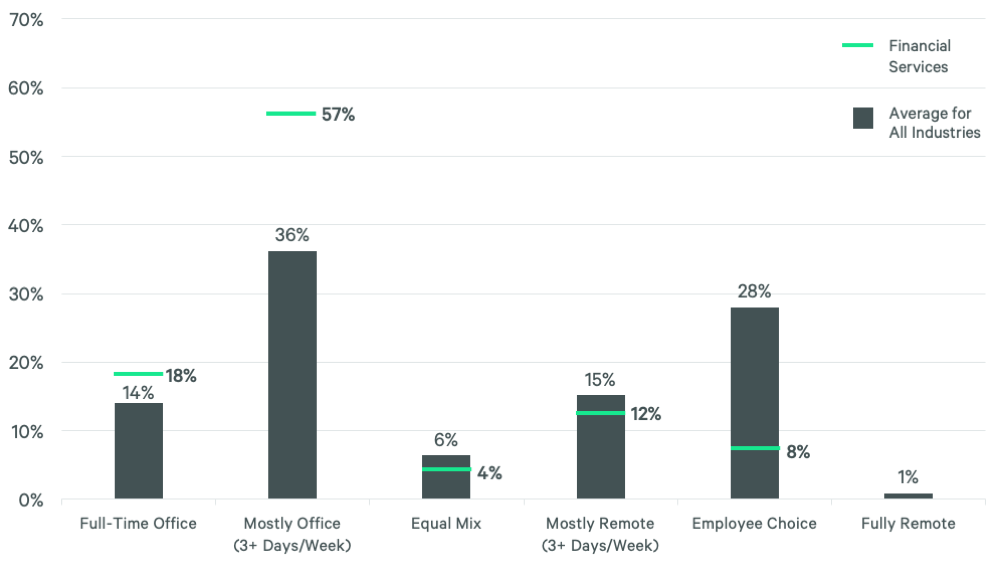

Figure 1: How does attendance policy vary by industry sector?

N= 343 companies sourced through CBRE client data and publicly available statements to the press / announcements on company websites.

1 Note on methodology: The authors interviewed 15 millennial and Gen Z U.S. finance professionals using an anonymous open-ended questionnaire to get candid feedback about their workplace experience and future preferences. The participants are age 25-35 in their early to mid-career.

“Yes [people adhere to the policy], and it’s because management comes in through Friday even.”

When asked for the reasoning behind more in-office work, most mentioned collaboration and mentoring:

“I think in-person interactions are valuable for getting work done, building relationships.”

Other primary reasons for in-office work include social gatherings and team building, which support a positive impact on mental health.

One thing that all finance managers would like to see more of? Flexibility.

“Yes, slightly more flexibility, but I like going in and like that my teams are available to work in person.”

To understand the industry's outlook, we asked the participants to imagine themselves as current executives and respond to the following question: As a future policy setter, how would you approach office attendance guidelines? The results are surprising because they are very close to what we observe now:

“Probably same as my company does currently.”

In the future, everyone will value flexibility, but that does not mean remote work exclusively.

“I would not want to work remotely since it harms employee relations, especially in a field like finance, which is very small anyways, and everyone knows everyone.”

Some respondents desire a flexible schedule for personal travel and long weekends. Contrary to popular belief that millennials prefer a fully remote environment, some interviewees also prefer full-time in-office work:

“Every day in-office as baseline, but no issues with people working from home when they need to as an exception.”

Remote Work and Promotions

Most finance managers agree that office attendance does impact promotion decisions. Some even say that it’s absolutely a consideration.

“In-person [is] hard to beat when it comes to quick decision-making and career advancement.”

This sentiment aligns with most recent research on this topic:

- A survey by the American Staffing Association found that 56% of respondents believe remote workers are at a disadvantage for promotions compared to in-office employees.

- A report by the HR Policy Association highlights a study where fully remote workers were less likely to receive promotions compared to hybrid workers. The study suggests remote workers might miss out on informal networking and mentorship opportunities that can aid career advancement.

- Over the past year, remote workers were promoted 31% less frequently than people who worked in an office, either full-time or on a hybrid basis, according to an analysis of 2 million white-collar workers by employment-data provider Live Data Technologies.

