Creating Resilience

Facilities Management Procurement Perspectives: Risk, Economic Stability and Inflation

January 24, 2024 5 Minute Read

Having a world-class procurement capability for Facilities Management requires expertise across a broad set of topics such as cost savings, service quality, employee productivity and well-being, risk management, sustainability and innovation.

Our Facilities Management Procurement Perspectives report was developed to fill the insights gap in FM procurement. We asked industry experts from more than 40 organizations for their outlook on critical topics that are top-of-mind across sectors: risk, economic stability and inflation. Their perspectives provide an understanding of key challenges and strategic responses shaping facilities management procurement today.

FM Procurement Risks

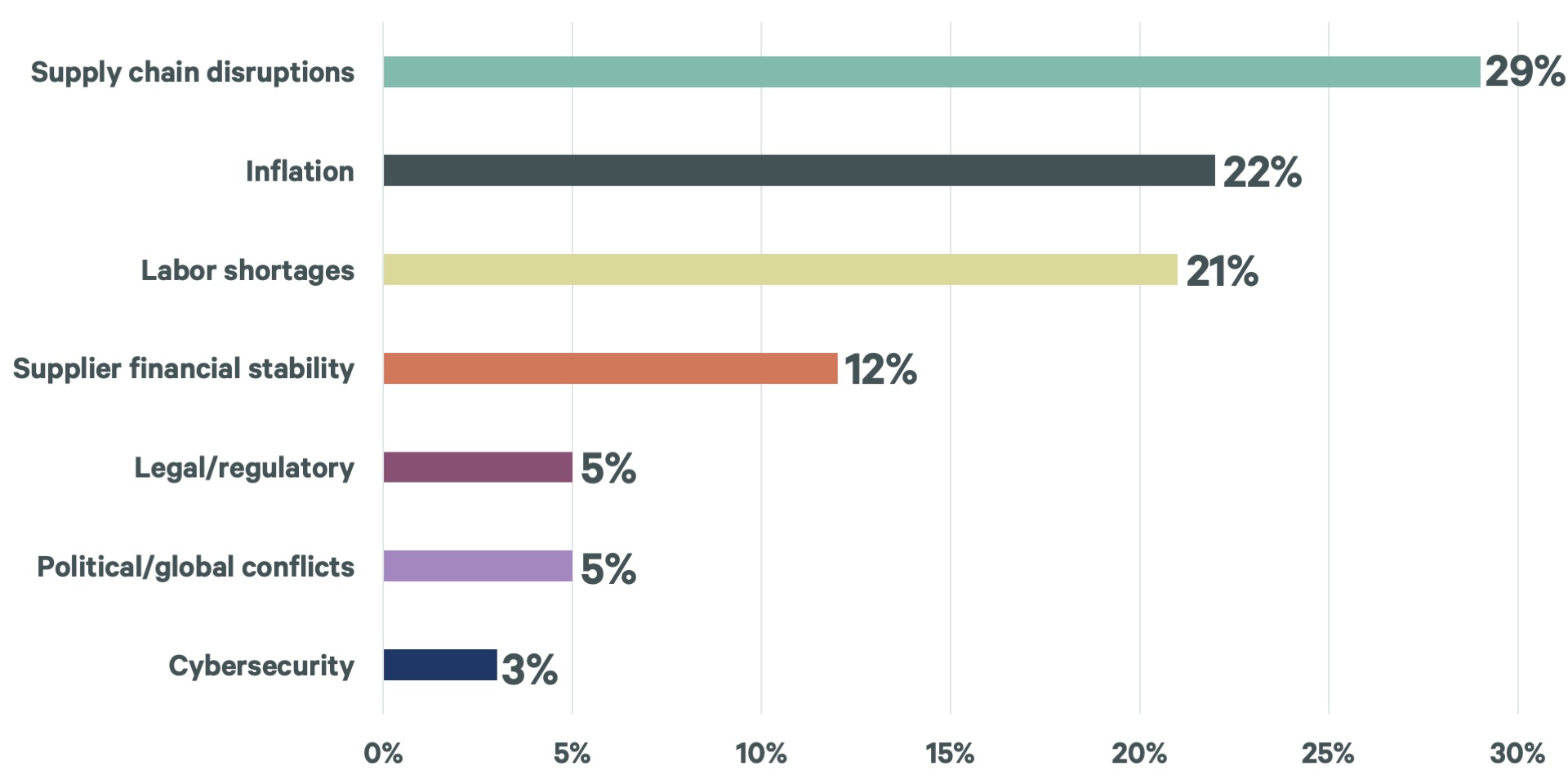

Figure 1: What are the top three FM procurement risks for your company?

The top four FM supply chain risks remained unchanged since our 2022 survey but are more evenly distributed. The percentage of respondents who cited supply chain disruptions or inflation as the leading risk for their company decreased, indicating that these risks were at least moderately mitigated in 2023.

Supply Chain Disruptions

Supply chain disruptions were the number one risk for 29% of surveyed companies. These disruptions can come from various factors—natural disasters, transportation issues or component shortages, etc—which can lead to delays in receiving materials or equipment and affect the ability to maintain and manage facilities effectively. To mitigate this risk, companies are diversifying their supplier base, nearshoring and seeking alternative products and materials.

Inflation

CBRE’s FM Cost Index shows that cost pressures peaked in 2022, with 2023 FM cost inflation forecast to be half of the previous year, although still above pre-pandemic levels. While CBRE expects FM costs to rise again in 2024, the rate of increase is expected to be lower than 2023.

Labor Shortages

Strong competition for labor across multiple industries (e.g., logistics, manufacturing, life sciences) has led to shortages of qualified workers in facilities management. This is the primary reason this risk remains in the top three. Contributing factors include aging workforces, a shortage of workers with qualified technical skills (e.g., HVAC) and fewer younger workers entering the industry. Investing in workforce development and training programs to upskill existing employees can help companies mitigate this risk. Additionally, implementing recruitment and retention strategies can attract new employees.