Workstations

Seat sharing met with moderately negative responses, even in a hybrid work environment where employees may alternate between remote and in-office work. During the days when employees come to the office, interviewees generally expect to have an assigned seat. When asked their opinions on desk sharing:

“Absolutely not.”

“Not a fan.”

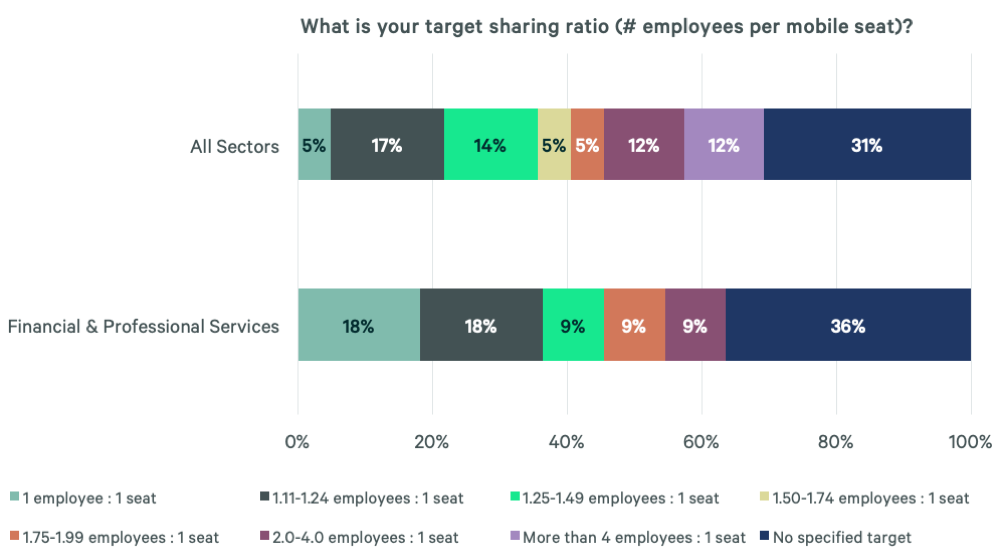

Figure 2: Majority of Financial Service Occupiers Targeting Conservative Sharing Ratios

While interviewees want workstations to be assigned to specific individuals, they also want flexibility to access private offices on an as-needed basis. Many individuals need private offices to conduct phone calls or engage in confidential conversations.

“Private offices are outdated but should have some available first-come, first-served for days with many calls.”

“Like having access to some.”

“Nice for calls but not needed unless C-suite.”

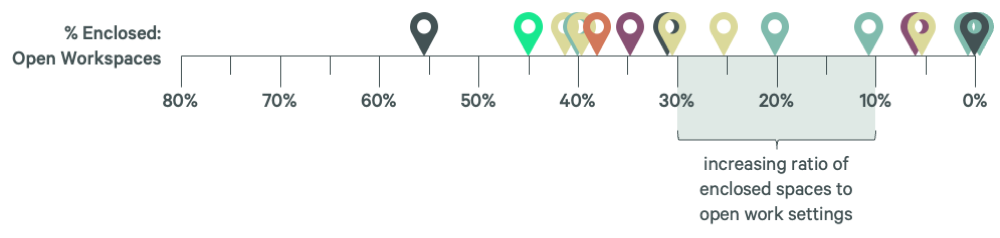

Figure 3: Demand for Enclosed Space is Increasing Across the Sector

Working from home has allowed many people to enjoy privacy amid a distraction-free environment. Replicating this level of privacy within the office setting can significantly contribute to maintaining productivity levels.

While interviewees generally agree on the need for some private offices in the modern workplace, they don’t want office size and job titles. The traditional hierarchical structure of offices is gradually becoming obsolete in today's professional environment.

“I think big offices make sense for people who often have visitors/meetings in their office. Not just for the sake of being more senior.”

Work Styles

How employees interact and collaborate in Financial Services can vary significantly. It would be unfair to compare the casual setting of a Bay Area venture capital fund with a formal money center bank in New York City. However, all financial work environments share one characteristic: Hybrid meetings are the primary communication method. All interviewees described meeting on Zoom/Teams as the norm, often even if most participants are in the office.