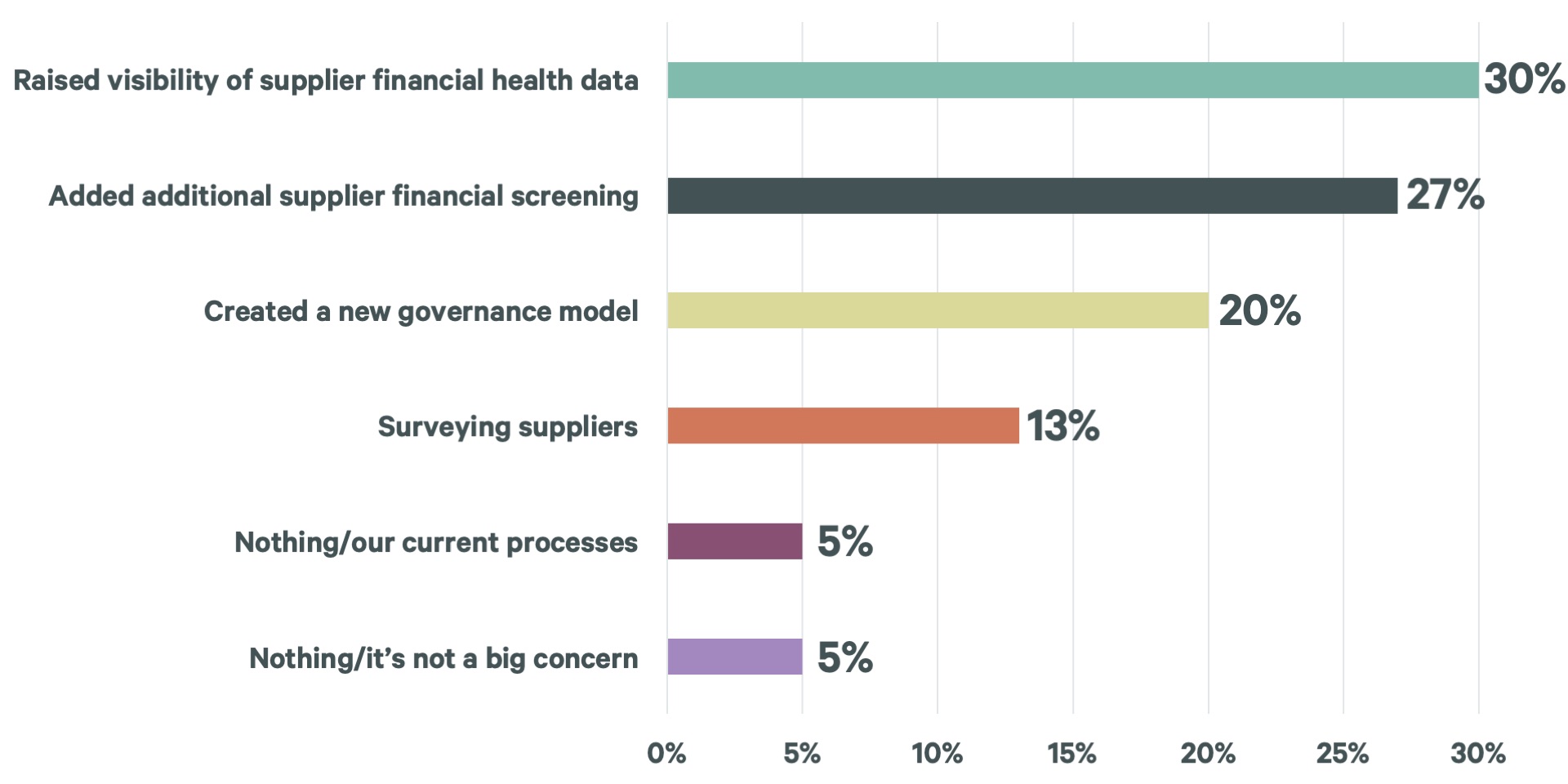

Figure 2: What is your primary strategy for managing supplier financial stability risks?

Concern about supplier financial stability has been on the rise, due to recent bank failures, reduced demand and an uncertain economy. No procurement professional wants to deal with supplier bankruptcies and resulting operational disruptions, so most are taking proactive steps. The primary strategy for managing supplier financial stability risks is to raise visibility of existing supplier health data (30% of respondents). Other companies are adding additional levels of external financial screening (e.g., using multiple risk assessors), surveying suppliers on their financial health or creating increased governance and reporting around the topic.

By raising visibility into supplier financial data, companies have taken a proactive stance in managing supplier financial stability risks to ensure the long-term success and reliability of the supply chain.