While interviewees like flexibility, online meetings have some limitations, including the following:

Difficulty protecting sensitive information

“Typically fine, but there are times where you’re working with sensitive information that is not conducive to sharing closely with those outside of your team.”

Informal setting lacks gravitas

“Hybrid meetings are too casual for a place where we manage money.”

Participant Inequalities

“Hybrid creates inequalities—in-person attendees will always be more vocal and more seriously treated, even with less merit.”

Travel for meetings is increasing, but introductory meetings usually happen virtually. Interviewees stated that their schedule requires both types, but in-person meetings improve client relationships and are preferred for most important meetings.

“Travel for anything serious, Zoom for anything operational.”

What Will Impact the Future of Work in Finance?

Top 5 Trends to Watch

Interest Rates

In the quantitative world of finance, the future of work cannot be discussed without context. One interviewee noticed that employee flexibility and dynamics are directly correlated with the economy and interest rates:

“All depends on interest rates and economy: cheap money => good times => easy life => flexibility. High interest rates => productivity squeeze => more incentive to limit flexibility.”

AI & Tech Talent

Technology integration is a strong trend within the financial industry. This means finance is leveraging technology to improve efficiency, create new products and services (FinTech) and meet customers' evolving needs. As financial firms hire more engineers, their office experience might need to evolve to provide a comparable experience to big tech firms. AI automation will have a significant impact on all industries, including finance.

“AI may take over our jobs someday. Until then, we may try to find a way to show that humans + AI is actually better.”

Wellness & Sustainability

It’s not a novelty to finance investors that companies focusing on wellness and sustainability present better financial returns. Based on a 2021 study by The Josh Bersin Company, companies leveraging wellbeing strategies are 2.2x more likely to exceed financial targets and 3.2x more likely to engage and retain workers. S&P 500 ESG index has outperformed S&P 500 by a cumulative 15%. We’re already observing a significant focus on improved employee well-being, and it will only become more prominent with time.

Competitor Research

In finance, as in tech or legal services, occupiers look to industry leaders for trends and solutions. They do this for inspiration and to remain competitive for talent. Space benchmarking will only increase in significance to support data-driven real estate choices.

Location, Location, Location

For financial institutions, the location or street address is often a primary consideration. Finance tenants are willing to pay significantly more for a space on a prestigious address, as validation of credibility. That gives landlords an opportunity to adjust their offering to a tailored user and a specific client.

Summary

The finance industry isn’t going fully remote anytime soon, but flexibility is here to stay. The ideal future workplace offers a blend of in-person collaboration and focus time, supported by technology that bridges the gap. As the industry evolves, finance firms will need to adapt their workplaces to attract and retain top talent while considering economic trends, technology integration and employee well-being.

Methodology

The authors interviewed 15 millennial and Gen Z U.S. finance professionals using an anonymous, open-ended questionnaire to get candid feedback about their workplace experience and future preferences. The participants represented different industry parts, from banking and hedge funds to private equity and venture capital.

For more information, please contact [email protected]

Related Insights

-

Article | Creating Resilience

Three Ways Financial & Professional Services Organizations Are Evolving for the Future

June 4, 2024

Through a focus on space utilization, workplace experience and sustainability, organizations are building business resilience.

-

Viewpoint | Evolving Workforces

People, talent, and experience: the challenge for financial services occupiers

April 25, 2024

Tight labour market conditions have driven people and talent-related issues to the forefront in real estate, particularly for financial institutions.

-

Report | Adaptive Spaces

Corporate Real Estate Priorities for Financial and Professional Services Occupiers

November 3, 2023

CBRE’s recent European Office Occupier Sentiment Surveyhighlighted priorities that feature strongly in occupiers’ thinking. Our latest report explores the Financial andProfessional Services (FPS) sector’s approach to these focus areas and key recommendations for successful decision-making.

Related Services

- Plan, Lease & Occupy

Workplace Consulting

Build resilience, attract and retain talent, and foster connection and collaboration in your workplace.

- Industry

Banking and Financial Services

Find out how our experts can help you achieve your real estate and property management goals around the world.