Economic Stability

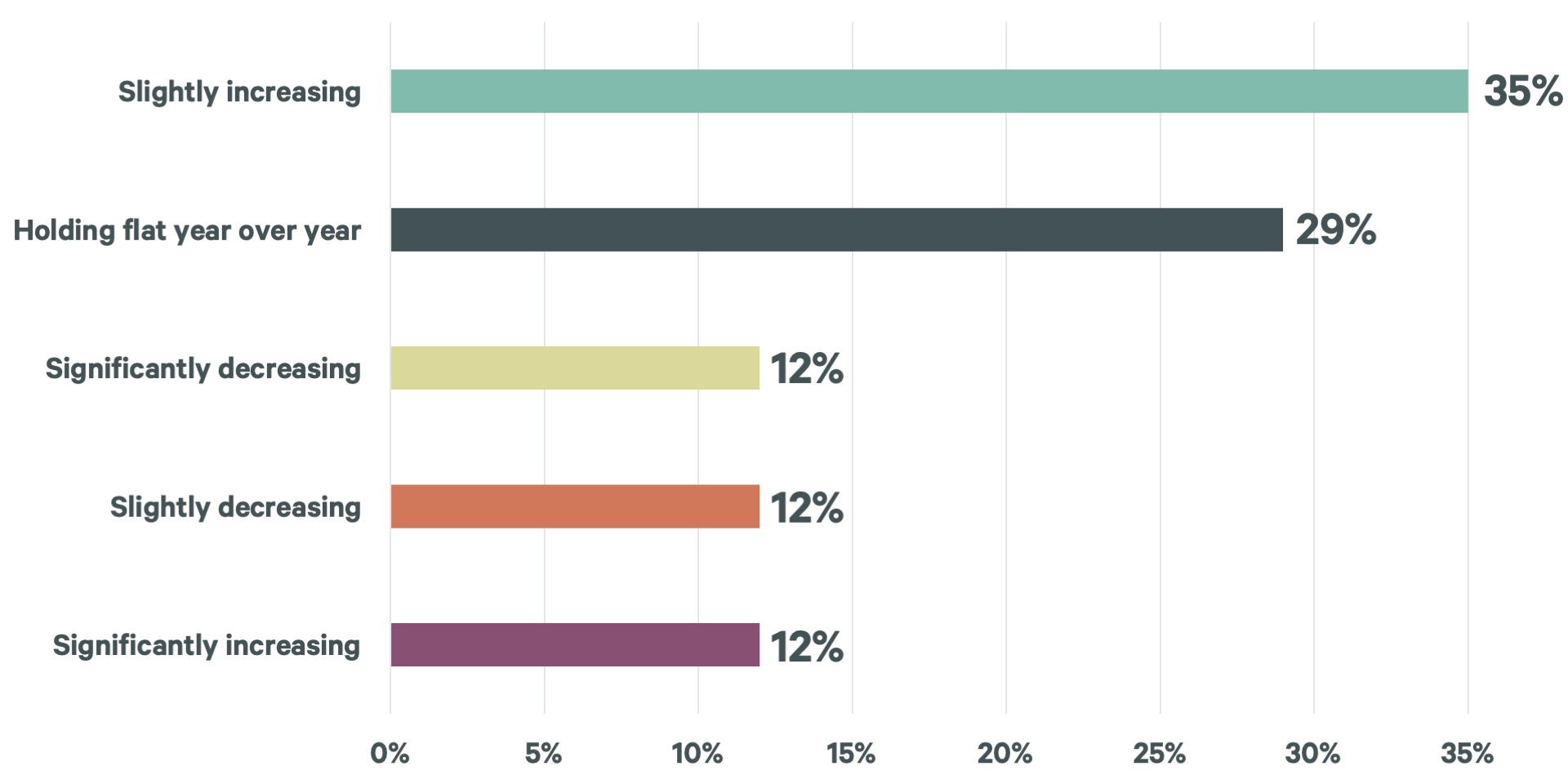

Figure 3: Given factors like return-to-office planning and inflation, to what extent has your organization modified 2023 FM operating budgets?

Over a third of organizations (35%) slightly increased their FM operating budgets in 2023. This approach reflects the evolving nature of facilities management, especially with the impacts of return-to-office plans and inflation. This increase allows companies to cover the rising costs of materials, labor and services, while meeting the changing demands and expectations of employees and clients.

Nearly a third (29%) reported they are holding budgets flat year-over-year, reflecting a conservative approach to budget management in uncertain economic times.

Some organizations (12%) have opted to significantly increase their FM budgets, indicating a proactive approach to ensure that facilities remain fully operational and attract employees back to the office post-pandemic.

Inflation

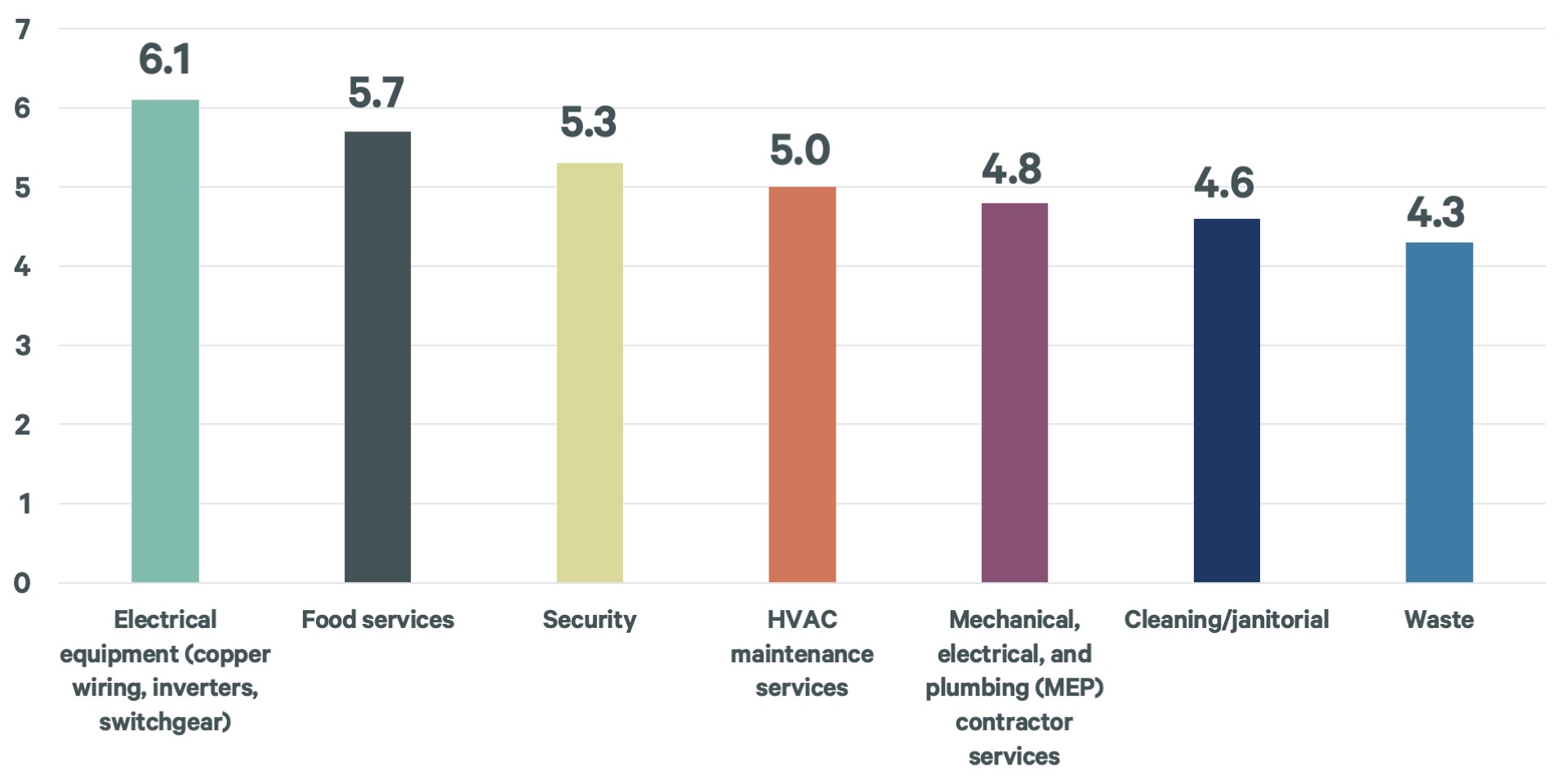

Figure 4: What level of cost increase have you seen within these six categories?

Companies have experienced moderate cost increases across all categories, which aligns with CBRE’s findings in our 2023 FM Cost Index report. Our FM Cost Index for contracted services indicated an inflation rate of 5.3% in Q1, but that rate has been declining each quarter and is expected to be 3.7% for the year. Equipment costs have been rising due to global demand and manufacturing shortages. Service categories have been rising due to increasing labor costs and input costs (e.g., cleaning suppliers, parts, food, fuel). CBRE forecasts that inflation for contracted FM services will cool off even further in 2024, with an average rate of 2% globally.

Electrical Equipment (Copper Wiring, Inverters, Switchgear)

Electrical equipment costs have increased significantly likely due to a surge in demand for renewable energy and electrical infrastructure improvements.

Food Services

The cost increase in food services is attributed to various factors, including inflation affecting the prices of ingredients, labor costs and supply chain disruptions that can impact food product availability.

Security

Security costs are moderately higher due in part to technology requirements for advanced security systems.

HVAC Maintenance Services

HVAC maintenance services have seen moderate cost increases due to rising energy costs and more complex system requirements.

MEP Contractor Services

Mechanical, electrical, and plumbing (MEP) contractor services may have seen cost increases driven by skilled labor demand, fluctuating material costs and the need for compliance with changing building codes and energy-efficiency standards.

Cleaning/Janitorial

Cleaning and janitorial services have experienced moderate cost increases because they are influenced by labor costs, the need for enhanced cleaning protocols and supply chain disruptions.

Waste

The relatively lower cost increase in waste services is due in part to leveraging technology to optimize pickup schedules and sustainable waste management practices.

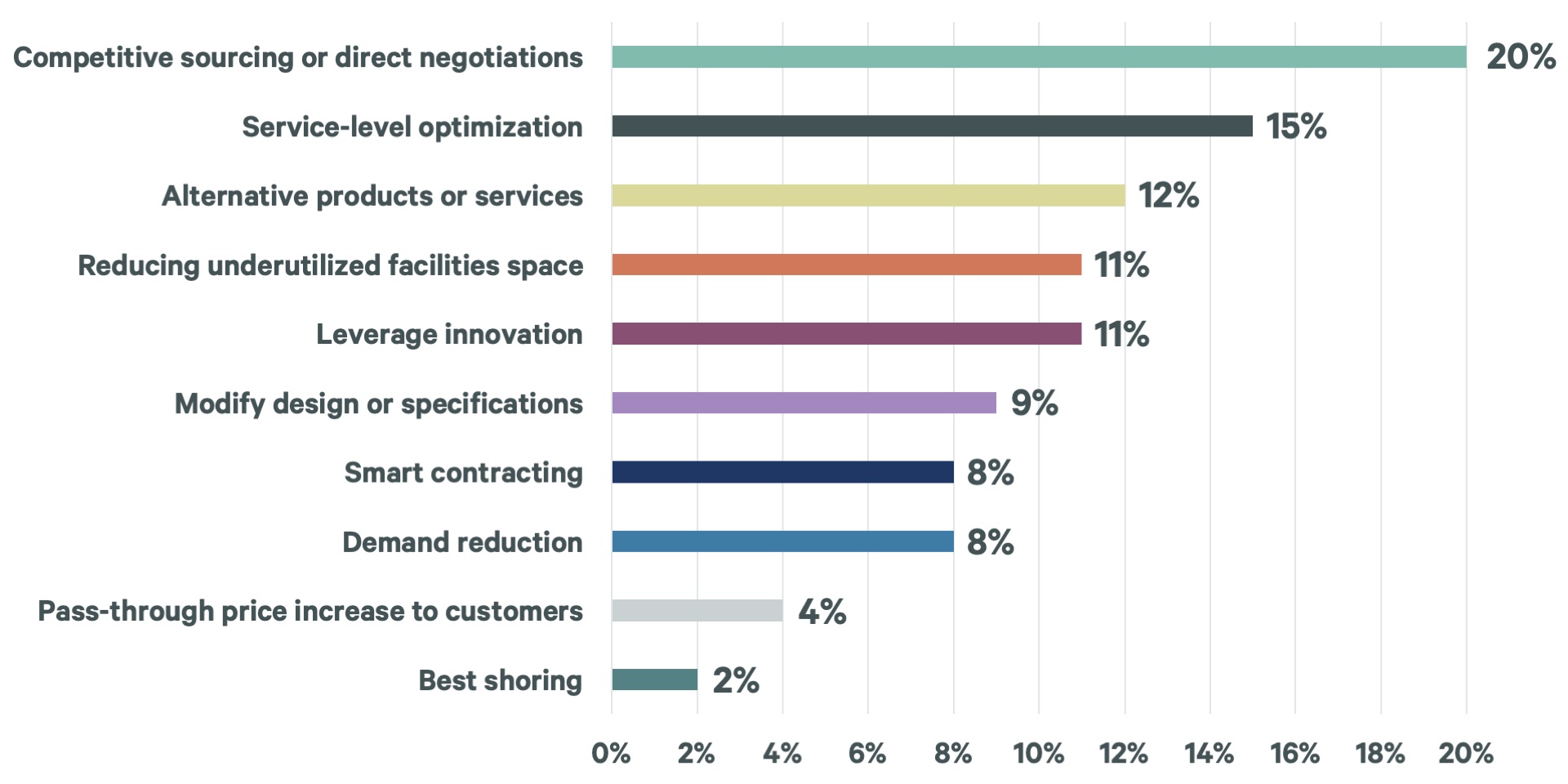

Figure 5: What strategies have you deployed or are currently deploying to mitigate increases in these categories? (Select all that apply)

Most procurement organizations have been challenged by inflation for the past several years and employ a wide variety of strategies to mitigate price pressures. The top three strategies remain unchanged since our last survey. The newcomer to the list is demand reduction, specifically reducing underutilized facilities space to reduce the total cost of services. This is unsurprising, as companies have had varying levels of success attracting employees back into the office post-pandemic.

Our survey results highlight the persistent challenges and evolving strategies embraced by FM leaders in the face of risk, economic shifts and inflation. The findings reveal a business climate marked by adaptability, where companies actively address supply chain risks, navigate economic uncertainties and counteract inflationary pressures. Focusing on commitments to innovation, sustainability and workforce development will allow companies to not only mitigate risks but also chart a path toward resilience and long-term success. As FM procurement continues to evolve, these insights serve as actionable takeaways, grounding the discourse in the realities of today’s procurement landscape.

Related Insights

-

Article | Intelligent Investment

Buying smarter FM technology to get the intended results

July 28, 2023

Explore five key steps to establish and maintain a successful smart-building program

Related Services

Optimize your workplace performance and ensure success with superior facilities management and maintenance services.

CBRE’s Procurement Advantage is a set of world class capabilities that includes innovative strategies, exceptional expertise, and integrated systems.

- Transform Business Outcomes

Real Estate Outsourcing Services

Guide transformational outcomes to create tangible value across your portfolio.